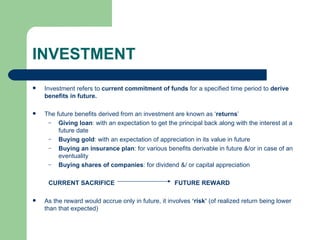

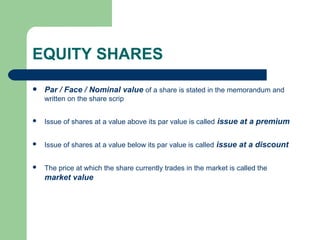

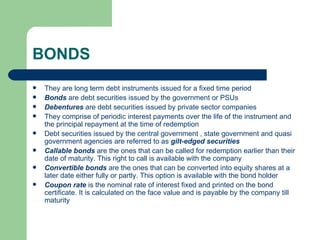

Investment involves committing funds for future benefits, known as returns, with associated risks and objectives like maximizing returns while minimizing risk. Key investment alternatives include financial assets like equity shares, bonds, and mutual funds, each with unique characteristics and risks. Financial derivatives have emerged to hedge against price fluctuations, primarily consisting of futures and options that derive their value from underlying assets.