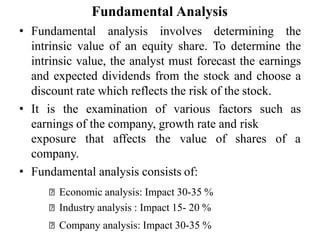

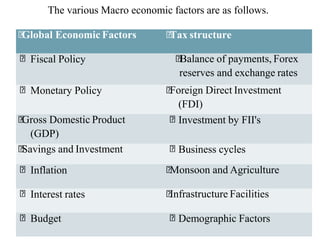

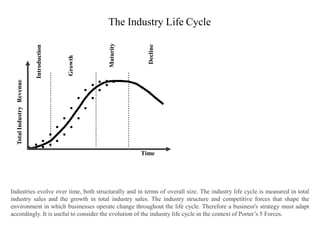

Fundamental analysis involves determining a company's intrinsic value by forecasting its future earnings and dividends. It examines factors like earnings, growth rates, and risk exposure. Fundamental analysis consists of economic (30-35%), industry (15-20%), and company (30-35%) analysis. Economic analysis considers macroeconomic factors' impact on security prices. Industry analysis examines an industry's performance, prospects, and life cycle stage. Company analysis evaluates specific factors of a business. Fundamental analysis is used to evaluate investment opportunities.