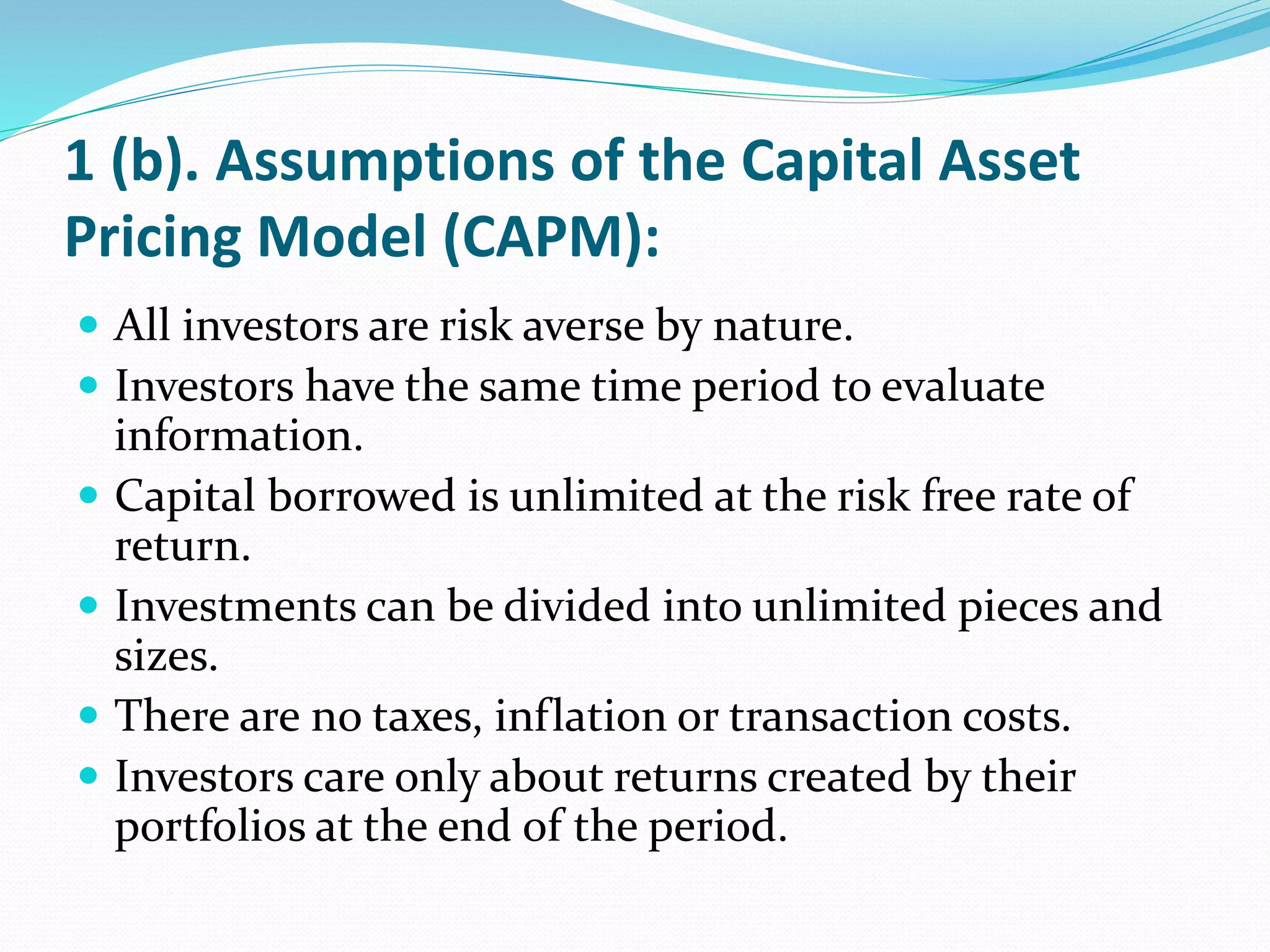

The document presents a case study on the demand for portfolio managers and outlines key concepts related to the Capital Asset Pricing Model (CAPM), including its assumptions and calculations for security returns. It includes a comparison between the Capital Market Line (CML) and Security Market Line (SML) while providing data on various securities for analysis. Additionally, it details how to calculate expected returns from a constructed portfolio comprising different securities.

![1 (c). Using the security market line (SML), to

determine securities which are underpriced:

The SML is used to display the expected rate of return

of a particular security as a function of the systematic

or non-diversifiable risk.

SML is given by the formula;

E(Ri) = Rf + βi [ E(Rm) – Rf ]](https://image.slidesharecdn.com/groupeight-powerpoint-170516165657/75/Financial-Management-Capital-Asset-Pricing-Model-CAPM-8-2048.jpg)

![SECURITY A:

Therefore

A: E(Ri) = Rf + βi [ E(Rm) – Rf ]

E(Ri) = 50 + 2 [ 30 – 50)

= 50 + 2 [-20]

= 50 + -40

= 10 per cent.](https://image.slidesharecdn.com/groupeight-powerpoint-170516165657/75/Financial-Management-Capital-Asset-Pricing-Model-CAPM-10-2048.jpg)

![SECURITY B:

E(Ri) = Rf + βi [ E(Rm) – Rf ]

E(Ri) = 40 + 1.5 [ 25 – 40)

= 40 + 1.5 [-15]

= 40 + -22.5

= 17.5 per cent.](https://image.slidesharecdn.com/groupeight-powerpoint-170516165657/75/Financial-Management-Capital-Asset-Pricing-Model-CAPM-11-2048.jpg)

![SECURITY C:

E(Ri) = Rf + βi [ E(Rm) – Rf ]

E(Ri) = 30 + 1 [20 – 30]

= 30 + 1 [-10]

= 30 + -10

= 20 per cent.](https://image.slidesharecdn.com/groupeight-powerpoint-170516165657/75/Financial-Management-Capital-Asset-Pricing-Model-CAPM-12-2048.jpg)

![SECURITY D:

E(Ri) = Rf + βi [ E(Rm) – Rf ]

E(Ri) = 25 + 0.8 [11.5 – 25)

= 25 +0.8 [-13.5]

= 25 + -10.8

= 14.2 per cent.](https://image.slidesharecdn.com/groupeight-powerpoint-170516165657/75/Financial-Management-Capital-Asset-Pricing-Model-CAPM-13-2048.jpg)

![SECURITY E:

E(Ri) = Rf + βi [ E(Rm) – Rf ]

E(Ri) = 20 + 0.5 [10 – 20]

= 20 + 0.5 [-10]

= 20 + -5

= 15 per cent.](https://image.slidesharecdn.com/groupeight-powerpoint-170516165657/75/Financial-Management-Capital-Asset-Pricing-Model-CAPM-14-2048.jpg)