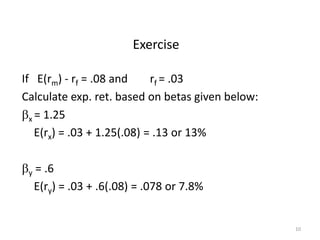

The Capital Asset Pricing Model (CAPM) was developed in the 1960s as a way to determine the expected return of an asset based on its risk. CAPM assumes that investors will be compensated only based on an asset's systematic or non-diversifiable risk as measured by its beta. The model builds on Markowitz's portfolio theory and introduces the security market line, which plots the expected return of an asset against its beta. According to CAPM, the expected return of an asset is equal to the risk-free rate plus a risk premium that is proportional to the asset's beta.