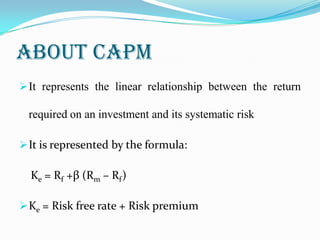

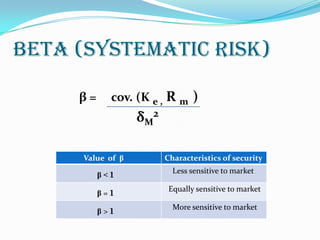

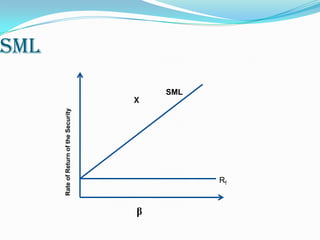

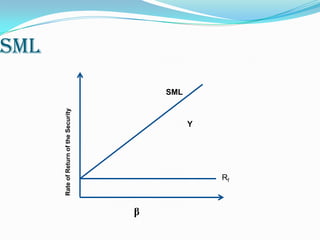

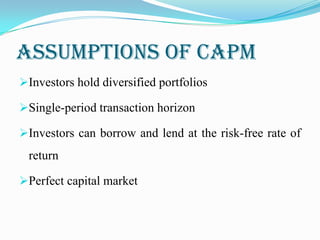

This document presents an overview of the Capital Asset Pricing Model (CAPM). It discusses the key assumptions of CAPM, including that investors hold diversified portfolios and can borrow/lend at the risk-free rate. CAPM represents the relationship between required return and systematic risk using the formula: Ke = Rf + β(Rm - Rf). It also discusses the different degrees of market efficiency, advantages of CAPM in considering only systematic risk, and disadvantages such as its assumptions. The conclusion states that while criticisms exist, CAPM remains a useful model and stands up well to criticism.