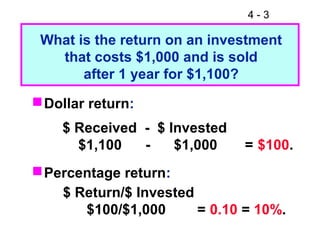

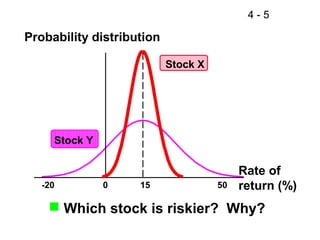

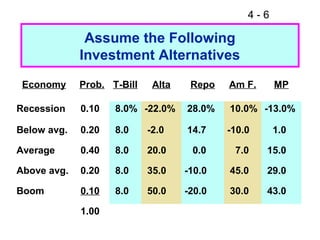

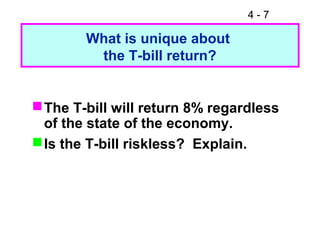

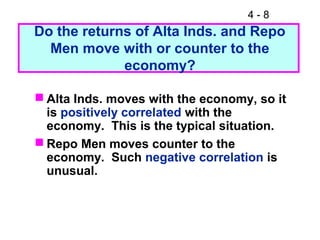

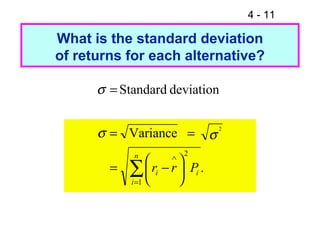

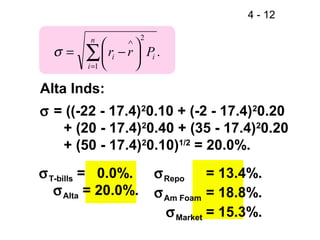

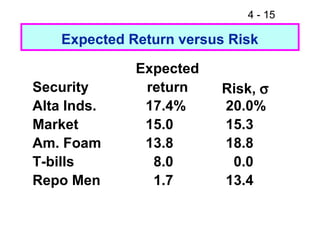

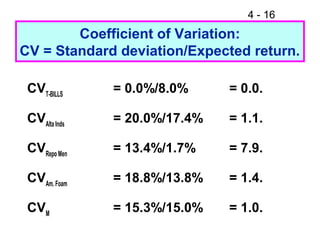

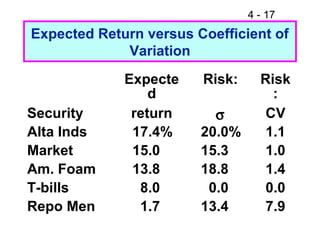

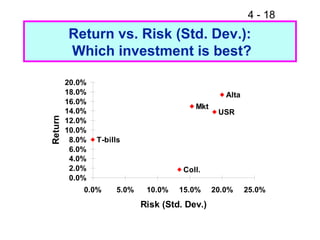

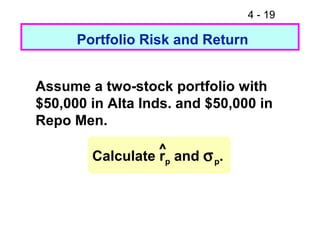

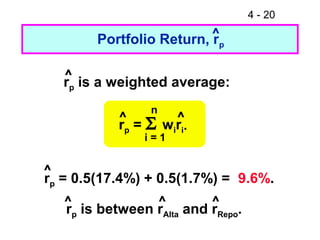

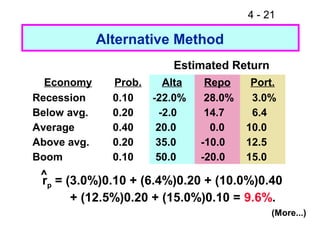

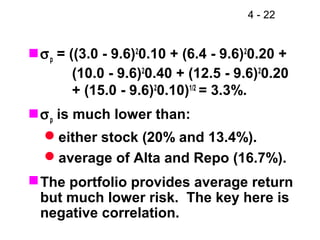

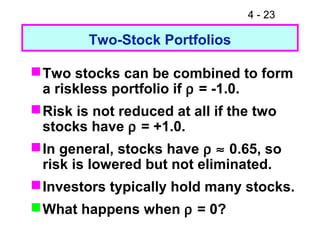

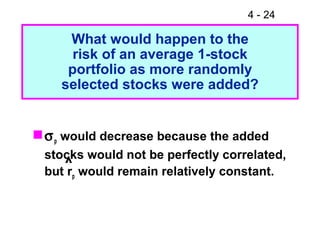

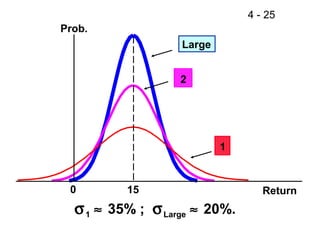

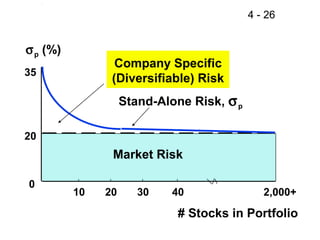

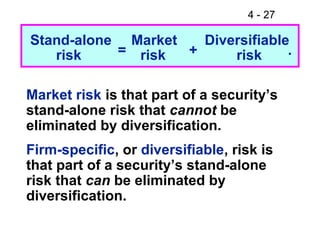

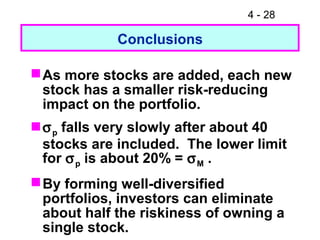

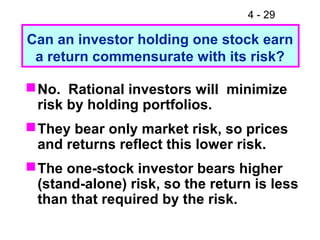

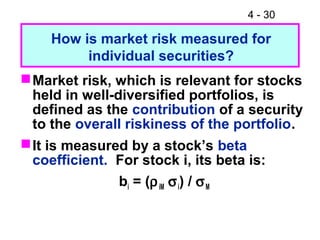

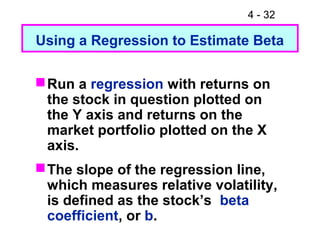

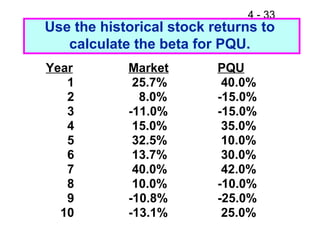

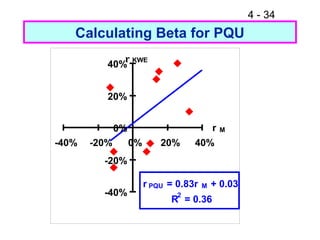

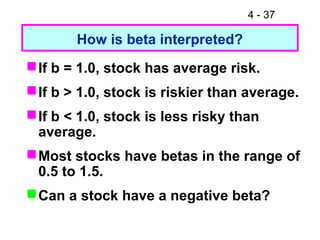

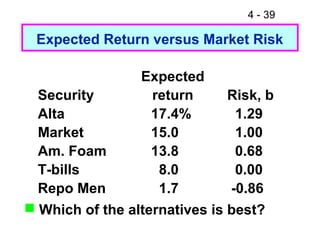

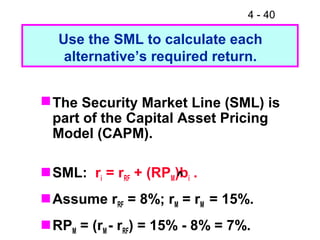

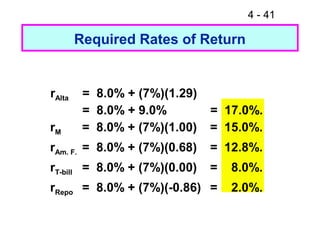

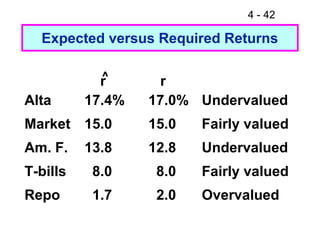

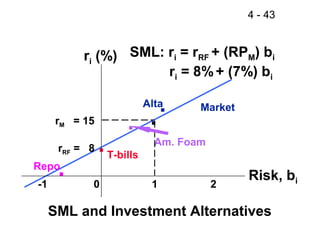

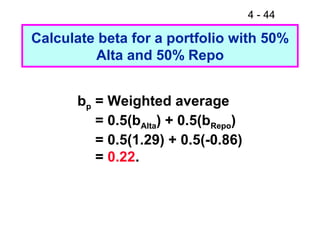

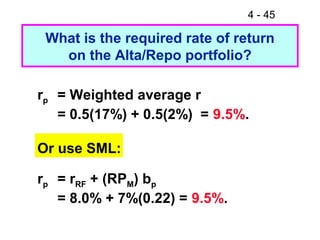

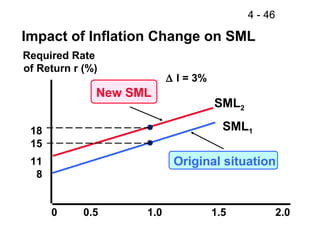

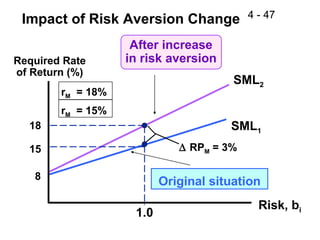

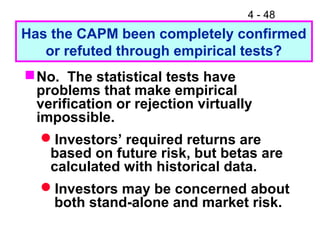

This chapter discusses key concepts related to investment risk and return. It defines investment returns as the financial results of an investment expressed in dollar or percentage terms. Investment risk is the probability of earning a return lower than expected and is impacted by how widely returns can vary from expectations. Diversifying a portfolio by holding many stocks from different industries can significantly reduce risk without lowering expected returns. The Security Market Line shows the expected return required based on a security's beta, which measures its non-diversifiable risk relative to the overall market.