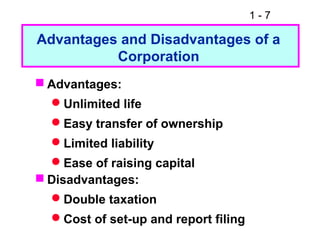

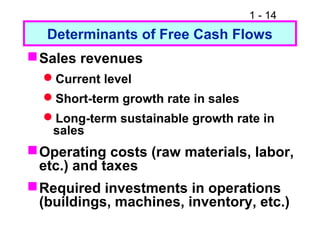

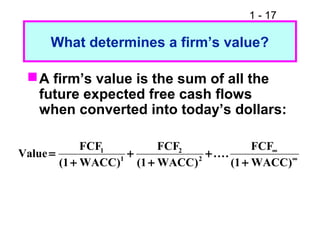

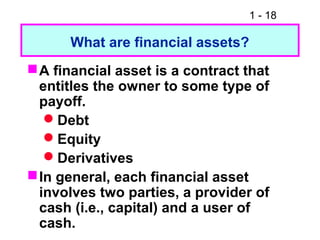

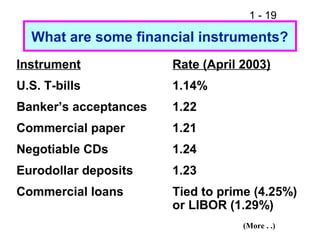

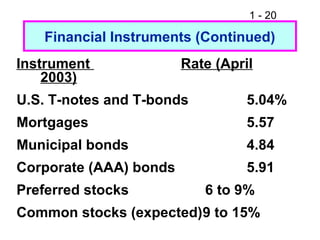

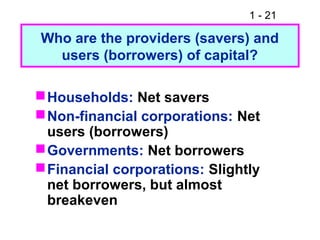

This document provides an overview of key concepts in corporate finance and the financial environment. It discusses the objectives of firms, forms of business organization including sole proprietorships, partnerships, and corporations, and how companies evolve from startups to public corporations. It also defines important financial terms like free cash flows, weighted average cost of capital, and different types of financial markets and instruments.

![1 - 40

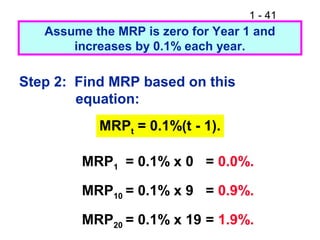

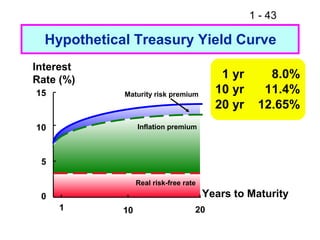

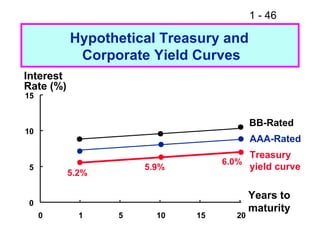

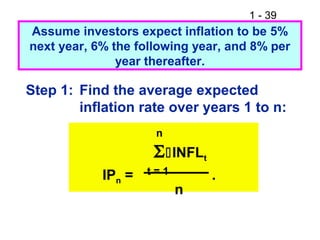

IP1 = 5%/1.0 = 5.00%.

IP10 = [5 + 6 + 8(8)]/10 = 7.5%.

IP20 = [5 + 6 + 8(18)]/20 = 7.75%.

Must earn these IPs to break even

versus inflation; that is, these IPs

would permit you to earn r* (before

taxes).](https://image.slidesharecdn.com/fm11ch01show-151013144834-lva1-app6891/85/Fm11-ch-01-show-40-320.jpg)