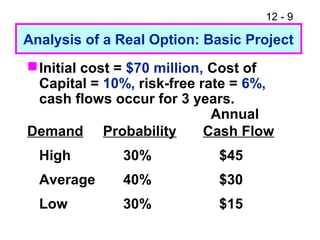

This document discusses real options valuation. It begins by defining real options as options that exist in managerial decisions about projects when future cash flows can be influenced by actions in response to changing market conditions. The document then compares real options to financial options, noting that real options have non-traded underlying assets like projects rather than securities. Several types of real options are described, and five procedures for valuing real options are outlined, including decision tree analysis and using models for corresponding financial options. An example project is analyzed in detail using several of these procedures.

![12 - 15

E(NPV) = [0.3($35.70)]+[0.4($1.79)]

+ [0.3 ($0)]

E(NPV) = $11.42.

Use these scenarios, with their given

probabilities, to find the project’s

expected NPV if we wait.](https://image.slidesharecdn.com/fm11ch12show-151013144925-lva1-app6892/85/Fm11-ch-12-show-15-320.jpg)

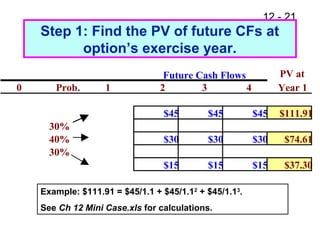

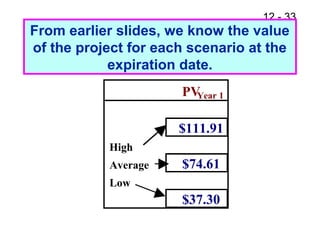

![12 - 22

Step 2: Find the expected PV at the

current date, Year 0.

PV2004=PV of Exp. PV2005 = [(0.3* $111.91) +(0.4*$74.61)

+(0.3*$37.3)]/1.1 = $67.82.

See Ch 12 Mini Case.xls for calculations.

PVYear 0 PVYear 1

$111.91

High

$67.82 Average $74.61

Low

$37.30](https://image.slidesharecdn.com/fm11ch12show-151013144925-lva1-app6892/85/Fm11-ch-12-show-22-320.jpg)

![12 - 32

Indirect Estimate of σ2

Here is a formula for the variance of a

stock’s return, if you know the

coefficient of variation of the

expected stock price at some time, t,

in the future:

t

]1CVln[ 2

2 +

=σ

We can apply this formula to the real

option.](https://image.slidesharecdn.com/fm11ch12show-151013144925-lva1-app6892/85/Fm11-ch-12-show-32-320.jpg)

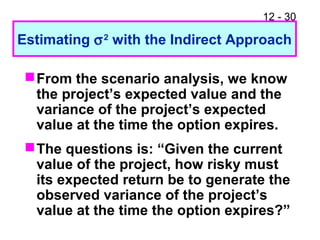

![12 - 34

E(PV)=.3($111.91)+.4($74.61)+.3($37.3)

E(PV)= $74.61.

Use these scenarios, with their given

probabilities, to find the project’s

expected PV and σPV.

σPV = [.3($111.91-$74.61)2

+ .4($74.61-$74.61)2

+ .3($37.30-$74.61)2

]1/2

σPV = $28.90.](https://image.slidesharecdn.com/fm11ch12show-151013144925-lva1-app6892/85/Fm11-ch-12-show-34-320.jpg)

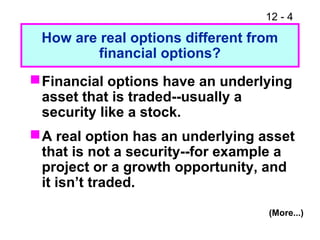

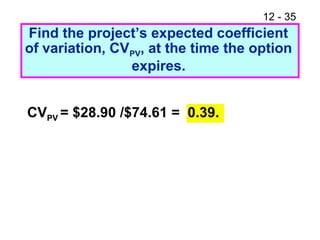

![12 - 36

Now use the formula to estimate σ2.

From our previous scenario analysis,

we know the project’s CV, 0.39, at the

time it the option expires (t=1 year).

%2.14

1

]139.0ln[ 2

2

=

+

=σ](https://image.slidesharecdn.com/fm11ch12show-151013144925-lva1-app6892/85/Fm11-ch-12-show-36-320.jpg)

![12 - 38

Use the Black-Scholes Model:

P = $67.83; X = $70; rRF = 6%;

t = 1 year: σ2 = 0.142

V = $67.83[N(d1)] - $70e-(0.06)(1)

[N(d2)].

ln($67.83/$70)+[(0.06 + 0.142/2)](1)

(0.142)0.5

(1).05

= 0.2641.

d2 = d1 - (0.142)0.5

(1).05

= d1 - 0.3768

= 0.2641 - 0.3768 =- 0.1127.

d1 =](https://image.slidesharecdn.com/fm11ch12show-151013144925-lva1-app6892/85/Fm11-ch-12-show-38-320.jpg)

![12 - 43

Expected NPV of New Situation

E(NPV) = [0.3($36.91)]+[0.4(-$0.39)]

+ [0.3 (-$37.70)]

E(NPV) = -$0.39.

The project now looks like a loser.](https://image.slidesharecdn.com/fm11ch12show-151013144925-lva1-app6892/85/Fm11-ch-12-show-43-320.jpg)

![12 - 46

Expected NPV of Decision Tree

E(NPV) = [0.3($58.02)]+[0.4(-$0.39)]

+ [0.3 (-$37.70)]

E(NPV) = $5.94.

The growth option has turned a

losing project into a winner!](https://image.slidesharecdn.com/fm11ch12show-151013144925-lva1-app6892/85/Fm11-ch-12-show-46-320.jpg)

![12 - 49

Now find the expected PV at the

current date, Year 0.

PVYear 0=PV of Exp. PVYear 3 = [(0.3* $111.91) +(0.4*$74.61)

+(0.3*$37.3)]/1.13

= $56.05.

See Ch 12 Mini Case.xls for calculations.

PVYear 0 Year 1 Year 2 PVYear 3

$111.91

High

$56.05 Average $74.61

Low

$37.30](https://image.slidesharecdn.com/fm11ch12show-151013144925-lva1-app6892/85/Fm11-ch-12-show-49-320.jpg)

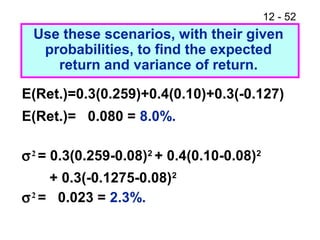

![12 - 55

E(PV)=.3($111.91)+.4($74.61)+.3($37.3)

E(PV)= $74.61.

Use these scenarios, with their given

probabilities, to find the project’s

expected PV and σPV.

σPV = [.3($111.91-$74.61)2

+ .4($74.61-$74.61)2

+ .3($37.30-$74.61)2

]1/2

σPV = $28.90.](https://image.slidesharecdn.com/fm11ch12show-151013144925-lva1-app6892/85/Fm11-ch-12-show-55-320.jpg)

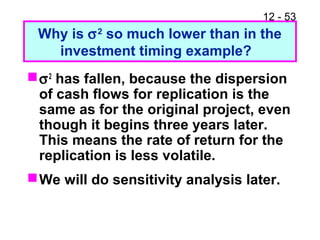

![12 - 56

Now use the indirect formula to

estimate σ2.

CVPV = $28.90 /$74.61 = 0.39.

The option expires in 3 years, t=3.

%7.4

3

]139.0ln[ 2

2

=

+

=σ](https://image.slidesharecdn.com/fm11ch12show-151013144925-lva1-app6892/85/Fm11-ch-12-show-56-320.jpg)

![12 - 57

Use the Black-Scholes Model:

P = $56.06; X = $75; rRF = 6%;

t = 3 years: σ2 = 0.047

V = $56.06[N(d1)] - $75e-(0.06)(3)

[N(d2)].

ln($56.06/$75)+[(0.06 + 0.047/2)](3)

(0.047)0.5

(3).05

= -0.1085.

d2 = d1 - (0.047)0.5

(3).05

= d1 - 0.3755

= -0.1085 - 0.3755 =- 0.4840.

d1 =](https://image.slidesharecdn.com/fm11ch12show-151013144925-lva1-app6892/85/Fm11-ch-12-show-57-320.jpg)