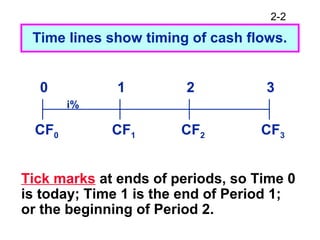

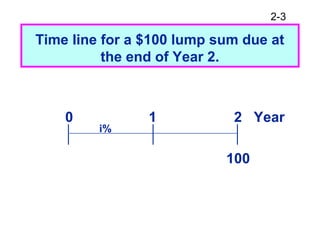

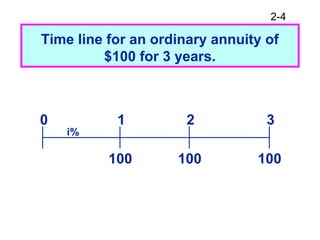

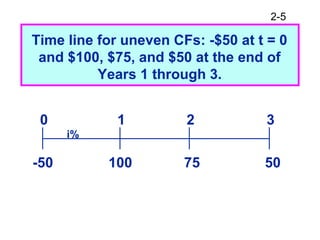

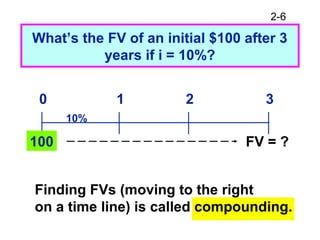

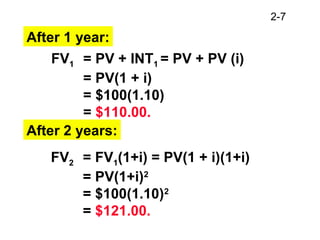

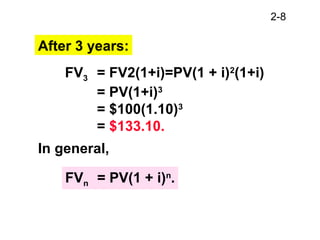

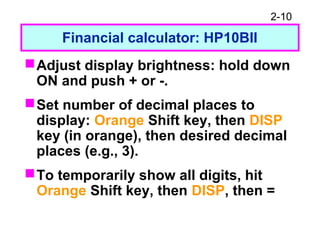

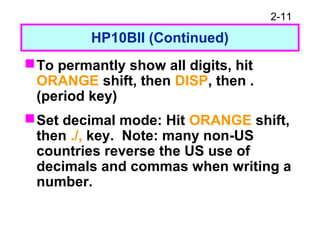

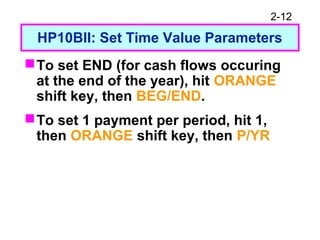

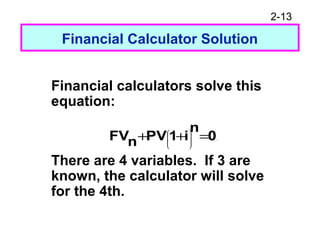

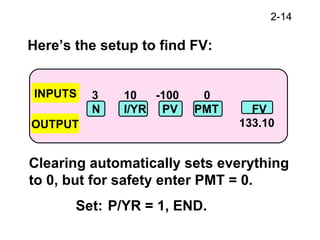

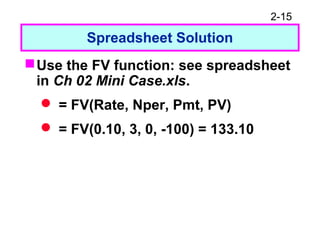

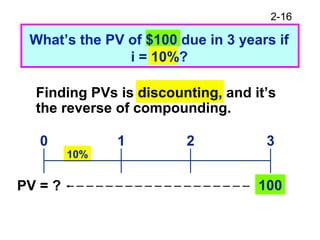

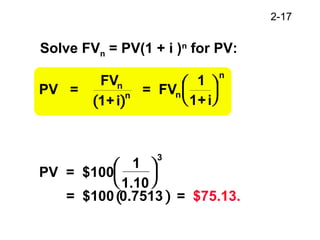

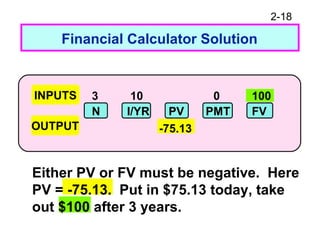

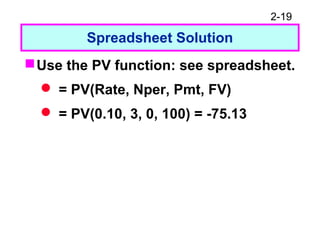

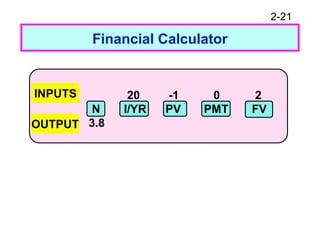

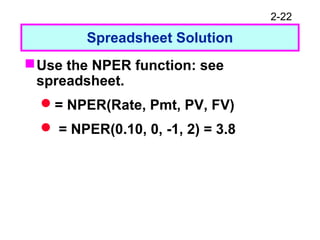

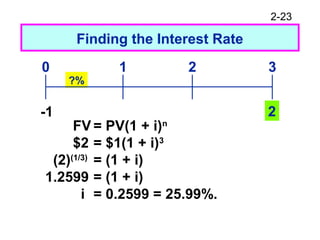

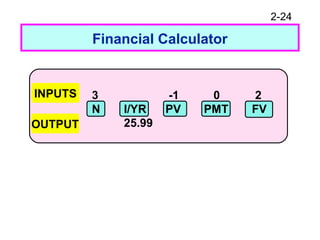

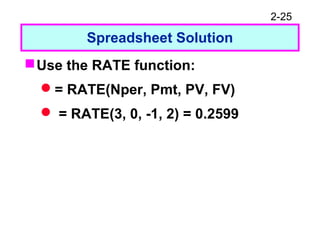

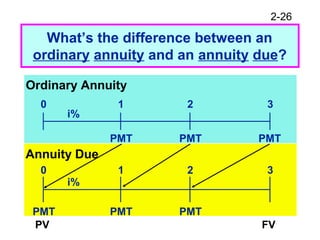

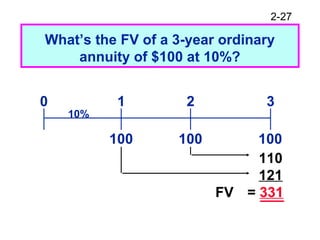

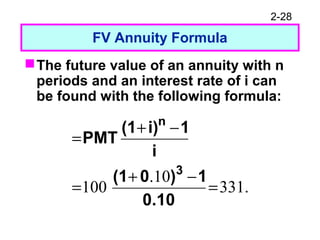

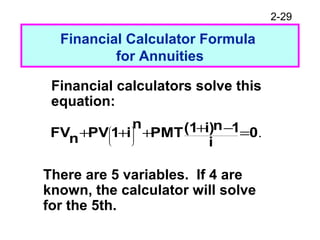

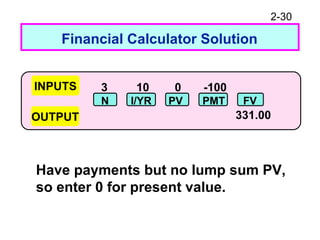

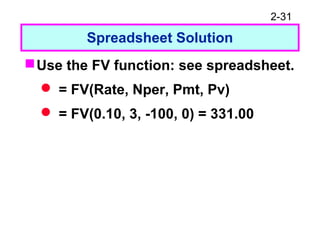

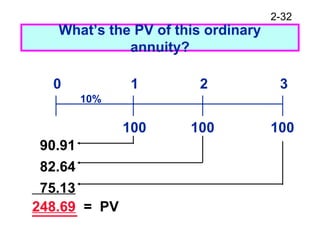

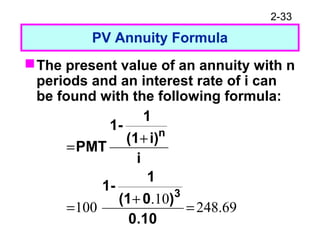

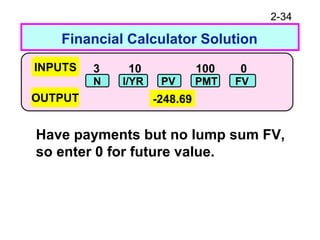

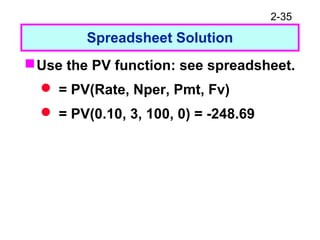

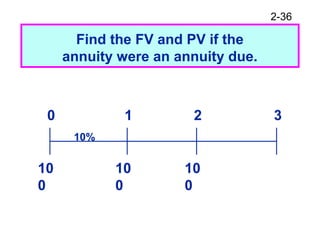

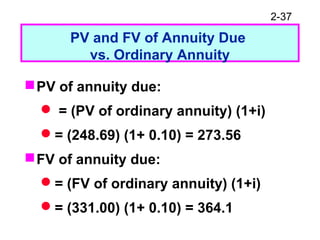

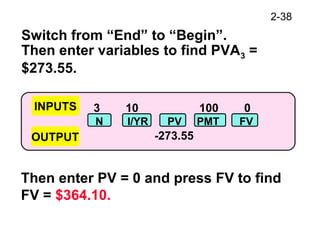

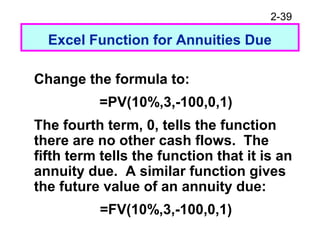

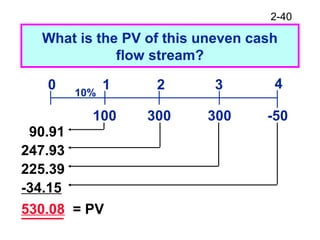

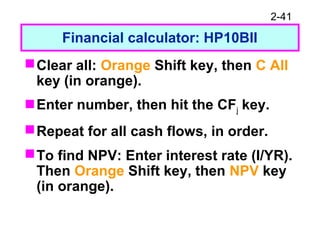

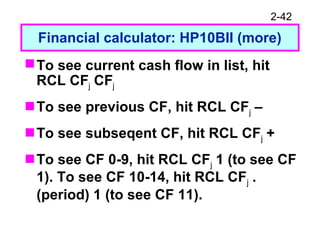

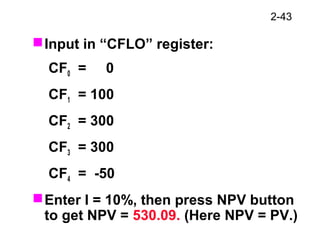

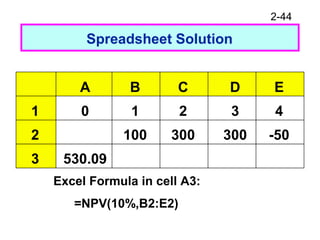

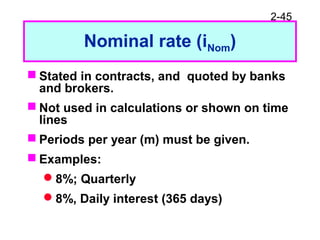

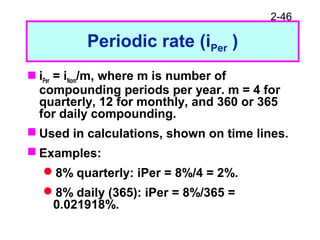

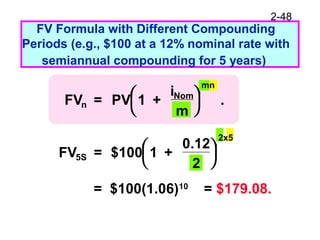

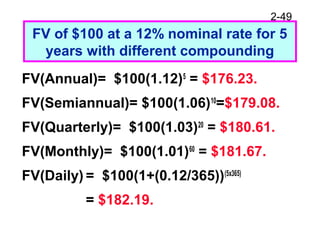

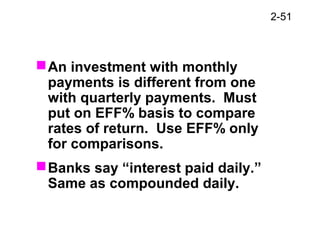

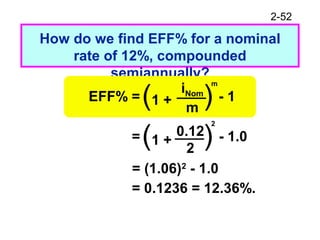

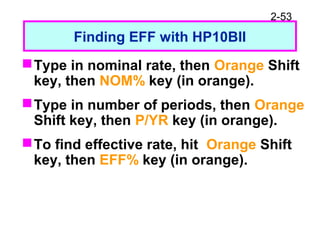

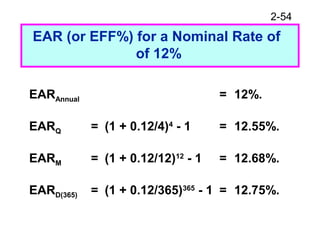

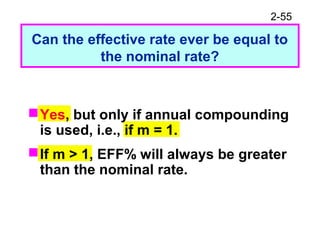

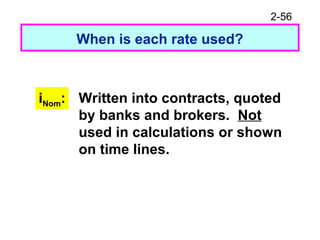

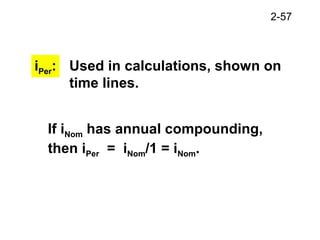

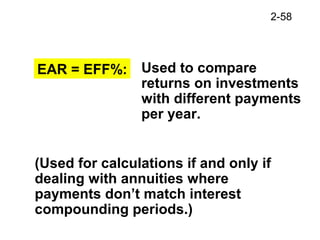

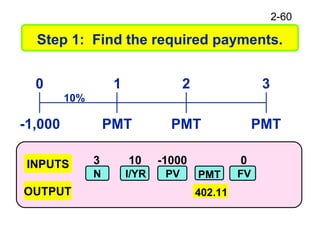

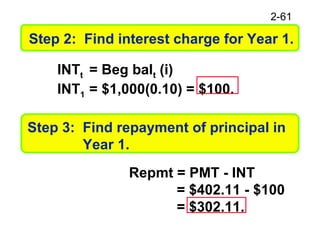

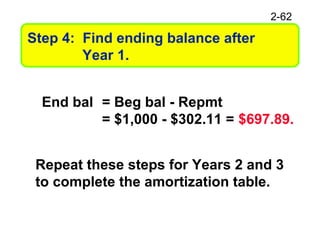

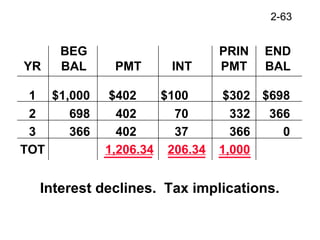

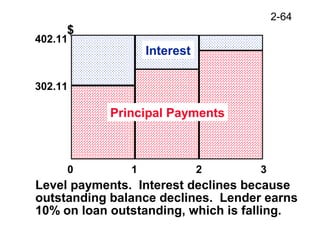

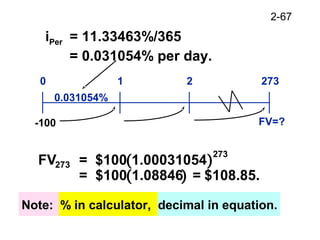

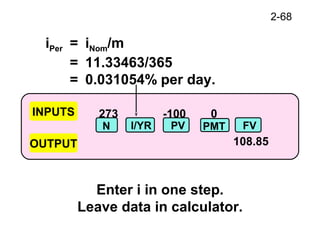

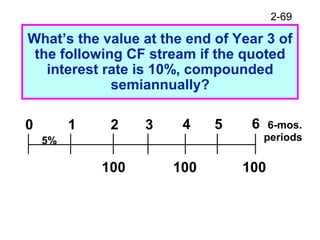

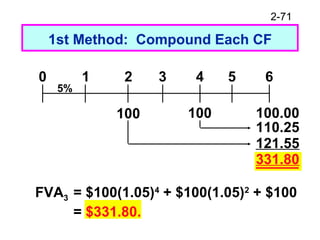

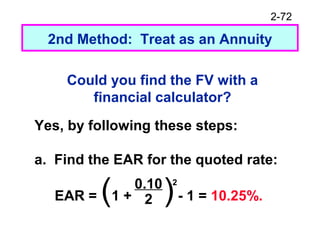

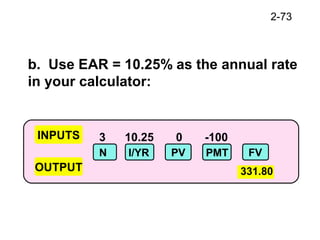

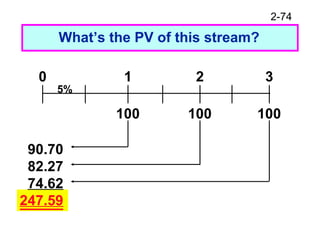

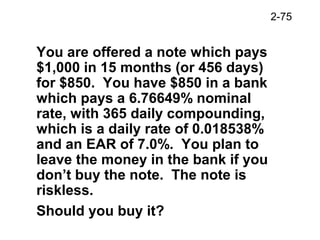

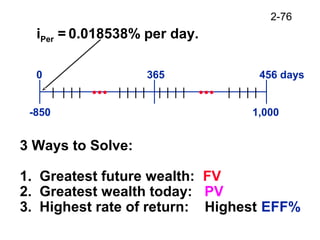

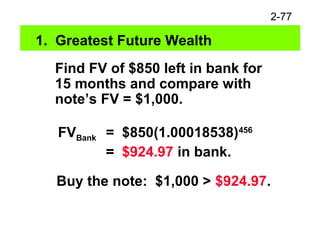

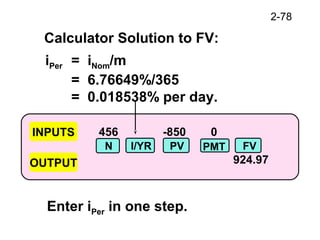

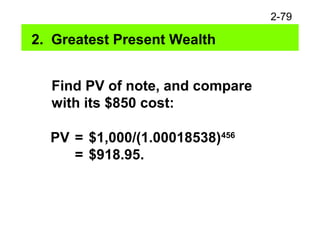

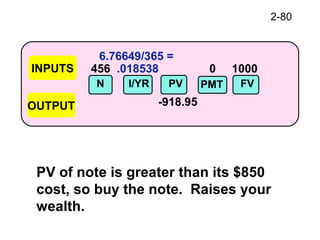

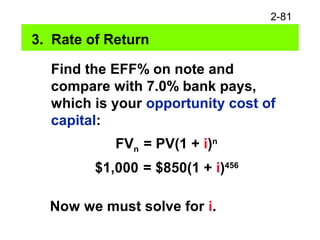

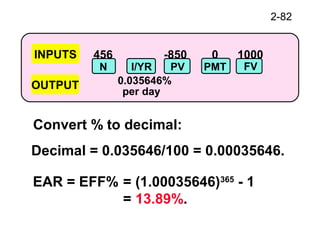

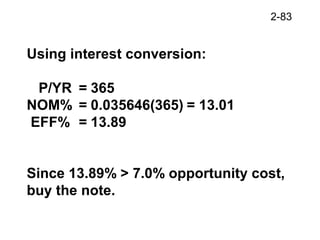

This document discusses time value of money concepts including future value, present value, rates of return, and amortization. It provides examples of cash flow timelines and formulas for calculating future and present value using a financial calculator or spreadsheet. It also covers topics such as effective annual rates, nominal rates, and periodic rates when interest is compounded more frequently than annually.