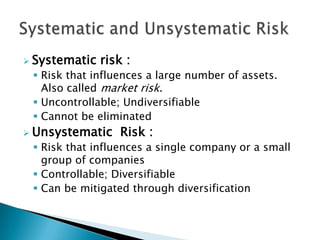

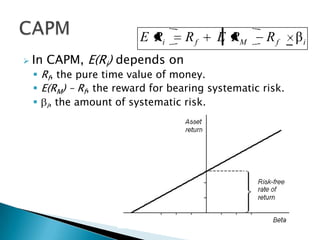

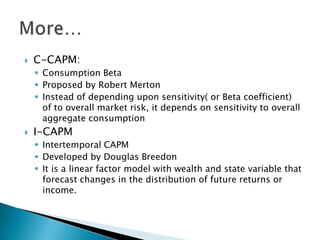

The document discusses the Capital Asset Pricing Model (CAPM). It defines systematic and unsystematic risk, the beta coefficient as a measure of systematic risk, and outlines the key assumptions and formula of CAPM. The Security Market Line (SML) graphs the relationship between risk and return predicted by CAPM. Some limitations of CAPM are that it assumes variance captures all risk and homogeneous investor expectations. Alternatives to CAPM discussed include Consumption CAPM, Intertemporal CAPM, and Arbitrage Pricing Theory.