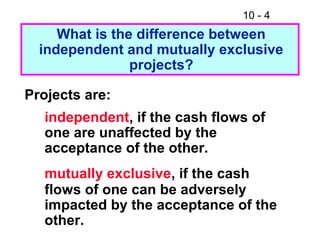

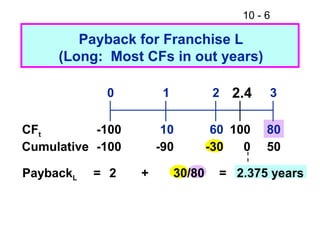

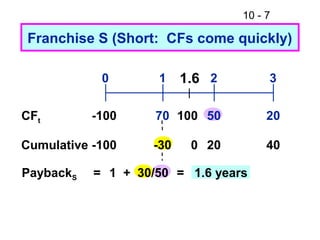

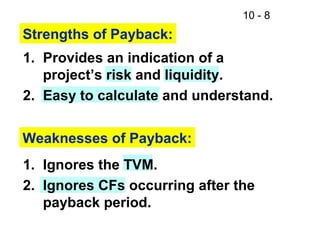

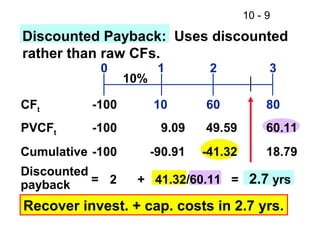

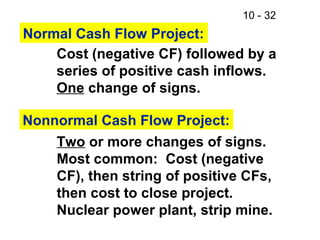

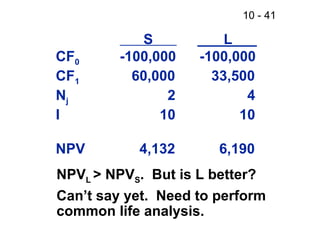

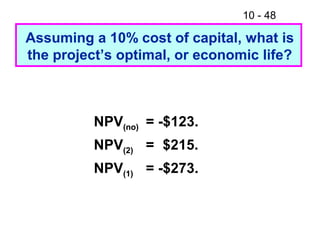

The document discusses various capital budgeting techniques for evaluating investment projects, including payback period, net present value (NPV), internal rate of return (IRR), modified internal rate of return (MIRR), and profitability index. It provides examples of calculating these metrics for projects and outlines the appropriate methods for analyzing independent vs. mutually exclusive projects. It also discusses how to handle non-normal cash flows and determine the economic life of a project.