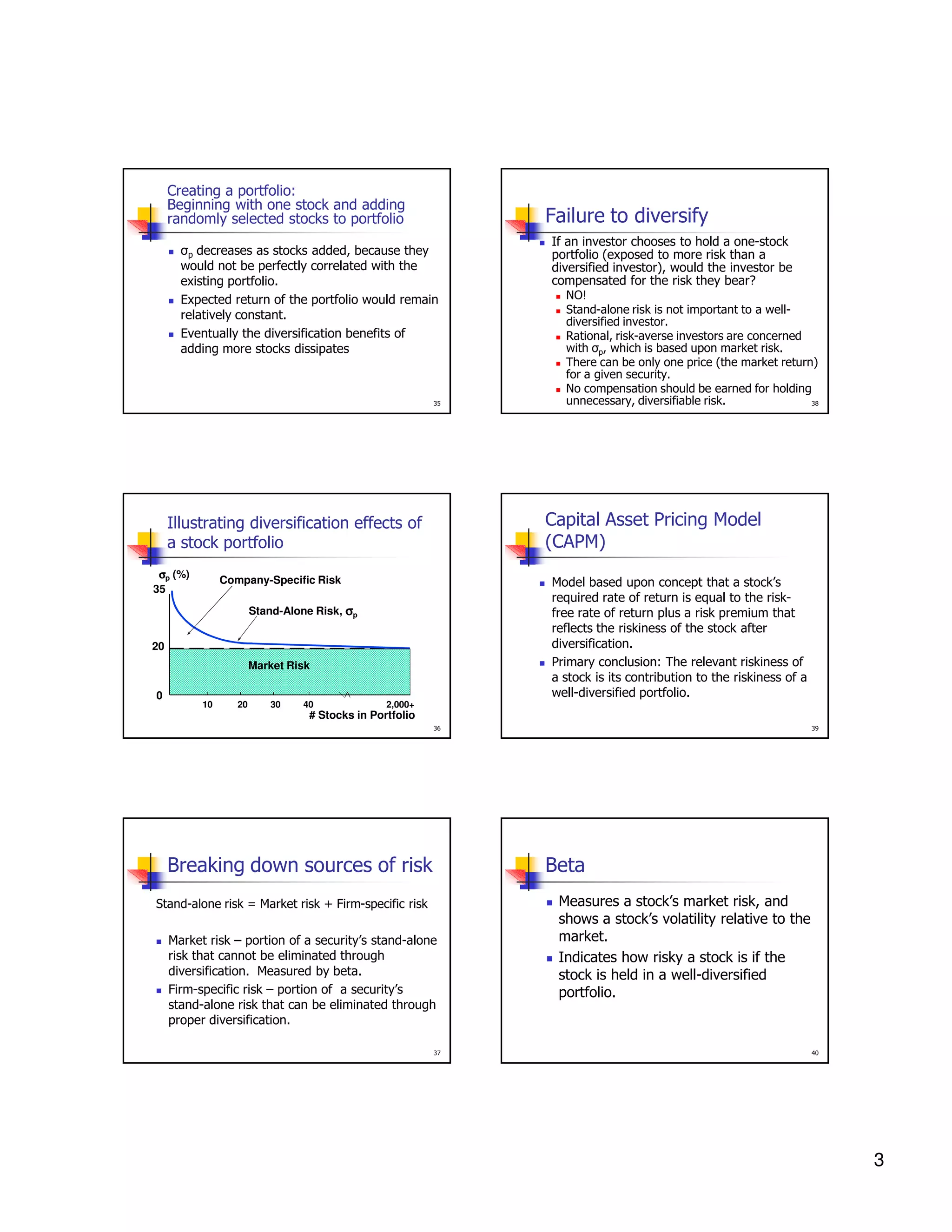

- Portfolio risk is calculated using the weighted average of the component assets' standard deviations and their correlations. Diversification reduces overall portfolio risk even when holding riskier individual assets.

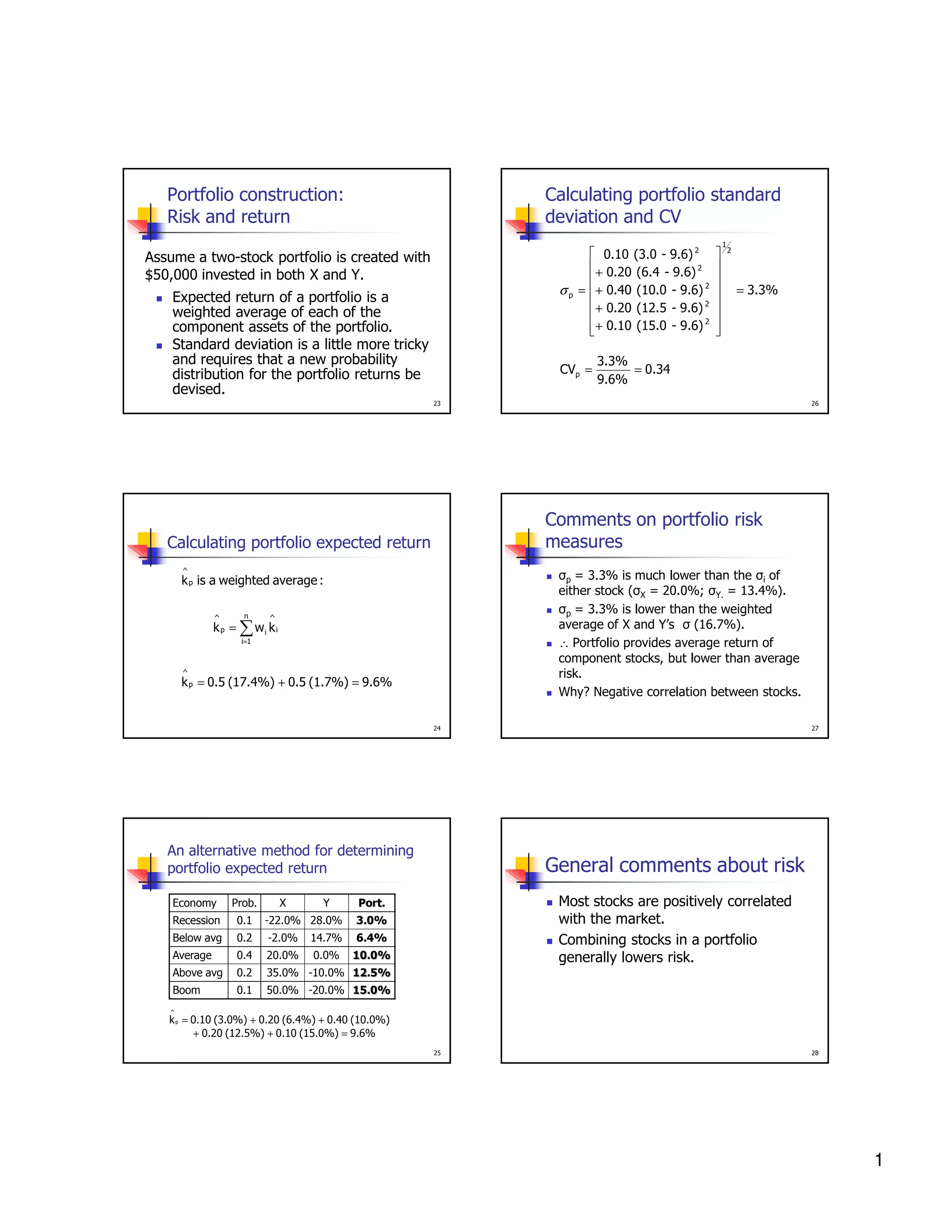

- The expected return of a portfolio is the weighted average of the individual assets' expected returns. Standard deviation requires determining a new probability distribution for portfolio returns.

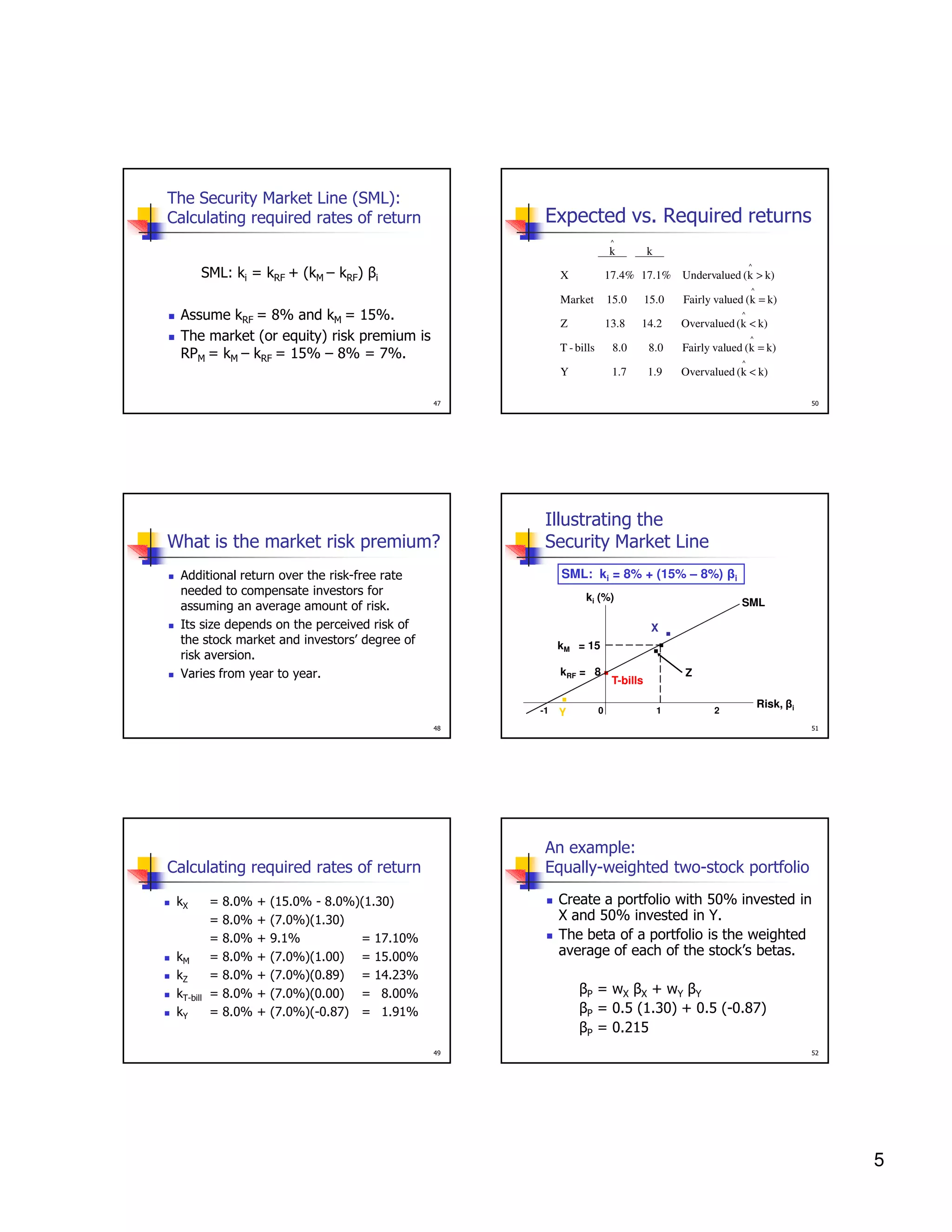

- The Capital Asset Pricing Model (CAPM) states that the expected return of an asset is determined by its beta coefficient, which measures non-diversifiable market risk relative to the overall market. The Security Market Line plots the relationship between risk and return based on the CAPM.

![Returns distribution for two perfectly

negatively correlated stocks (ρ = -1.0)

Covx,y & Corr x,y ?

A

Stock W

Stock M

Economy

25

25

25

15

15

15

0

0

0

-10

-10

Prob.

RX

0.1

0.2

0.4

0.2

0.1

-22%

-2%

20%

35%

50%

28%

15%

0%

-10%

-20%

17.4%

20.00%

C

1.7%

13.40%

Ex. Return

Std.dev

Covariance (x,Y)

-10

B

Ry

Recession

Below avg

Average

Above avg

Boom

Portfolio WM

A*B

RX -E(Rx) RY-E(RY)

-39.4% 26.3%

-19.4% 13.0%

2.6% -1.7%

17.6% -11.7%

32.6% -21.7%

-10.36%

-2.52%

-0.04%

-2.06%

-7.07%

C* Prob

-1.04%

-0.50%

-0.02%

-0.41%

-0.71%

-2.68%

Corr (x,Y)

-1.00

29

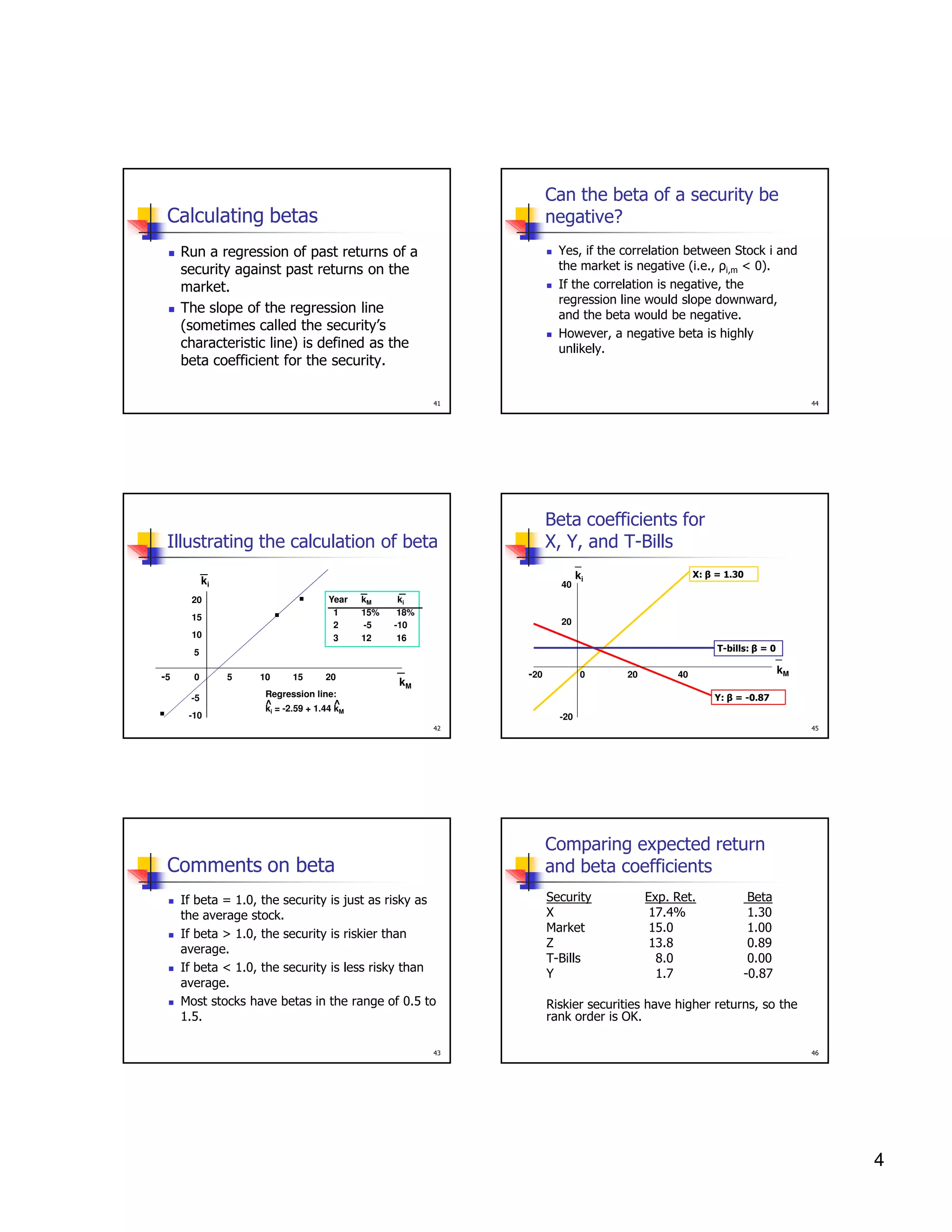

Incorporating correlation to

portfolio risk calculation

Returns distribution for two perfectly

positively correlated stocks (ρ = 1.0)

Stock M’

Stock M

2

σ p = Wx 2 *σ 2 + W y2 * σ y + 2WxW y Corrxyσ xσ y

x

Portfolio MM’

25

25

15

15

0

0

0

-10

-10

OR, using covariance

25

15

32

-10

2

σ p = Wx 2 *σ 2 + W y2 *σ y + 2WxW y Cov xy

x

Previous Example,

σ p = 0.5 2 * 20 2 + 0.5 2 *13.4 2 + 2 * 0.5 * 0.5 * −1* 20 *13.4

2

30

Co var iance ( X , Y )

σ x *σ y

Cov ( x , y ) = Corr ( x , y ) * σ

x

*σ

33

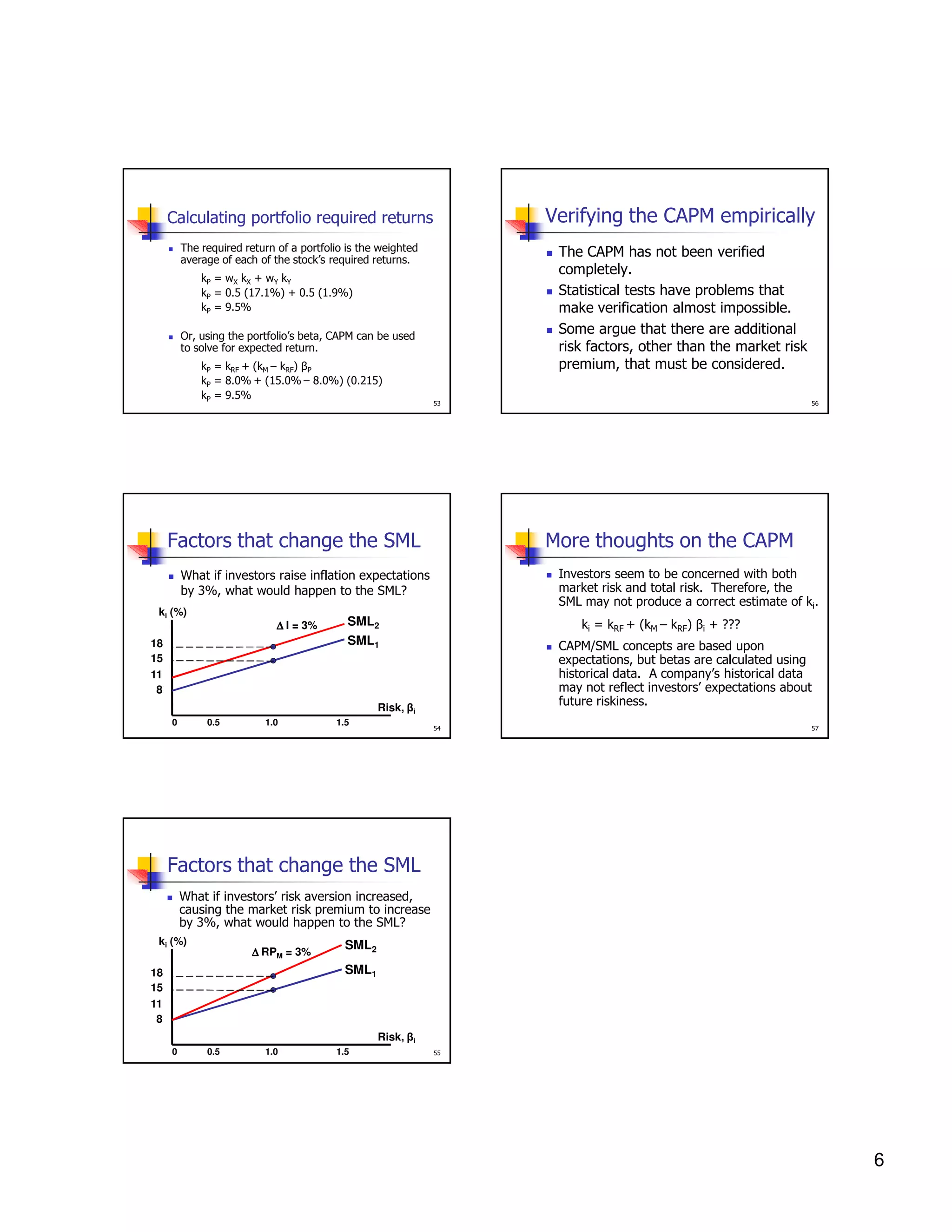

Calculate the portfolio risk and return

for the example 2 given above if 60%

of investment is made on stock P

,

Therefore

σ p = 0.5 * 20 2 + 0.52 *13.4 2 + 2 * 0.5 * 0.5 * −2.68

σ p = 3. 3

Portfolio risk and return using

historical data

How to find correlation ?

Corr ( x , y ) =

OR, using covariance

σ p = 3. 3

y

Covariance for forecast data with probabilities

n

Cov ( x , y ) =

∑ [r

x

− E ( r x )] [ r y − E ( r y )] Pi

i =1

Covariance for historical data

∑ ( x − x)( y

i

Cov( x, y ) =

i

− y)

i =1

n −1

31

34

2](https://image.slidesharecdn.com/s910-riskreturncontd1-131208223124-phpapp01/75/S9-10-risk-return-contd-1-2-2048.jpg)