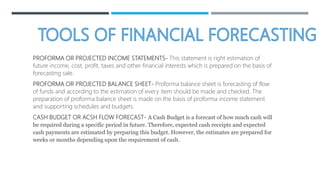

This document discusses financial planning and forecasting. It defines financial planning as a systematic process of determining financial objectives, policies, and procedures related to a firm's estimated financial requirements and financing patterns. Financial forecasting is described as using past financial statements, funds flow statements, ratios, and industry economic conditions to project a firm's future financial condition. Key aspects of financial planning and forecasting include determining objectives, formulating policies, developing procedures, assessing factors that influence financing decisions, and creating pro forma financial statements and cash budgets to estimate future needs and performance.