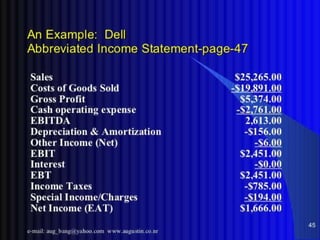

This document discusses financial management systems and the types of financing available to businesses. It explains that financial management systems are used to input, analyze, and report financial data to help managers make decisions. The document then covers four main components of financial management systems: cash management, investment management, capital budgeting, and financial planning. It also discusses two major sources of financing for businesses - equity financing such as personal savings, home equity loans, venture capital, and IPOs, and debt financing like loans from banks, commercial lenders, bonds, and government programs.