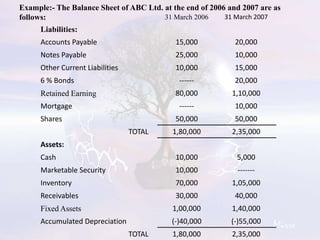

This document presents a fund flow statement example for ABC Ltd. between 2006 and 2007.

Key points:

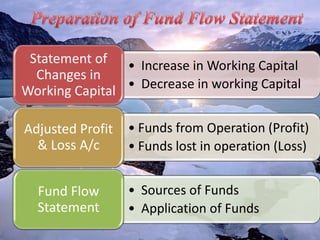

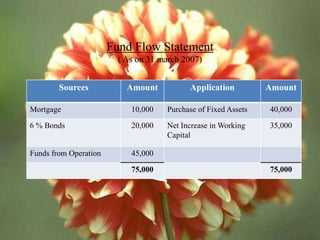

- A fund flow statement shows changes in funds between two balance sheet dates by listing sources and applications of funds.

- For ABC Ltd., sources of funds included taking a mortgage, redeeming bonds, and funds from operations. Applications included purchasing fixed assets and increasing working capital.

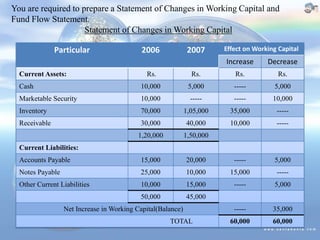

- A statement of changes in working capital and adjusted profit and loss account were also prepared to determine the increase in working capital and funds from operations.

- The completed fund flow statement for ABC Ltd. balanced sources of funds totalling Rs. 75,000 with applications of funds.