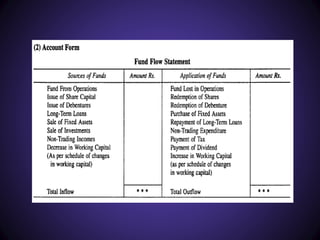

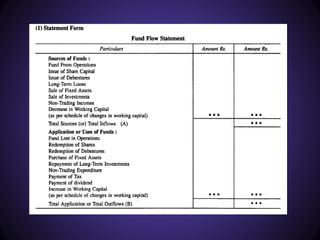

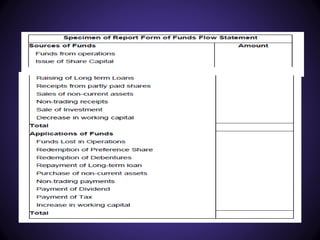

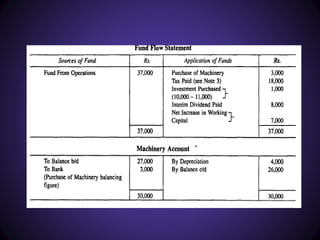

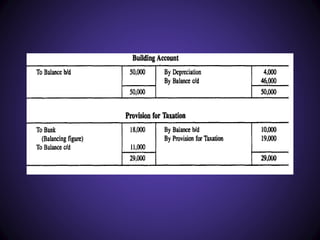

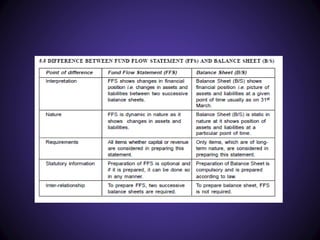

1. The funds flow statement shows the sources and applications of funds during a specific period of time. It indicates where funds came from and where they were used.

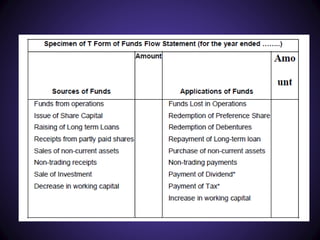

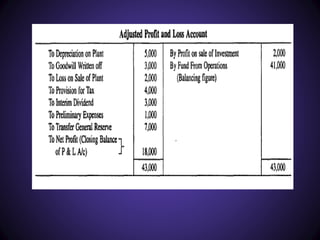

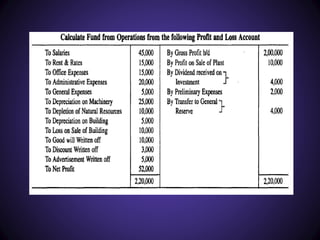

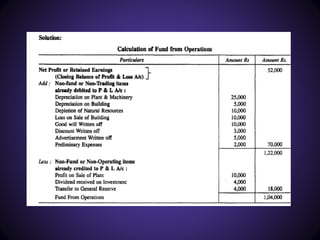

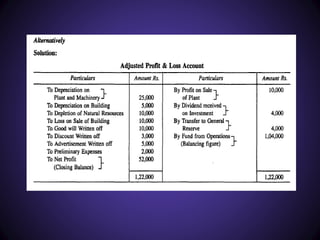

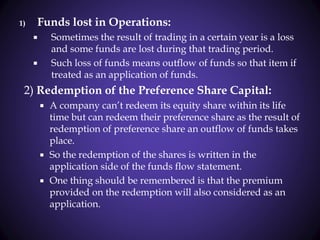

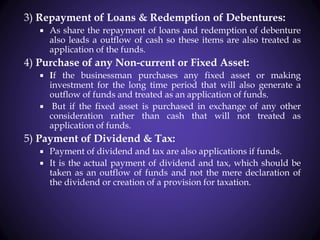

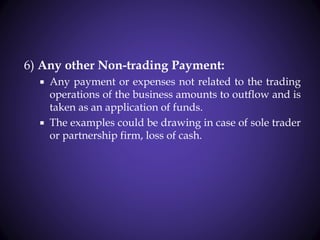

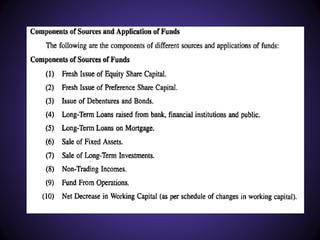

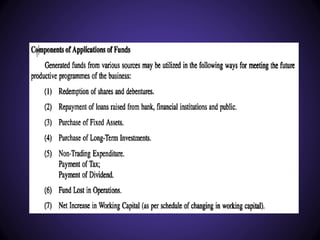

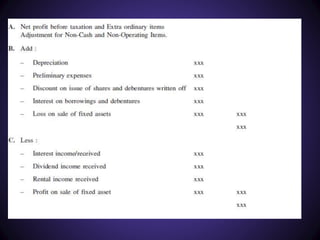

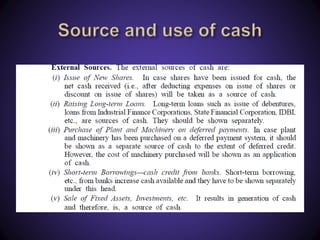

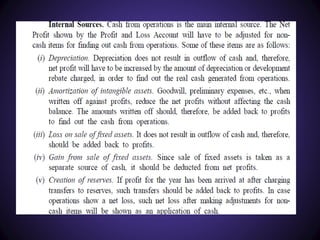

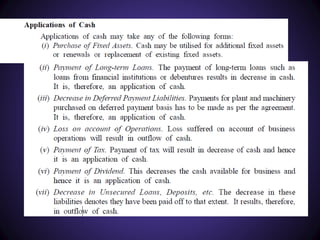

2. Sources of funds include internal sources like profits and external sources like issuance of shares or debentures. Applications of funds include losses, repayment of loans, purchase of assets, and payment of dividends.

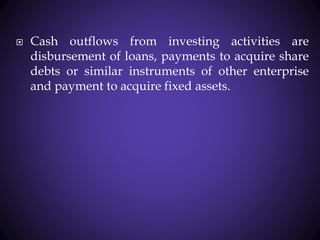

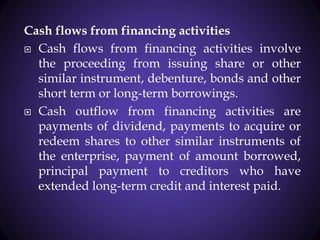

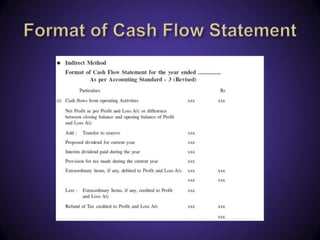

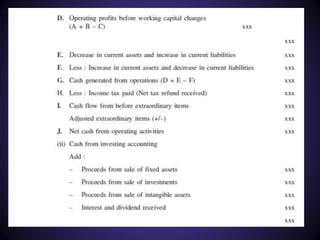

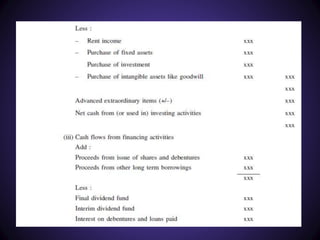

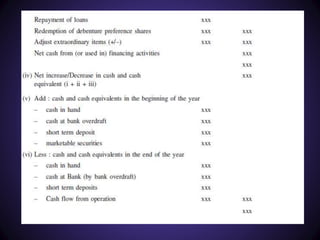

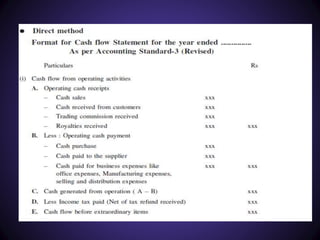

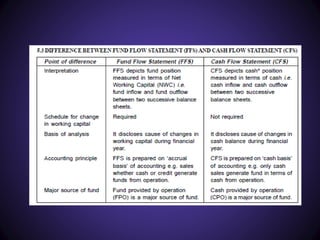

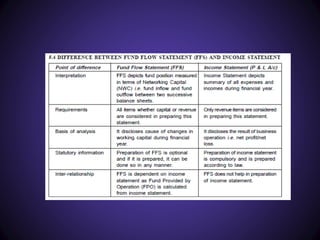

3. The cash flow statement differs from the funds flow statement in that it only deals with cash and cash equivalents, showing the inflows and outflows of cash from operating, investing and financing activities.