The document discusses what a fund flow statement is and how to prepare one.

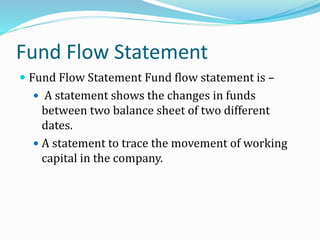

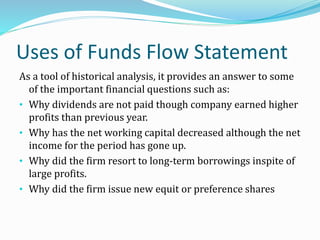

A fund flow statement shows changes in a company's working capital between two balance sheet dates by tracing the sources and uses of funds. It is prepared by analyzing changes in current assets and current liabilities, and adjustments such as funds from operations. The statement lists sources of funds like profits and financing activities, and uses of funds like purchases of assets and debt repayments. The objective is to analyze why a company's working capital increased or decreased over a period.