The document discusses strategic financial management and provides details on:

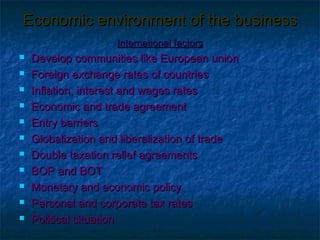

1. Strategic financial management focuses on the long-term outlook and anticipating environmental changes.

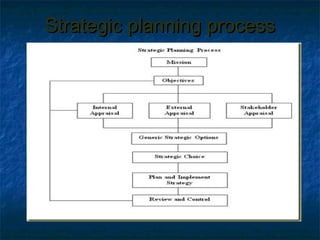

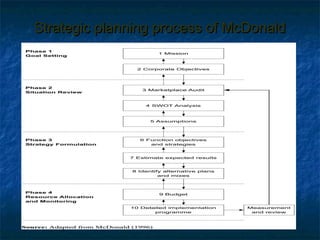

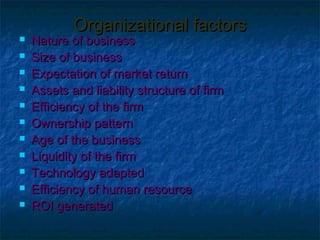

2. Strategic planning involves studying internal/external factors, identifying opportunities/threats, and leveraging core competencies.

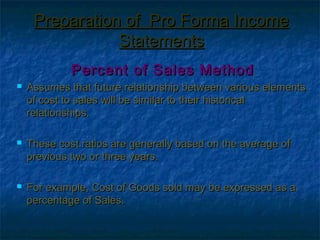

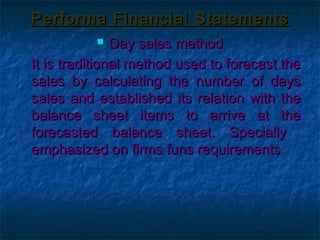

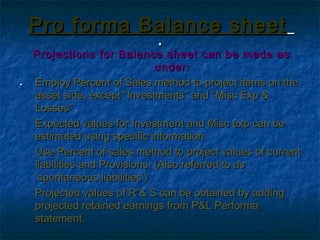

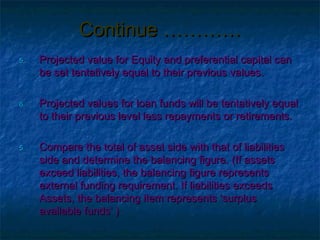

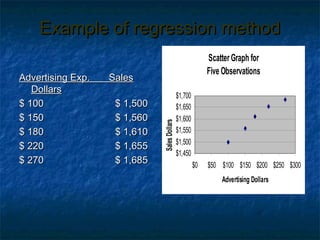

3. Financial forecasting helps prepare pro forma statements and budgets to project the future financial position.