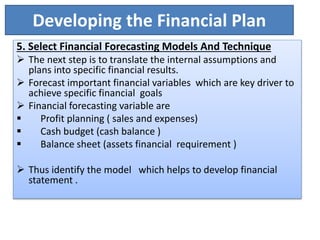

Financial planning involves forecasting possible future states, evaluating their effects, and analyzing options and strategies for management. It uses historical financial data to develop assumptions about external factors like the economy and industry trends, and internal factors like sales, expenses, assets and liabilities. Goals and strategies are set, forecasts are made using models, and sensitivity analysis is performed to modify assumptions and achieve desired results. The outcome is pro forma financial statements that determine the company's projected financial position.