The document discusses cash flow statements, including:

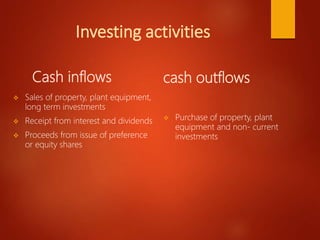

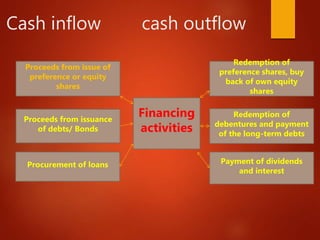

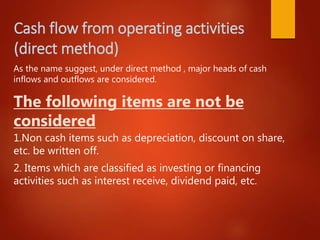

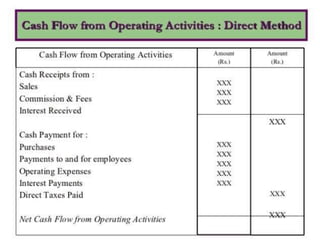

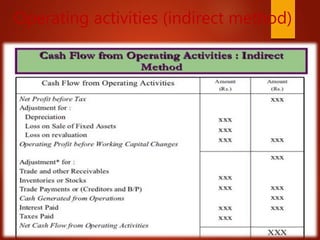

1. Cash flow statements describe changes in cash between periods by showing cash inflows and outflows from operating, investing, and financing activities.

2. The purpose is to provide information about a company's gross receipts and payments over a period of time to assess liquidity and profitability.

3. Advantages include ascertaining liquidity, determining optimal cash balances, cash management, and performance evaluation.