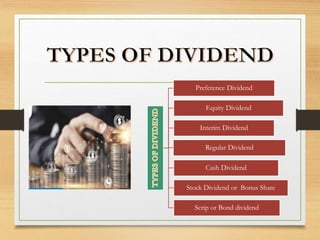

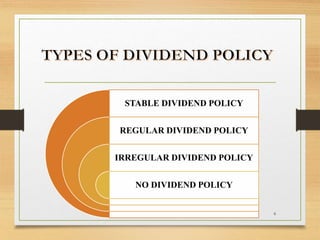

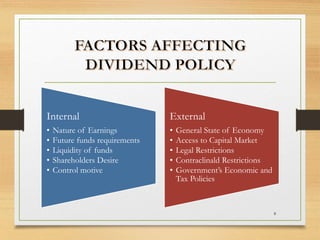

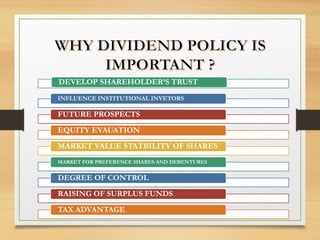

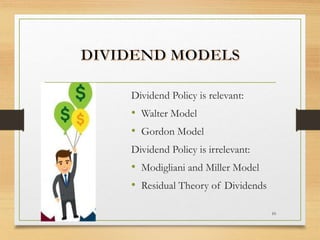

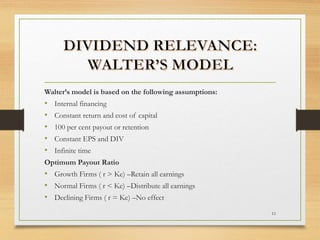

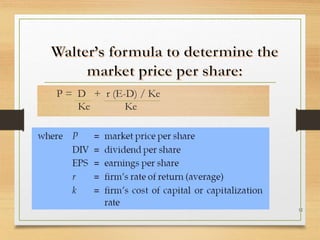

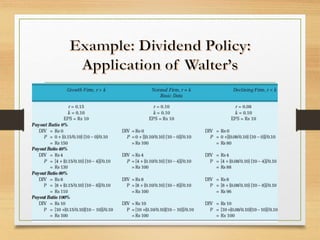

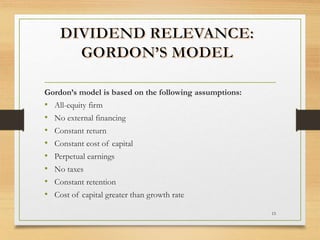

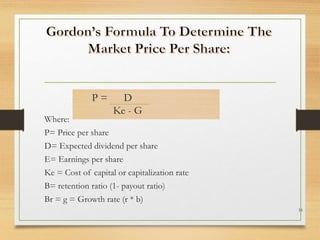

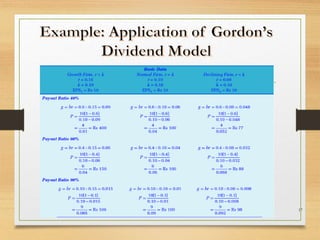

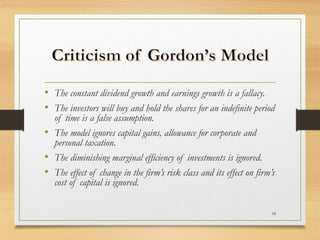

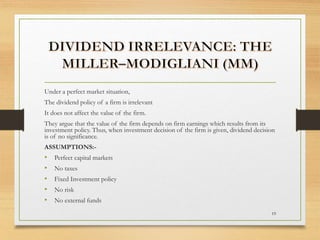

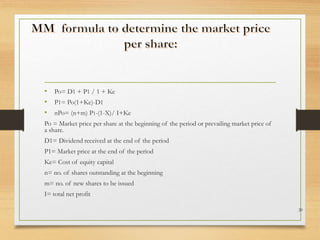

The document discusses dividends, defining them as divisible profits distributed to shareholders according to share proportion. It outlines types of dividends and policies, including stable, regular, and irregular policies, while also addressing factors affecting these policies and various models such as the Walter, Gordon, and Modigliani & Miller models. Additionally, it highlights the relevance and irrelevance of dividend policy to firm value under different market conditions.