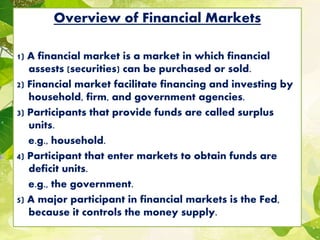

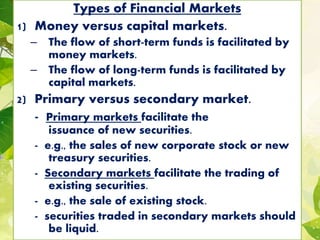

This document contains information about the duties of a financial manager and an overview of financial markets. It discusses that a financial manager's duties include monitoring and controlling finances, reviewing budgets, ensuring accurate financial reporting, and overseeing compliance. It also provides details about different types of financial markets, the securities traded in them, and participants that provide or obtain funds. Money markets facilitate short-term lending while capital markets focus on long-term financing. Primary markets issue new securities and secondary markets trade existing financial assets.