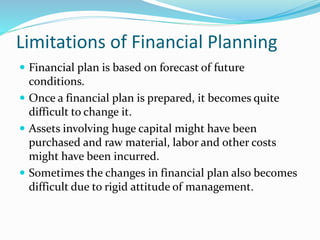

This document provides an overview of financial planning. It defines financial planning as determining a firm's financial objectives, policies, and procedures. The objectives of financial planning are to minimize the cost of capital, ensure simplicity and liquidity in the capital structure, and provide adequate but not excessive funds. Financial planning can be short, medium, or long term. Key steps are determining objectives, formulating policies and procedures, and providing flexibility. Factors like the nature of business and management attitudes also affect financial planning. Financial planning helps with efficient operations, capitalization, utilization of funds, and business expansion. Limitations include forecasts not always being accurate and difficulty changing plans once set.