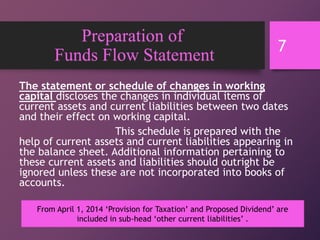

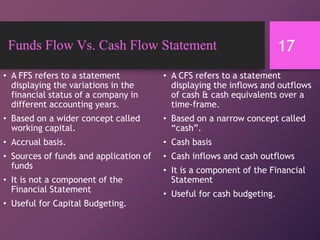

The document provides an overview of the funds flow statement, detailing its purpose, importance, and the distinctions between funds flow, income, and cash flow statements. It explains the changes in working capital, the classification of assets and liabilities, and methods for calculating fund from operations. Additionally, it outlines the preparation of the funds flow statement and its relevance in analyzing financial positions.