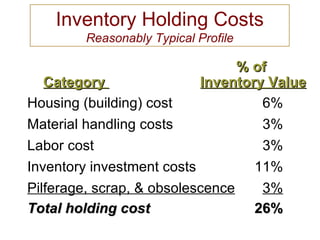

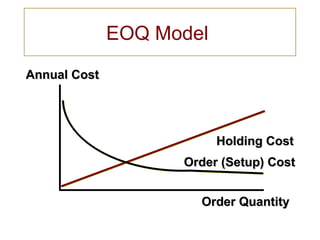

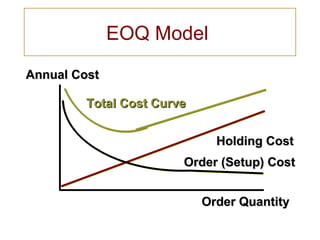

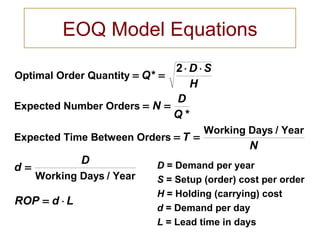

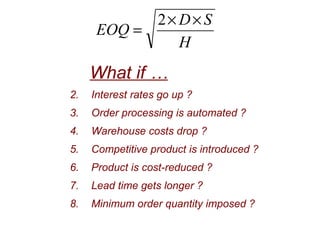

Higher interest rates increase holding costs, lowering EOQ. Automating orders lowers setup costs, increasing EOQ. Lower warehouse costs lower holding costs, increasing EOQ. New competition may change demand assumptions. Cost reductions lower unit costs but not other factors. Longer lead times increase safety stock needs, lowering EOQ. Minimum orders impose a floor that may exceed the calculated EOQ.