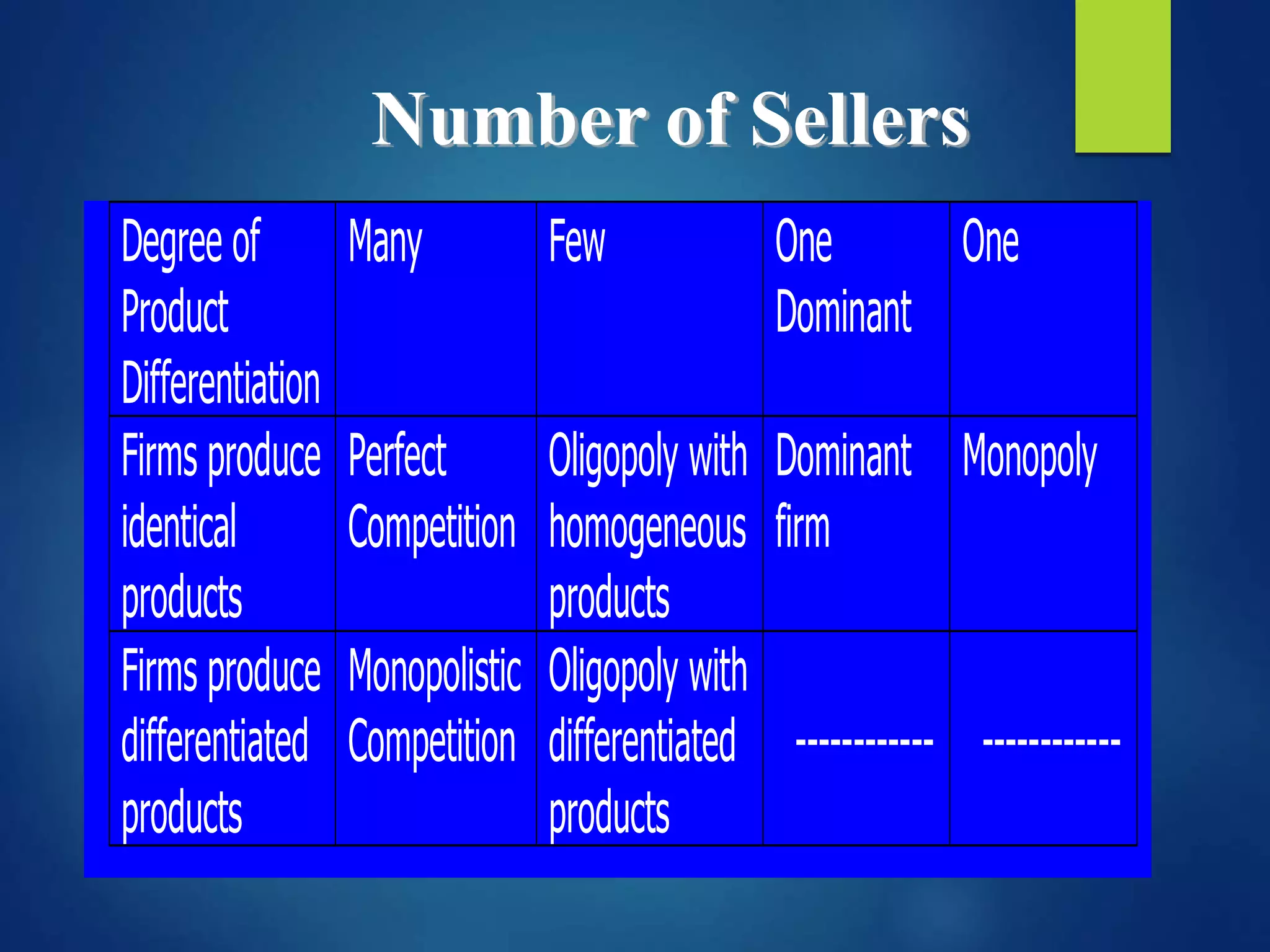

This document provides an overview of the Cournot model for duopoly markets. The key points are:

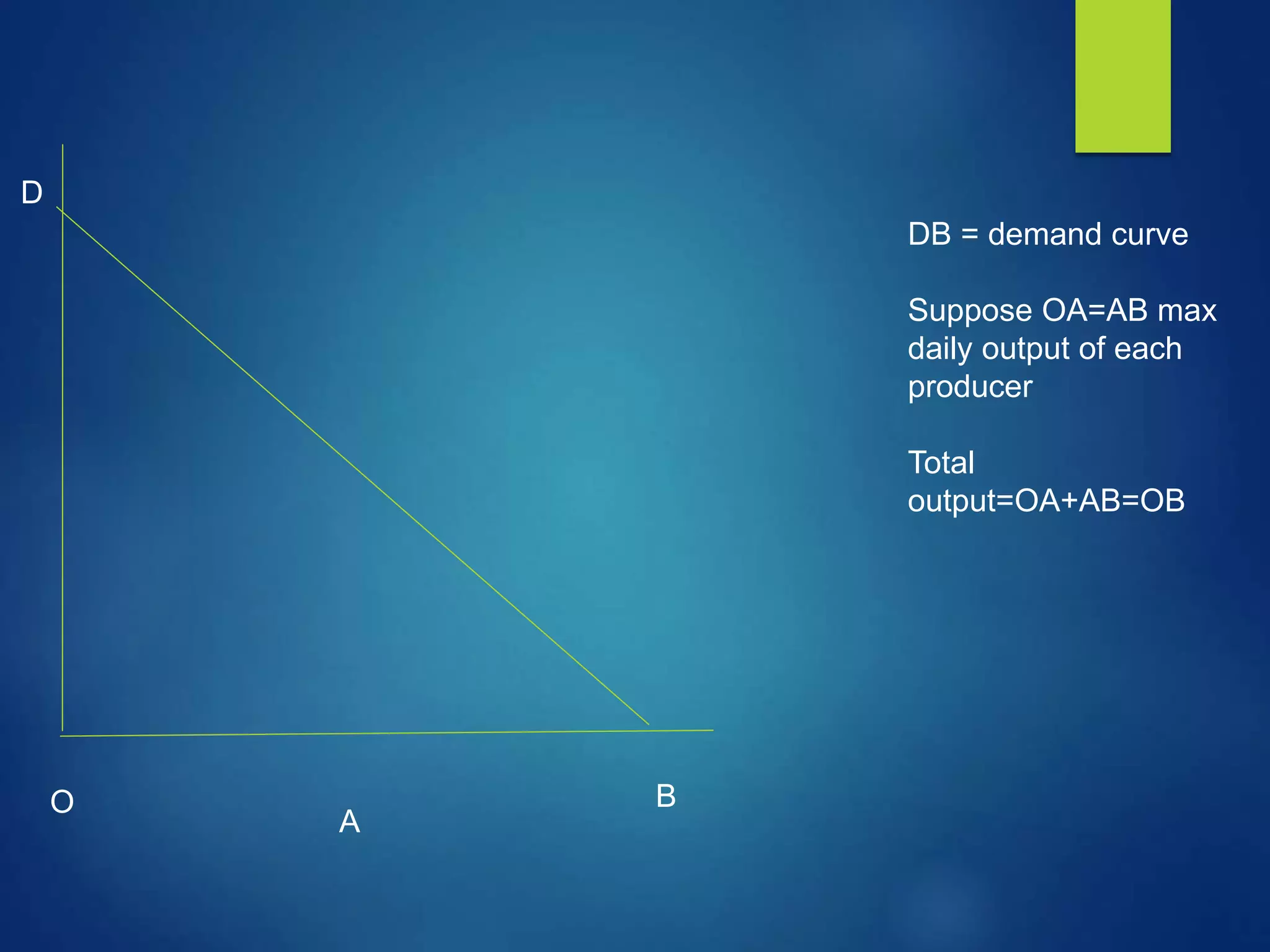

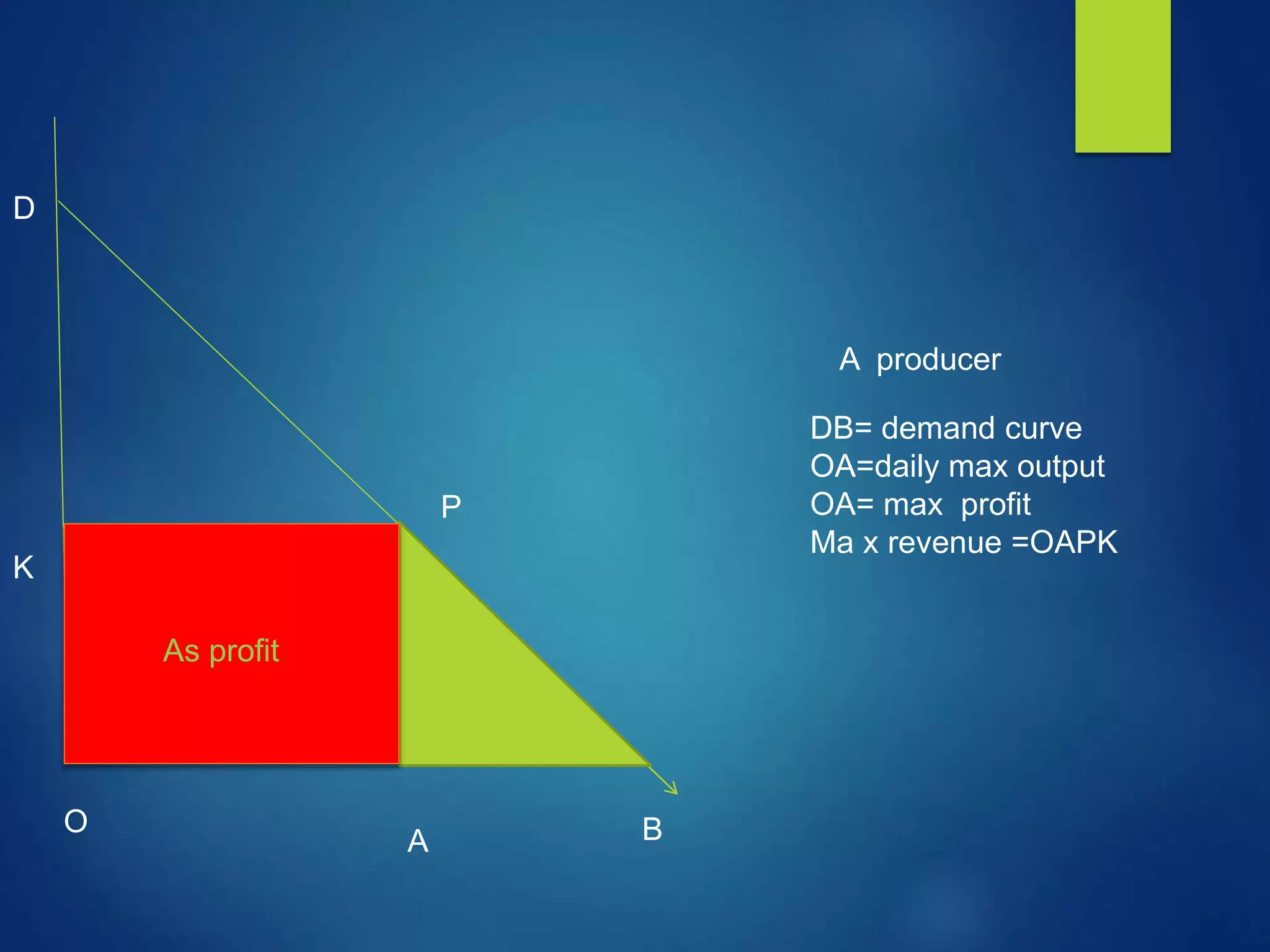

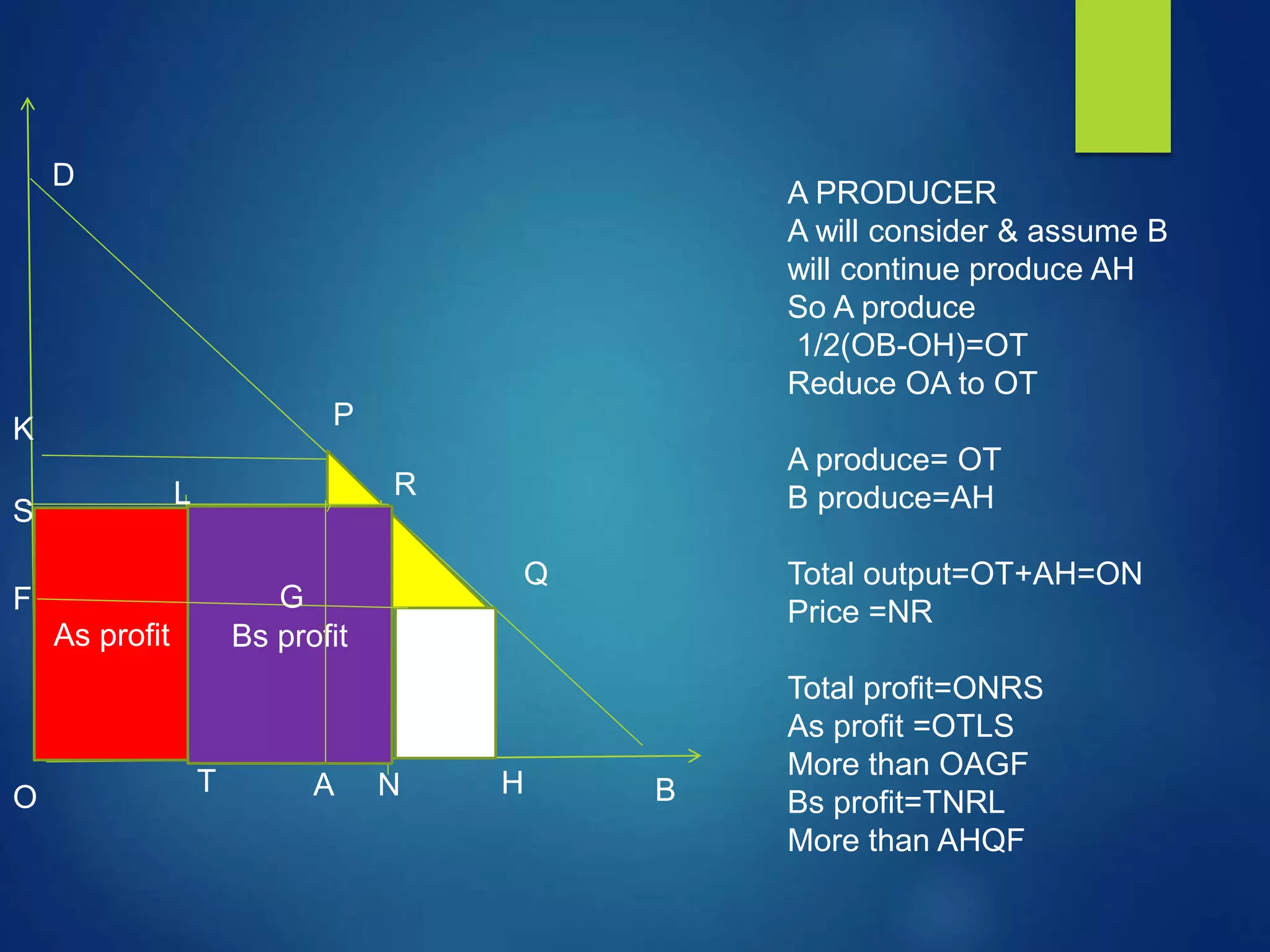

1) The Cournot model assumes two firms produce a homogeneous good, each treats the other's output as fixed, and they decide quantity simultaneously.

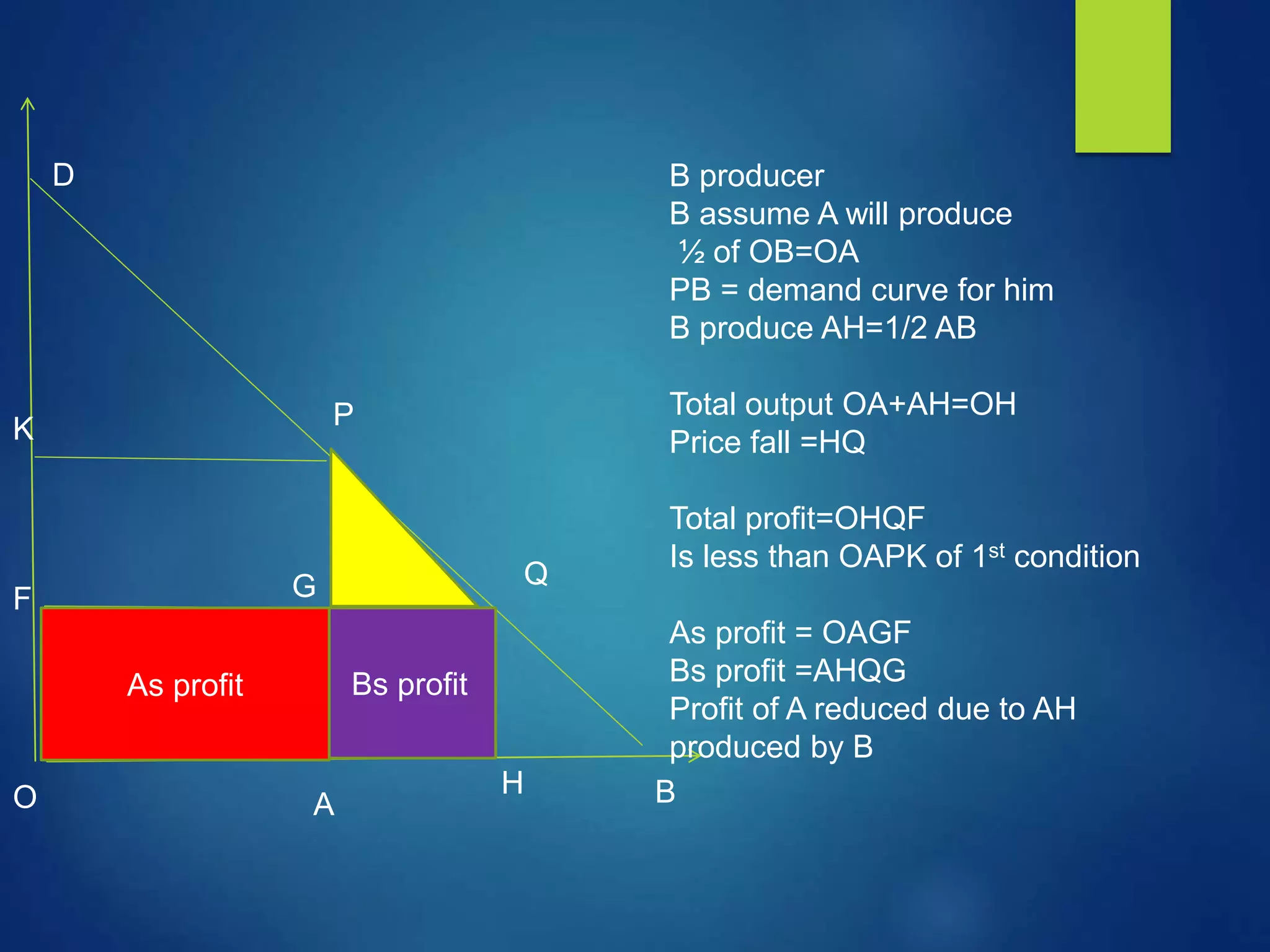

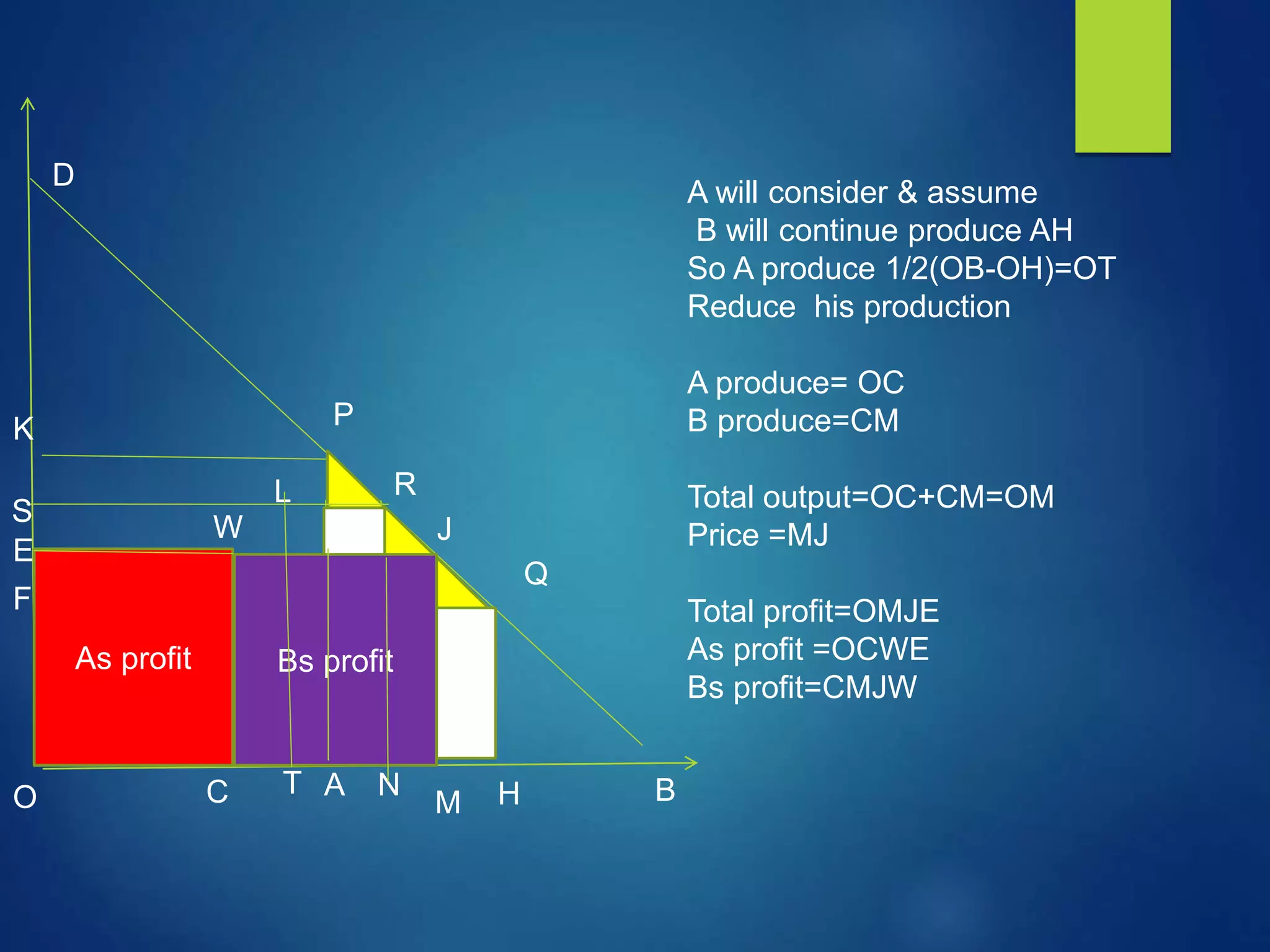

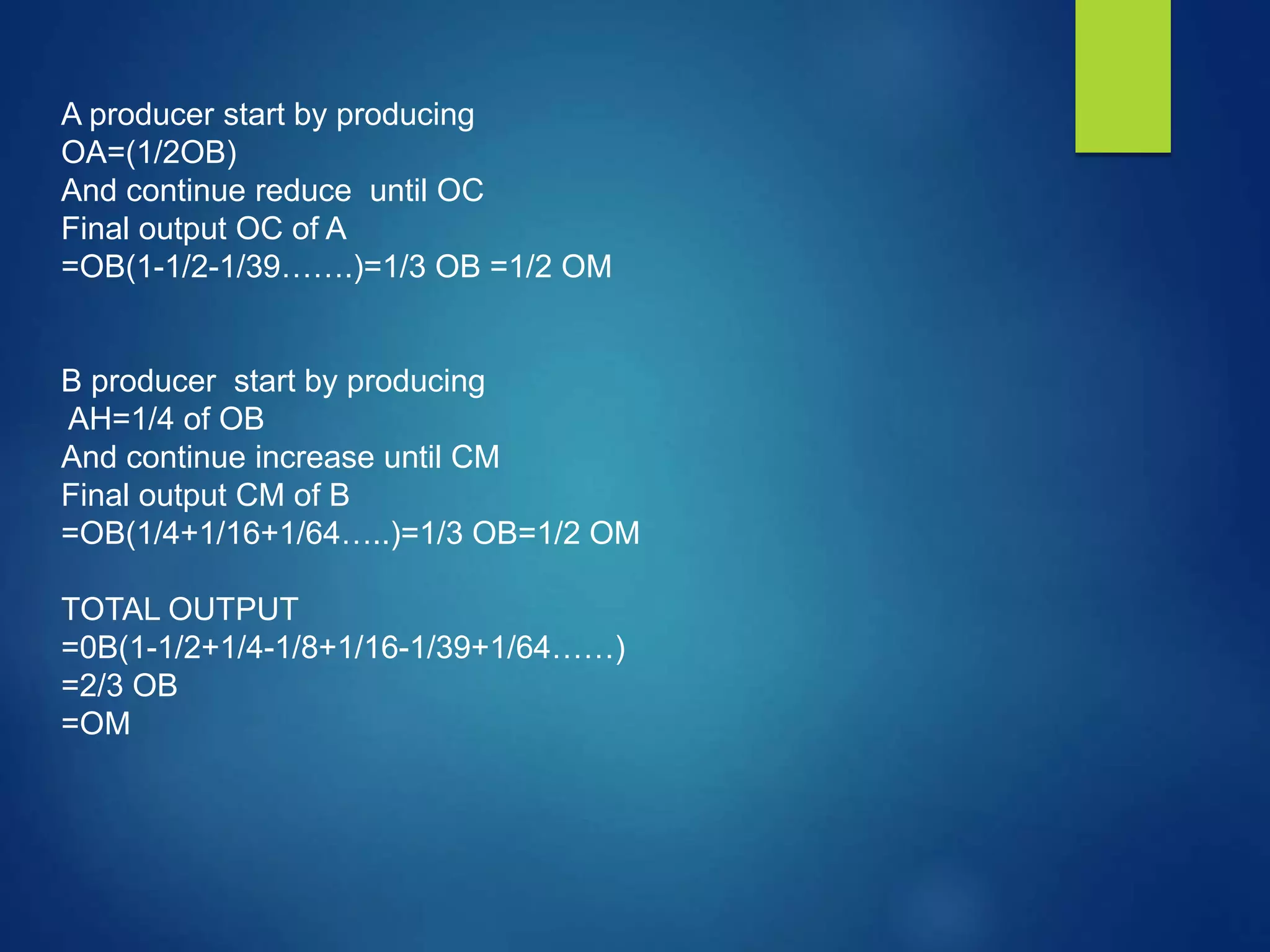

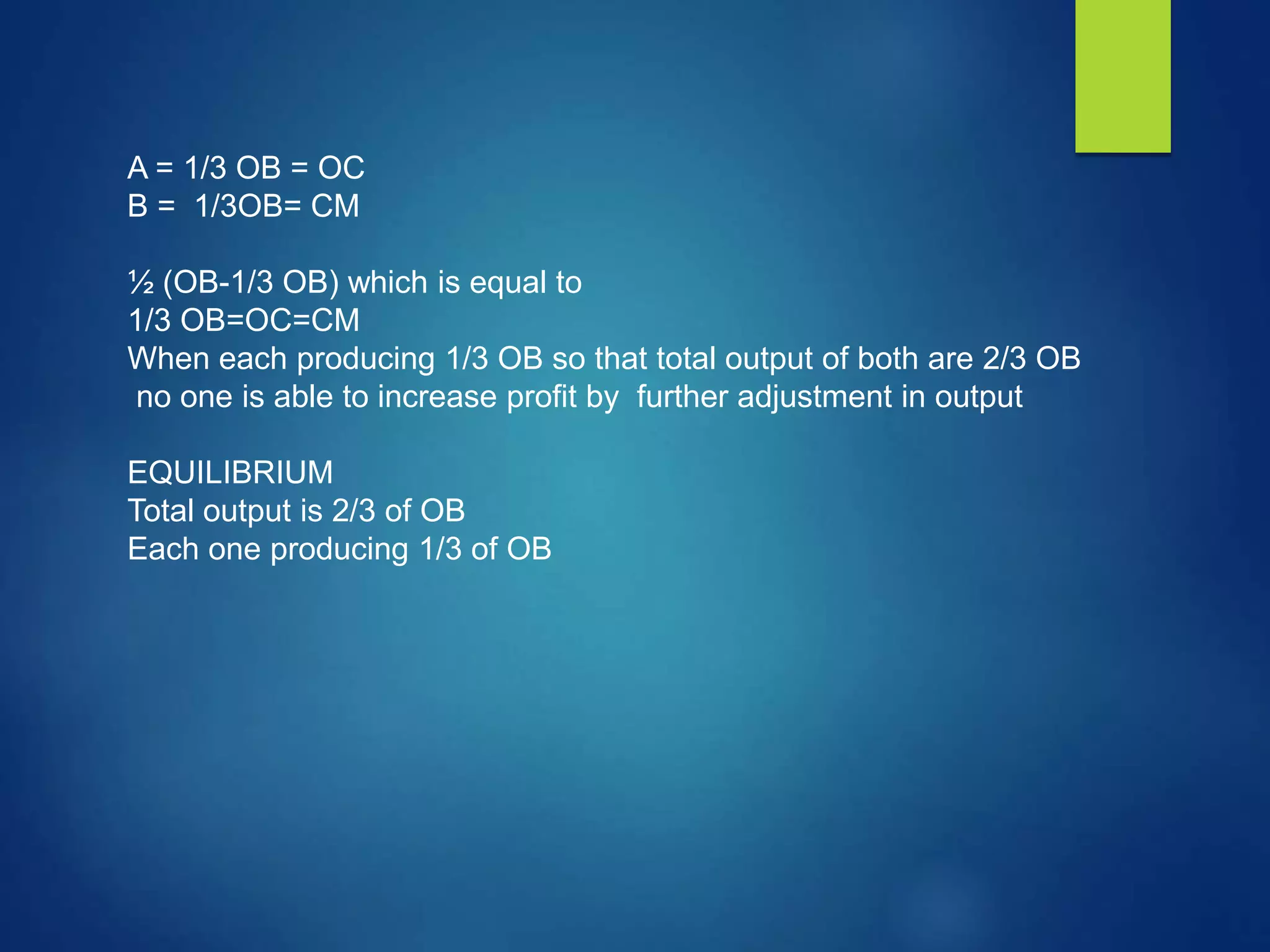

2) Through a process of adjustment and readjustment, each firm will gradually reduce or increase production until equilibrium is reached where both firms produce 1/3 of the total market output and maximize their profits.

3) The equilibrium point occurs when no firm can increase profits by altering their quantity unilaterally, and total output is 2/3 of the maximum market quantity.