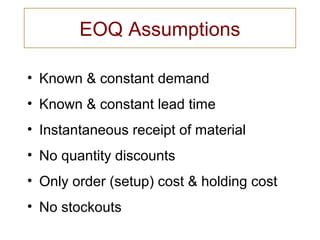

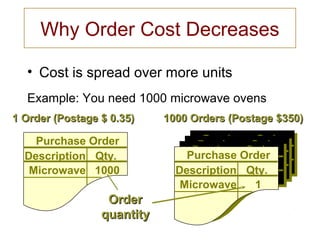

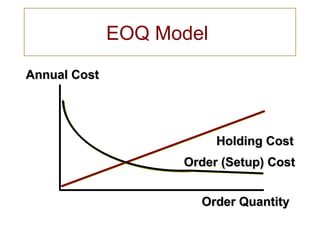

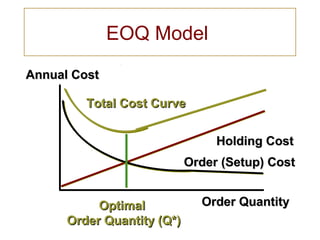

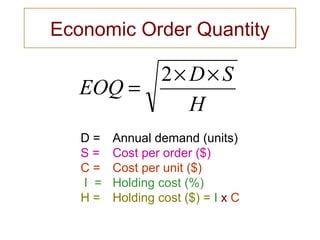

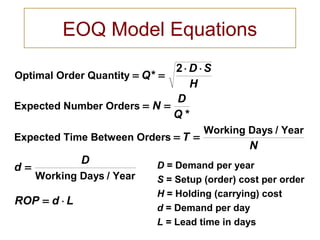

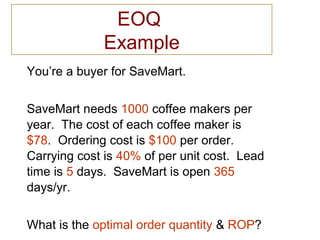

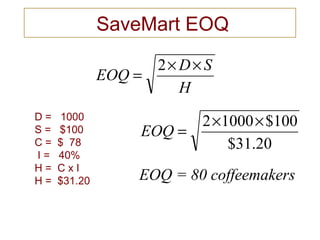

This document discusses the economic order quantity (EOQ) model, which aims to minimize total inventory costs by balancing order processing costs and inventory holding costs. It provides the EOQ formula and assumptions, including known constant demand and lead times. An example is shown for a company ordering coffee makers with annual demand of 1000 units. The optimal order quantity is calculated as 80 coffee makers with an expected reorder point of 14 units. Factors that could impact the EOQ are also listed.