The document provides a summary of derivative market activity in India for August 27, 2010. Key points include:

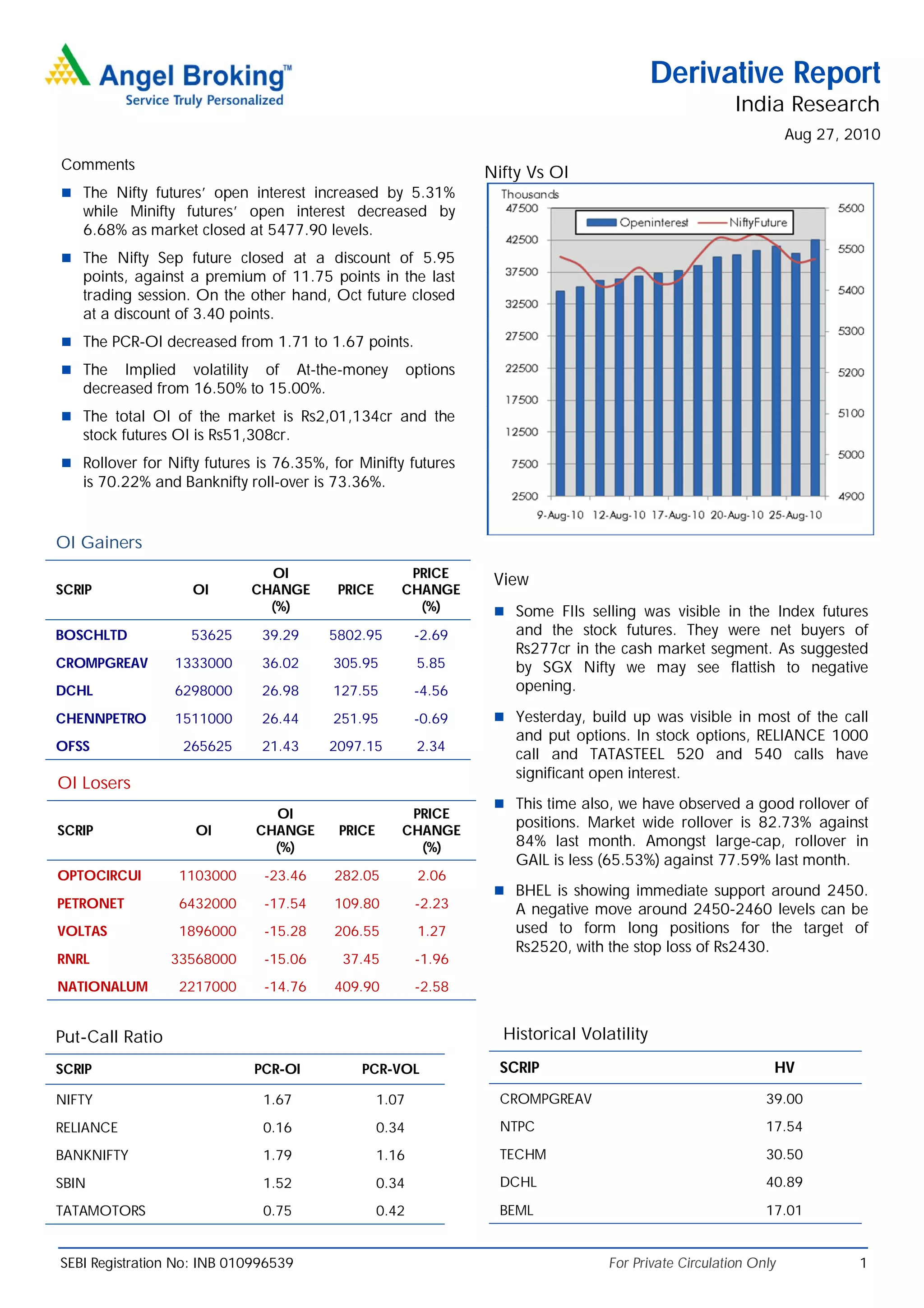

- Open interest in Nifty futures increased 5.31% while Minifty futures decreased 6.68% as the market closed at 5477.90.

- Nifty September futures closed at a discount of 5.95 points and October futures closed at a discount of 3.40 points.

- Implied volatility of at-the-money options decreased from 16.50% to 15%.

- Rollover for Nifty, Minifty, and Banknifty futures were 76.35%, 70.22%, and 73.36% respectively.