The document provides a summary of derivative market activity in India as of June 30, 2010. Key points include:

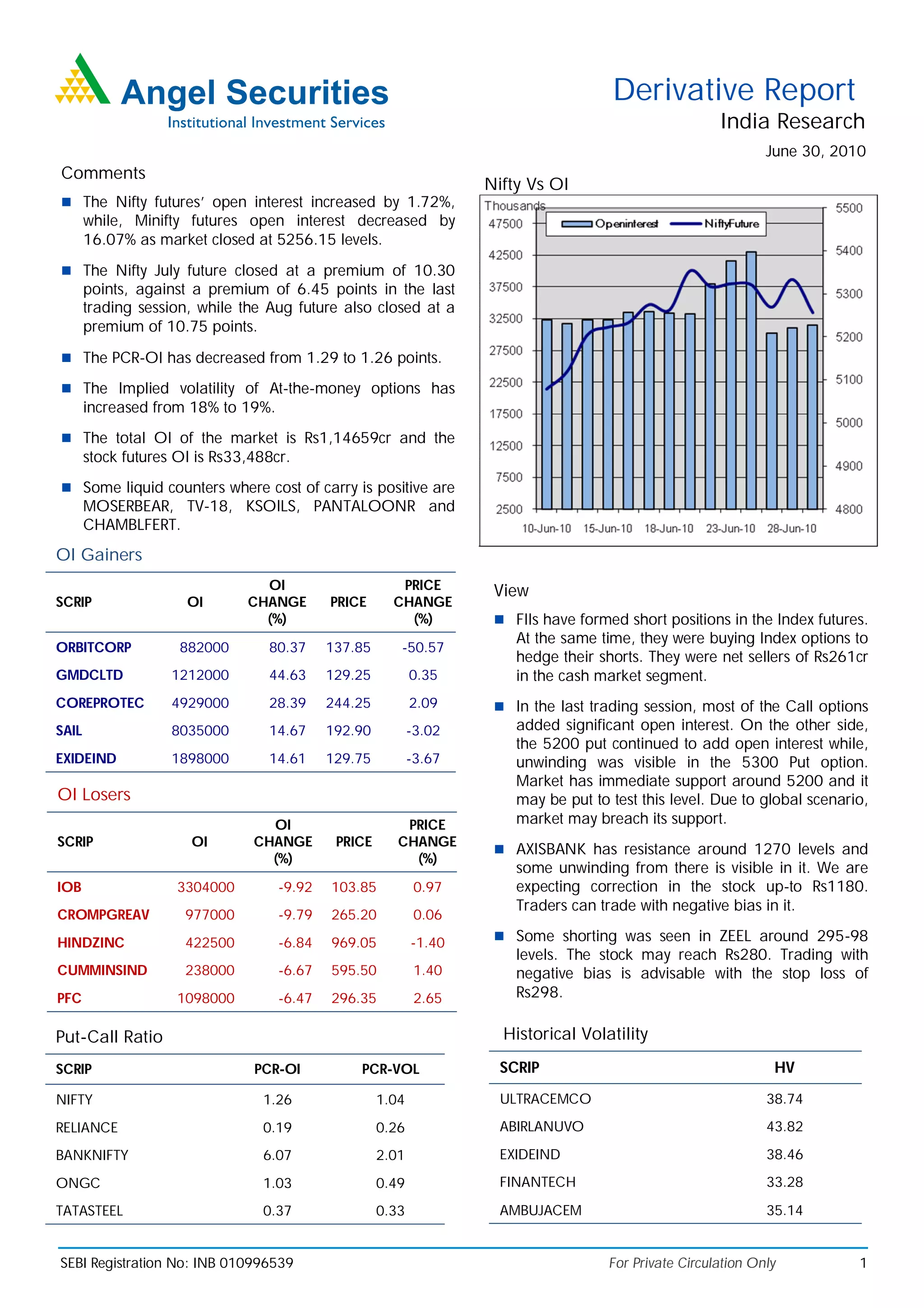

- Nifty futures open interest increased 1.72% while Mini Nifty interest decreased 16.07% as the market closed at 5256.15.

- The Nifty July future closed at a premium of 10.30 points and the August future at a premium of 10.75 points.

- Implied volatility of at-the-money options increased from 18% to 19%.

- Total open interest in the market was Rs. 1,14,659 crore with stock futures open interest at Rs. 33,488 crore.

- Some stocks with positive cost of carry included