Derivatives report 27 apr-2010

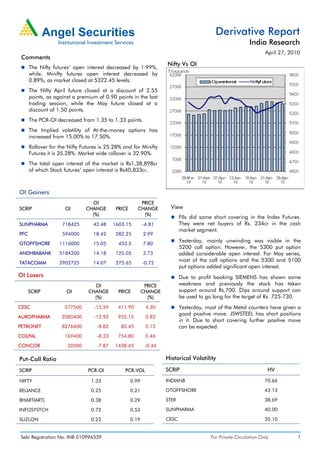

- 1. Derivative Report India Research April 27, 2010 Sebi Registration No: INB 010996539 For Private Circulation Only 1 Comments The Nifty futures’ open interest decreased by 1.99%, while, Minifty futures open interest decreased by 0.89%, as market closed at 5322.45 levels. The Nifty April future closed at a discount of 2.55 points, as against a premium of 0.90 points in the last trading session, while the May future closed at a discount of 1.50 points. The PCR-OI decreased from 1.35 to 1.33 points. The Implied volatility of At-the-money options has increased from 15.00% to 17.50%. Rollover for the Nifty Futures is 25.28% and for Minifty Futures it is 35.28%. Market wide rollover is 32.90%. The total open interest of the market is Rs1,38,898cr of which Stock futures’ open interest is Rs40,833cr. Nifty Vs OI OI Gainers SCRIP OI OI CHANGE (%) PRICE PRICE CHANGE (%) SUNPHARMA 718425 42.48 1603.15 -4.81 PFC 594000 18.42 282.25 2.99 GTOFFSHORE 1116000 15.05 453.5 7.80 ANDHRABANK 5184200 14.18 125.05 3.73 TATACOMM 2902725 14.07 275.65 -0.72 OI Losers SCRIP OI OI CHANGE (%) PRICE PRICE CHANGE (%) CESC 577500 -15.59 411.90 4.30 AUROPHARMA 2080400 -12.92 935.15 0.82 PETRONET 8276400 -8.82 82.45 0.12 COLPAL 169400 -8.33 754.80 0.46 CONCOR 20500 -7.87 1438.45 -0.44 Put-Call Ratio SCRIP PCR-OI PCR-VOL NIFTY 1.33 0.99 RELIANCE 0.25 0.21 BHARTIARTL 0.38 0.29 INFOSYSTCH 0.72 0.53 SUZLON 0.22 0.19 View FIIs did some short covering in the Index Futures. They were net buyers of Rs. 234cr in the cash market segment. Yesterday, mainly unwinding was visible in the 5200 call option. However, the 5300 put option added considerable open interest. For May series, most of the call options and the 5300 and 5100 put options added significant open interest. Due to profit booking SIEMENS has shown some weakness and previously the stock has taken support around Rs.700. Dips around support can be used to go long for the target of Rs. 725-730. Yesterday, most of the Metal counters have given a good positive move. JSWSTEEL has short positions in it. Due to short covering further positive move can be expected. Historical Volatility SCRIP HV INDIANB 70.66 GTOFFSHORE 43.13 STER 38.69 SUNPHARMA 40.00 CESC 35.10

- 2. Derivative Report | India Research For Private Circulation Only Sebi Registration No: INB 010996539 2 FII Statistics for 26-April-2010 Detail Buy Sell Net Open Interest Contracts Value Change (Rs. in cr.) (%) INDEX FUTURES 3244.72 3092.46 152.25 529928 14294.84 -2.92 INDEX OPTIONS 2328.04 2128.02 200.02 1681349 44781.67 1.76 STOCK FUTURES 6203.54 6172.46 31.08 998952 33138.24 2.00 STOCK OPTIONS 397.15 414.36 (17.21) 35849 1189.35 -0.69 TOTAL 12173.44 11807.30 366.14 3246078 93404.11 1.01 Turnover on 26-April-2010 Instrument No. of Contracts Turnover (Rs. in cr.) Change (%) Index Futures 421027 11253.83 -29.16 Stock Futures 766821 26504.11 18.61 Index Options 1522109 40532.59 -31.77 Stock Options 97637 3903.34 -18.93 Total 2807594 82193.87 -19.77 Nifty Spot = 5322.45 Lot Size = 50 Bull-Call Spreads Bear-Put Spreads Action Strike Price Risk Reward BEP Action Strike Price Risk Reward BEP Buy 5300 44.10 37.05 62.95 5337.05 Buy 5200 7.15 4.55 95.45 5195.45 Sell 5400 7.05 Sell 5100 2.60 Buy 5300 44.10 43.45 156.55 5343.45 Buy 5200 7.15 5.95 194.05 5194.05 Sell 5500 0.65 Sell 5000 1.20 Buy 5400 7.05 6.40 93.60 5406.40 Buy 5100 2.60 1.40 98.60 5098.60 Sell 5500 0.65 Sell 5000 1.20 Note: Above mentioned Bullish or Bearish Spreads in Nifty (April Series) are given as an information and not as a recommendation Nifty Put-Call Analysis

- 3. Derivative Report | India Research For Private Circulation Only Sebi Registration No: INB 010996539 3 Strategy Date Scrip Strategy Status 29-March-2010 SUZLON Long Call Continue 29-March-2010 IDBI Long Call Profit Booked on 06-Apr-2010 05-April-2010 RNRL Long Call Continue 05-April-2010 HUL Long Put Profit Booked on 08-Apr-2010 12-April-2010 JPASSOCIAT Ratio Call Spread Continue 19-April-2010 BHARTIARTL Long Call Did not trigger 26-April-2010 CAIRN Long Call Did not trigger 26-April-2010 PUNJLLYOD Long Call Continue DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe these restrictions. Opinion expressed is our current opinion as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward- looking statements are not predictions and may be subject to change without notice. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true and are for general guidance only. While every effort is made to ensure the accuracy and completeness of information contained, the company takes no guarantee and assumes no liability for any errors or omissions of the information. No one can use the information as the basis for any claim, demand or cause of action. Recipients of this material should rely on their own investigations and take their own professional advice. Each recipient of this document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Price and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance. Certain transactions - futures, options and other derivatives as well as non-investment grade securities - involve substantial risks and are not suitable for all investors. Reports based on technical analysis centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals and as such, may not match with a report on a company's fundamentals. We do not undertake to advise you as to any change of our views expressed in this document. While we would endeavor to update the information herein on a reasonable basis, Angel Broking, its subsidiaries and associated companies, their directors and employees are under no obligation to update or keep the information current. Also there may be regulatory, compliance, or other reasons that may prevent Angel Broking and affiliates from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Angel Broking Limited and affiliates, including the analyst who has issued this report, may, on the date of this report, and from time to time, have long or short positions in, and buy or sell the securities of the companies mentioned herein or engage in any other transaction involving such securities and earn brokerage or compensation or act as advisor or have other potential conflict of interest with respect to company/ies mentioned herein or inconsistent with any recommendation and related information and opinions. Angel Broking Limited and affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Sebi Registration No.: INB 010996539 Derivative Research Team derivatives.desk@angeltrade.com