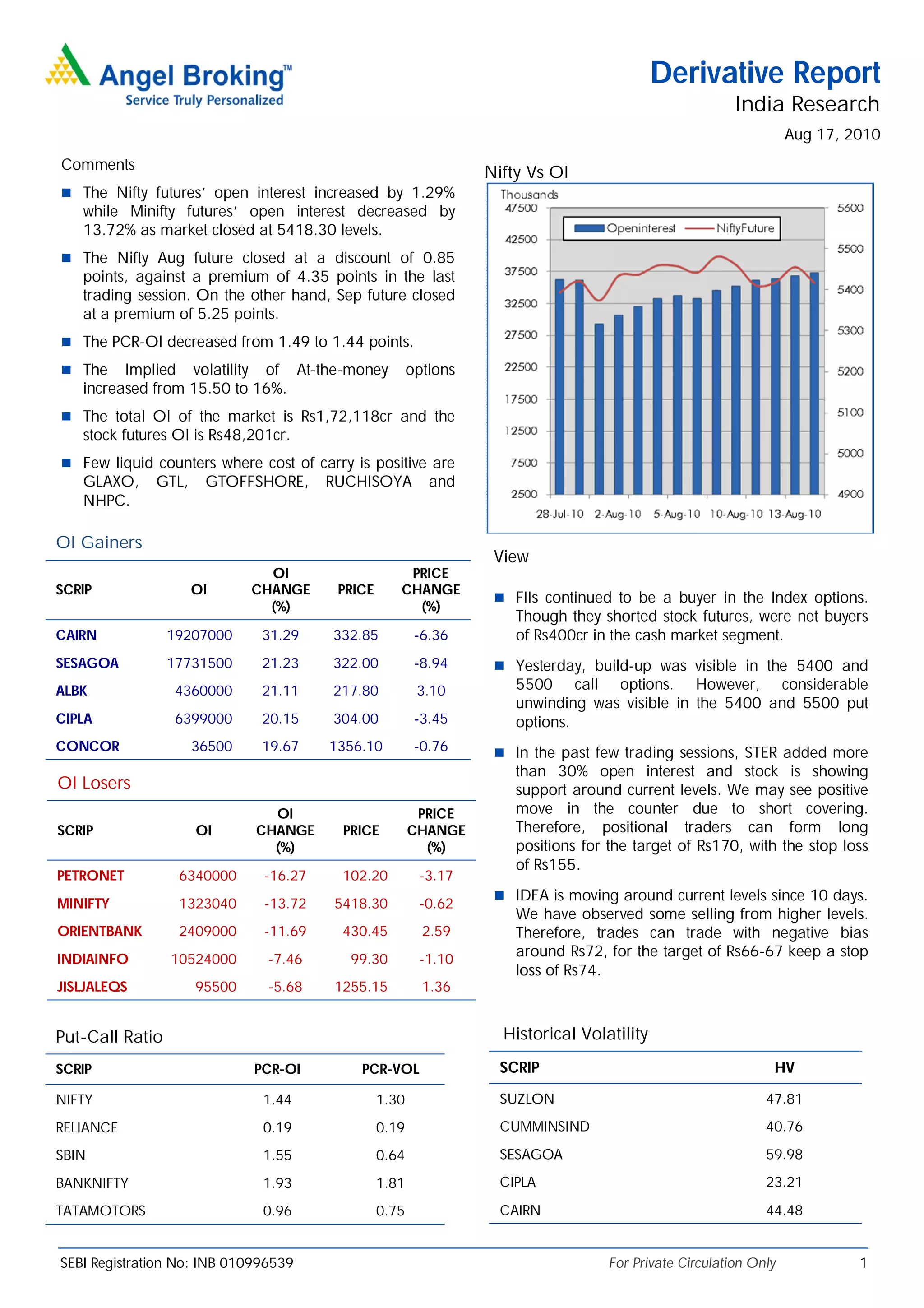

The derivative report summarizes developments in the Indian derivatives market on August 17, 2010. Open interest in Nifty futures increased slightly while decreasing for MiniNifty futures. The Nifty August future was at a discount while the September future was at a premium. Implied volatility and total open interest in the market increased. Specific stocks like Cairn, Sesa Goa, and Alkem saw large increases in open interest while others like Petronet and Minifity saw decreases. FII activity and option strategies are also summarized.