The key points from the document are:

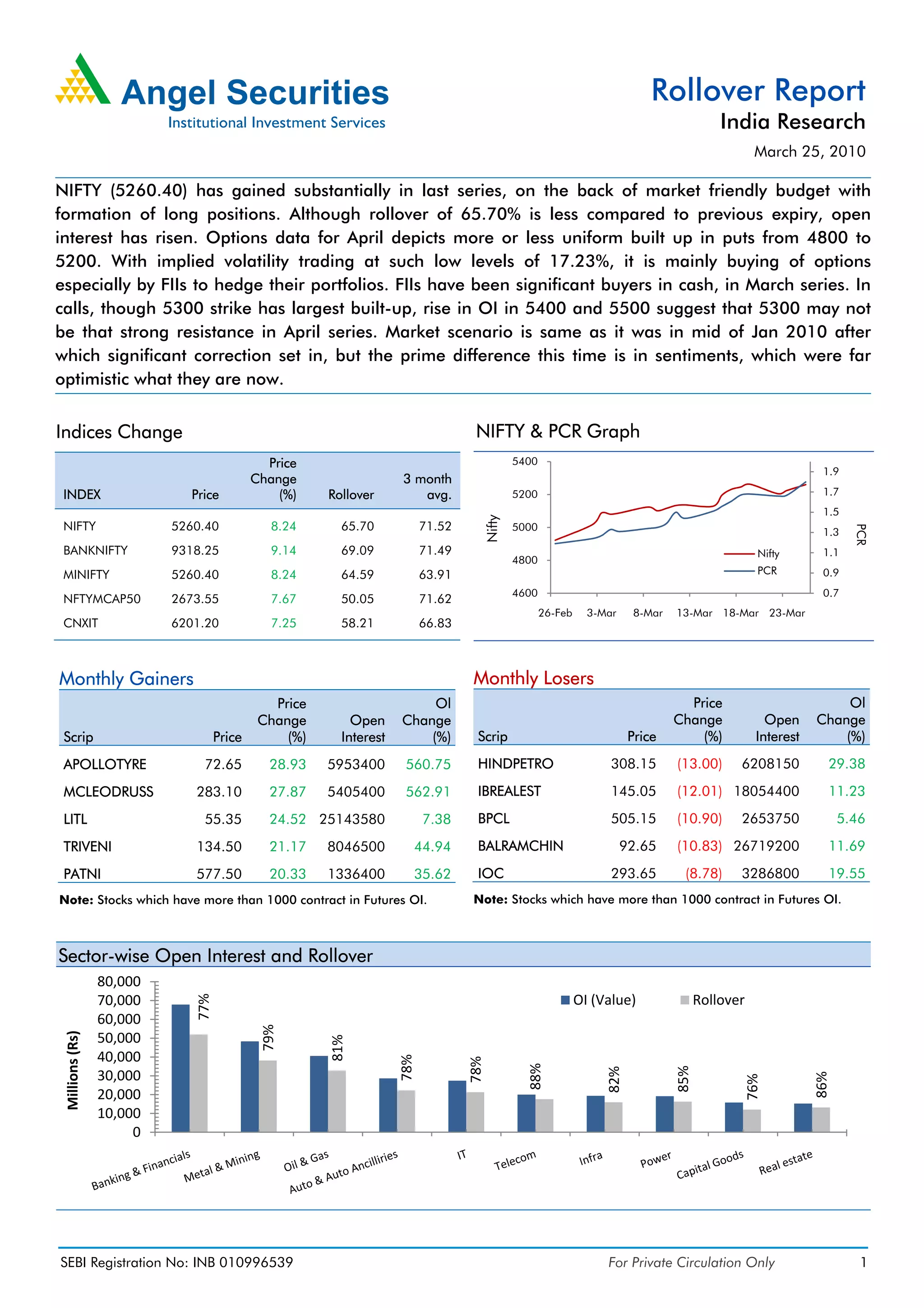

1) The Nifty gained over 8% in the last series due to a market friendly budget and formation of long positions, though rollover was lower than previous periods. Open interest in options for the next series shows uniform built up of puts.

2) Implied volatility is at low levels of 17.23%, with FIIs being significant buyers in the cash market in March. Calls at the 5300 strike saw the largest build up but rises in open interest at 5400 and 5500 suggest 5300 may not be a strong resistance.

3) Sentiments are now more cautious compared to mid-January 2010 when a significant correction set in, despite similarities