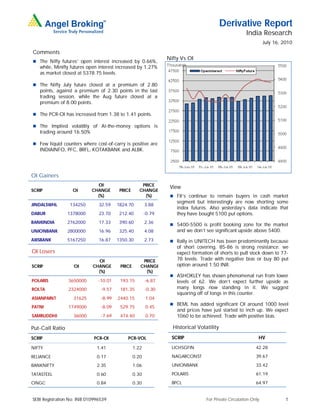

The document provides a summary of derivative market activity in India for July 16, 2010. Open interest for Nifty futures increased slightly while open interest for Mini Nifty futures rose by over 1%. The put-call ratio for Nifty increased from 1.38 to 1.41. FIIs were net sellers of index futures but net buyers of index options and stock futures. Specific stocks like Jindal Steel, Dabur, and Axis Bank saw increases in open interest, while stocks like Polaris, Rolta, and Asian Paint saw decreases.