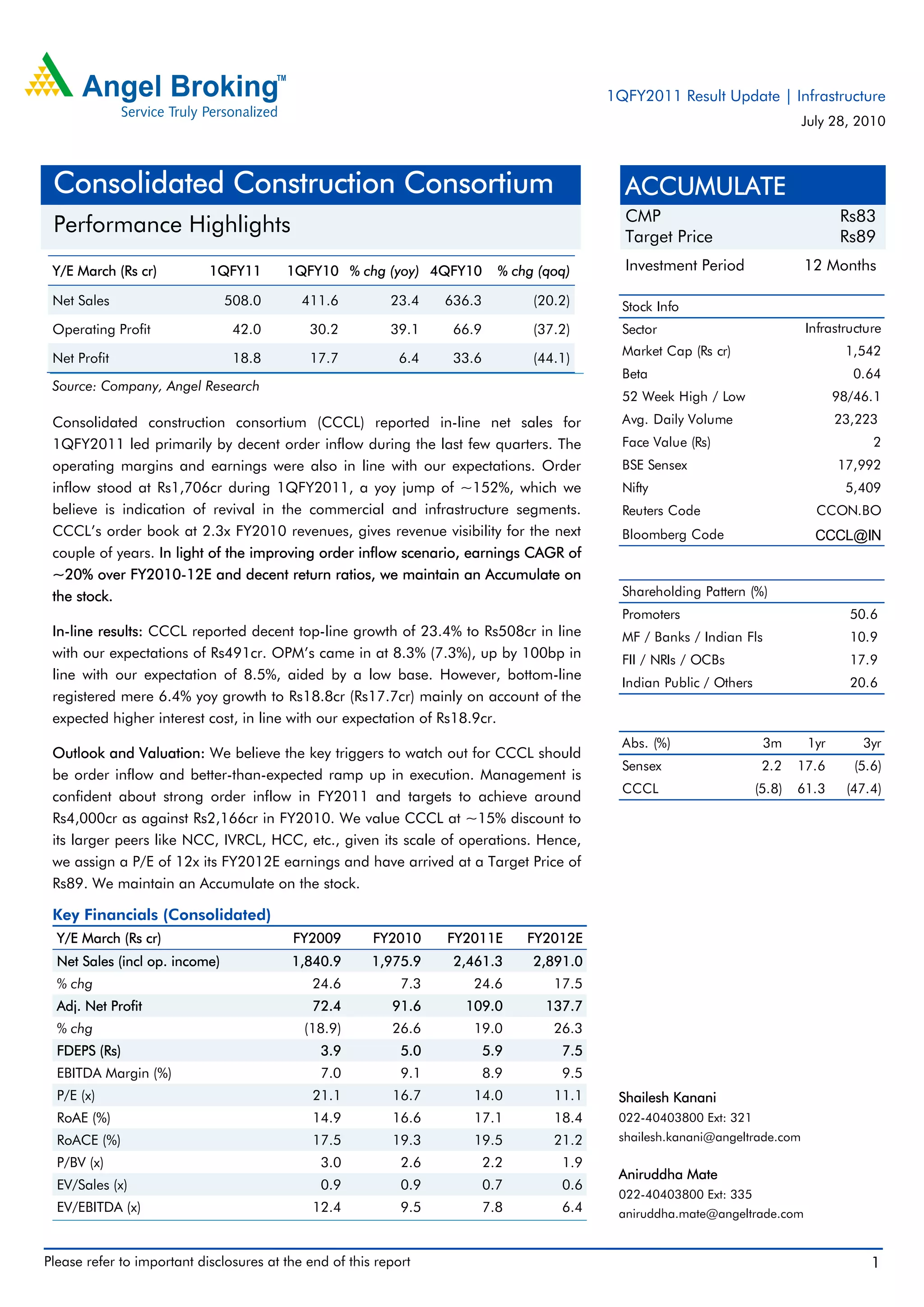

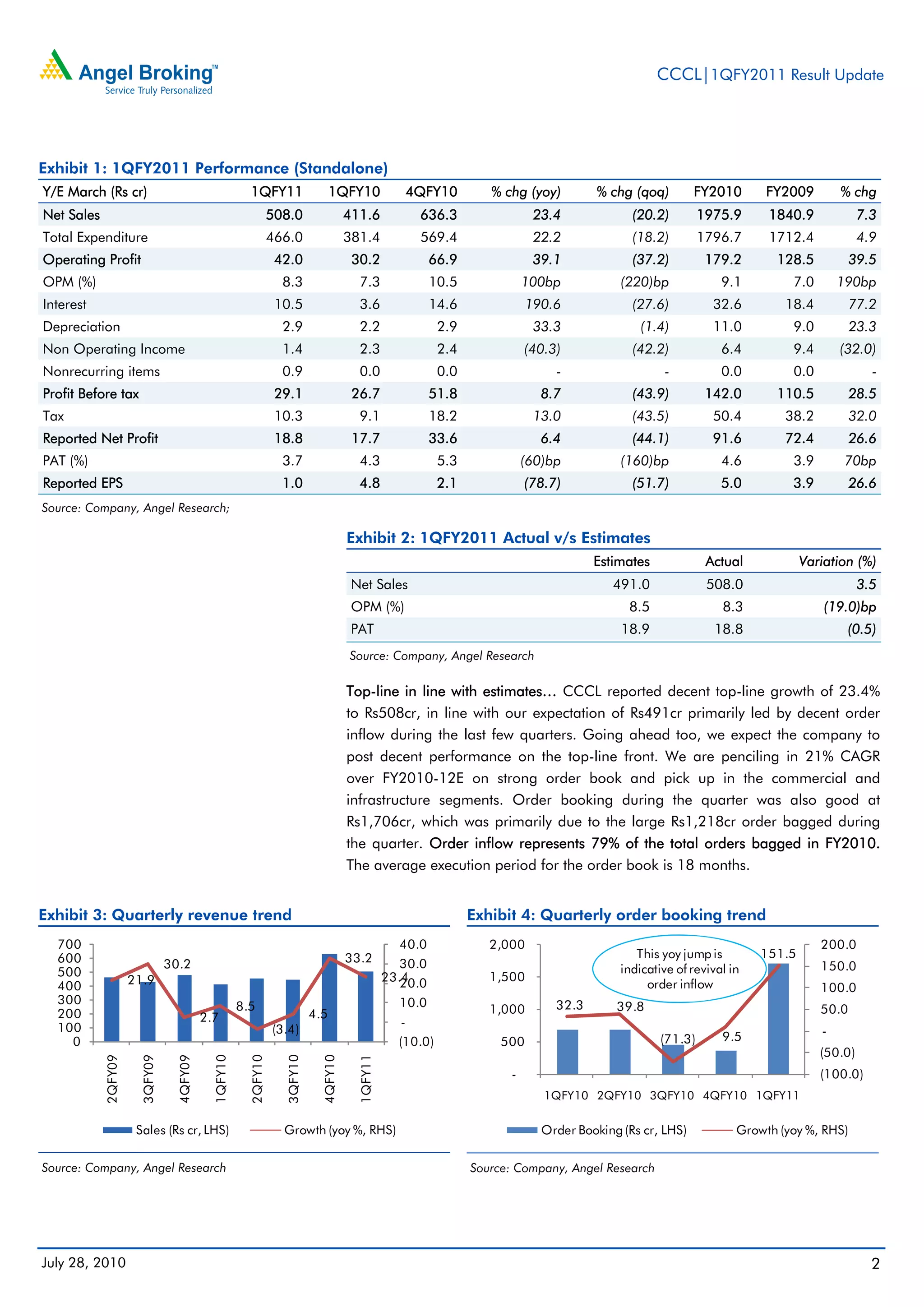

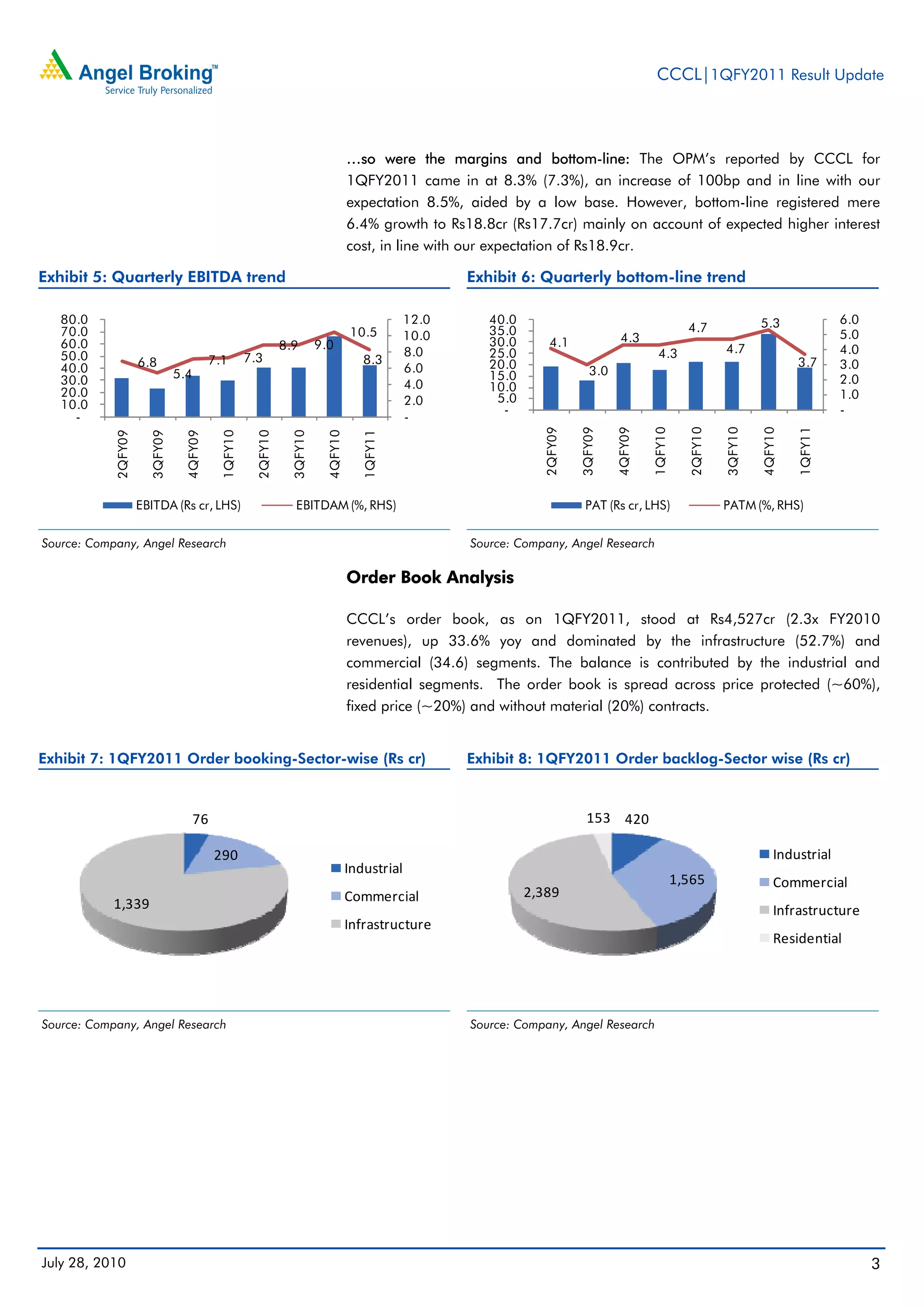

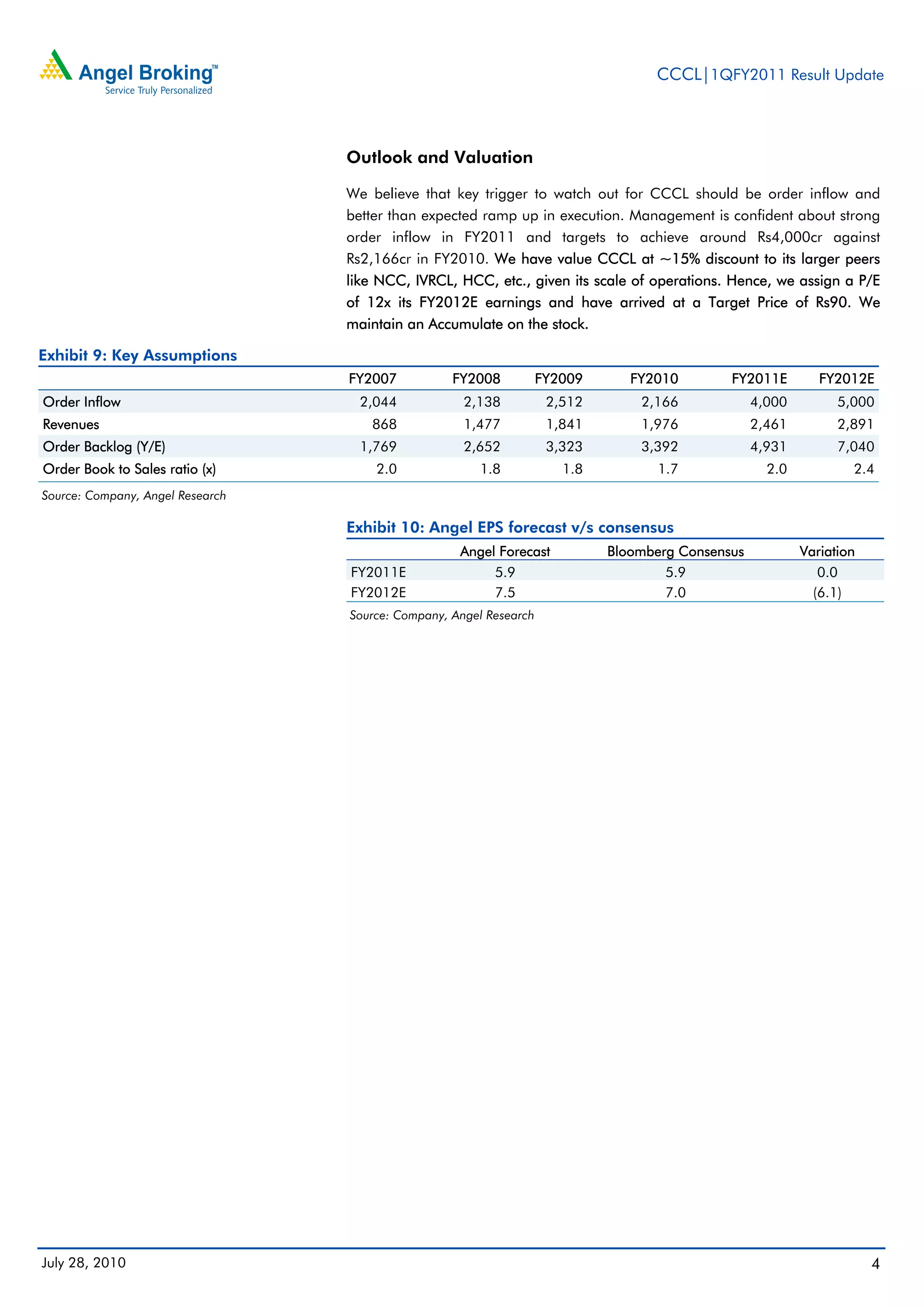

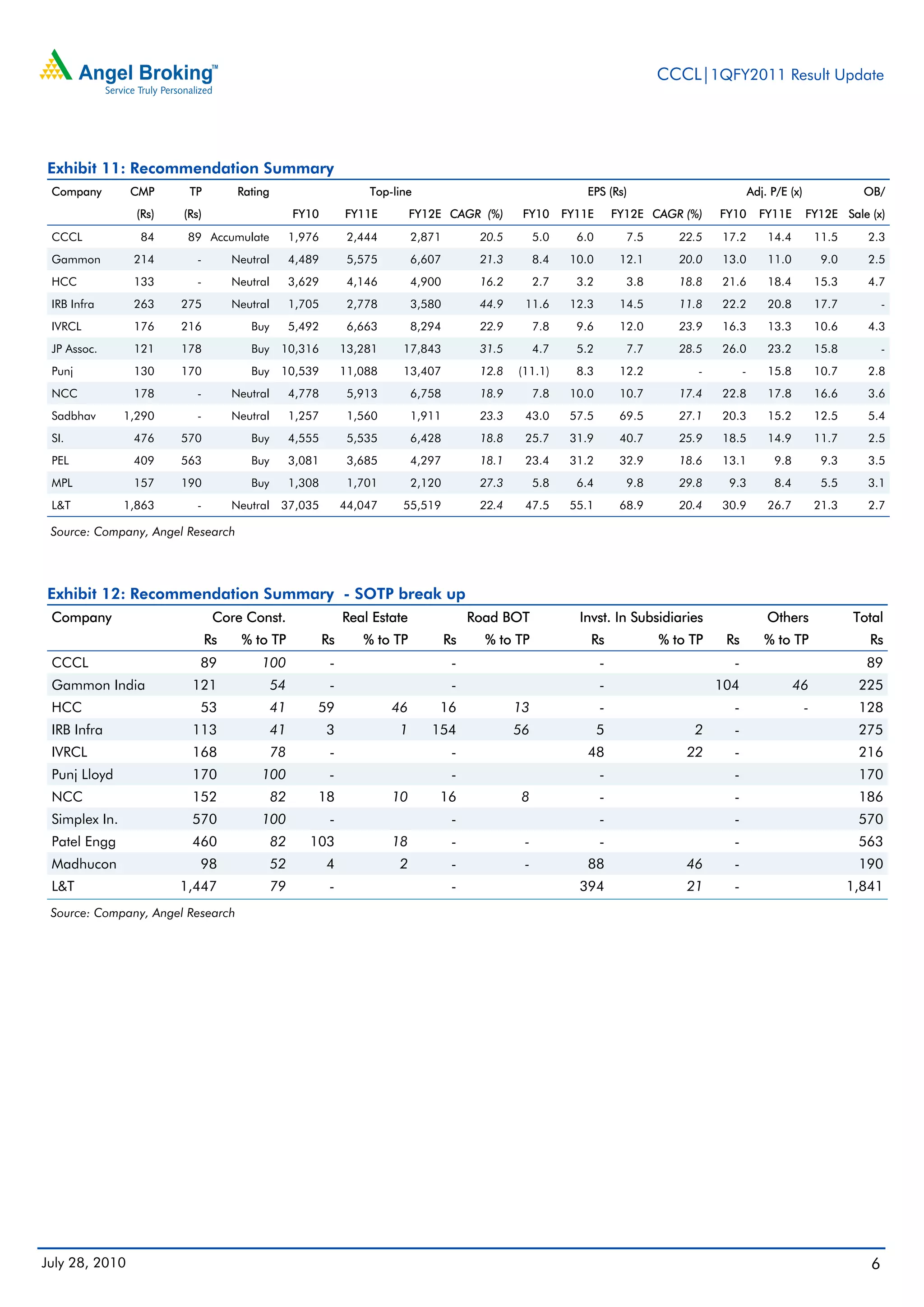

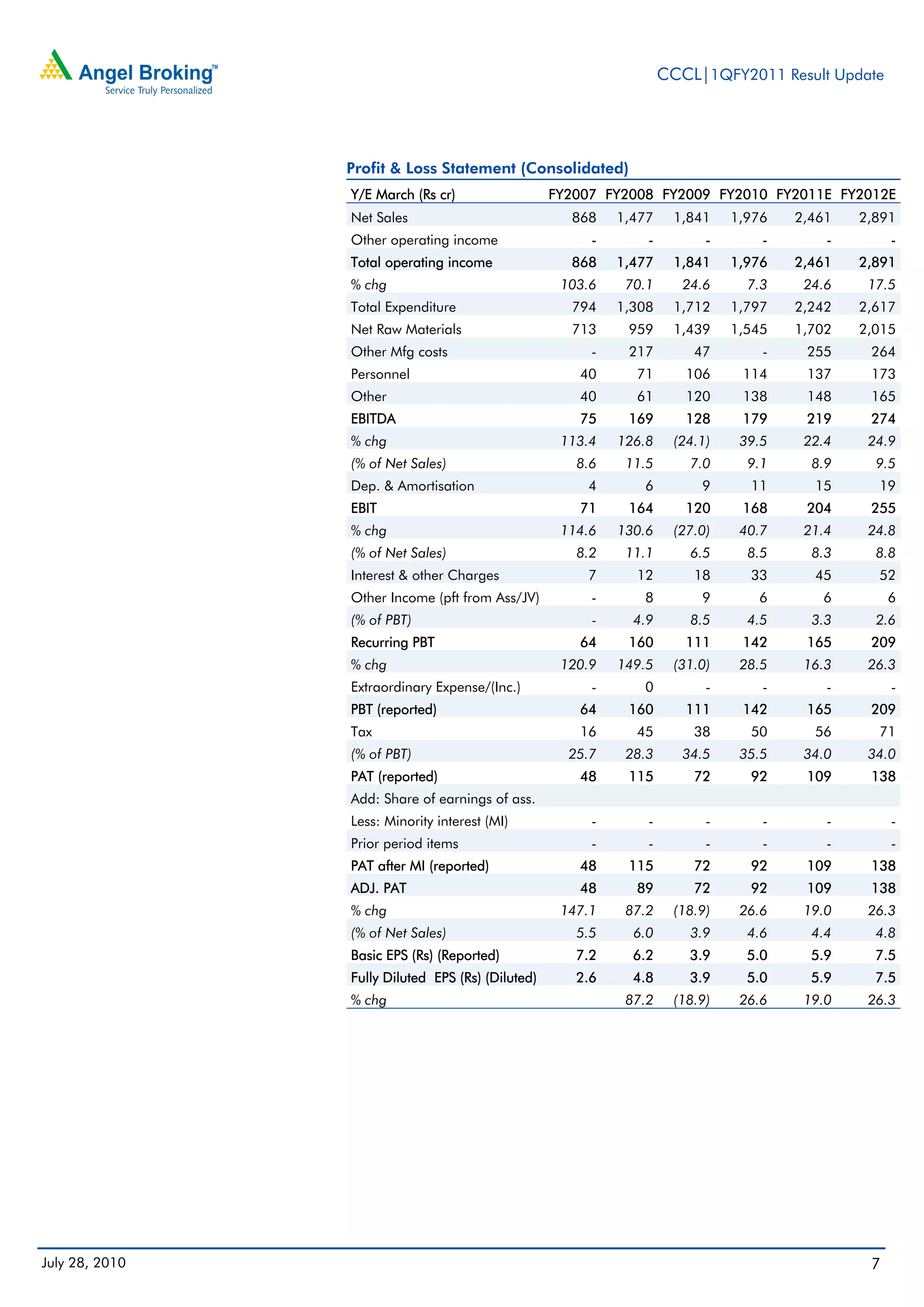

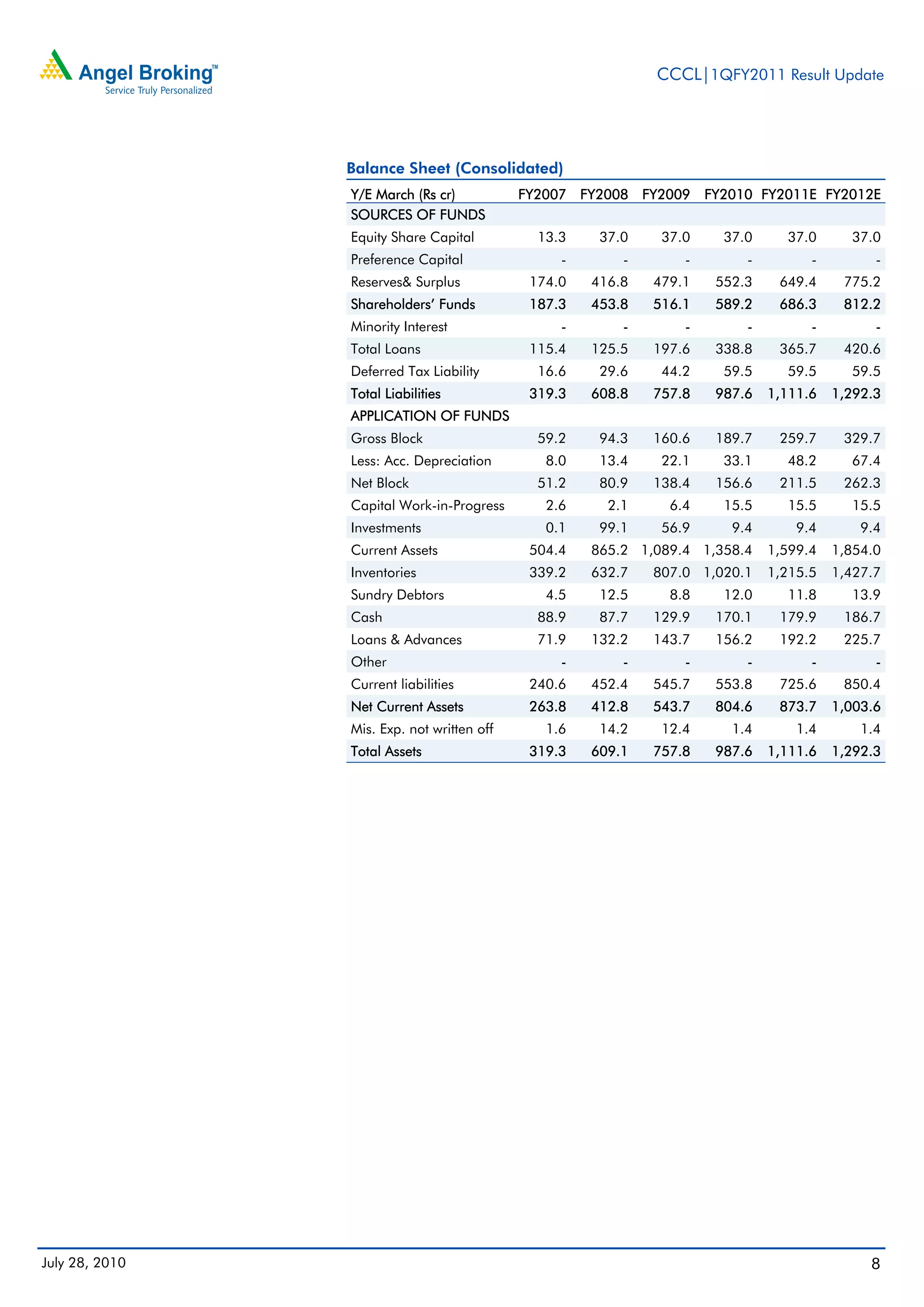

Consolidated Construction Consortium (CCCL) reported net sales of Rs.508 crore for 1QFY2011, in line with expectations. Operating margins of 8.3% and net profits of Rs.18.8 crore were also as expected. Order inflows grew 152% year-over-year to Rs.1,706 crore, indicating a revival in commercial and infrastructure segments. CCCL maintains an order backlog of Rs.4,527 crore, providing visibility for the next few years. While margins and profits met estimates this quarter, analysts maintain an 'Accumulate' rating given strong order backlog and expected 20% earnings growth over FY2010-12.