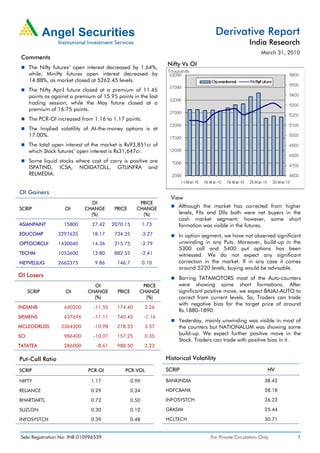

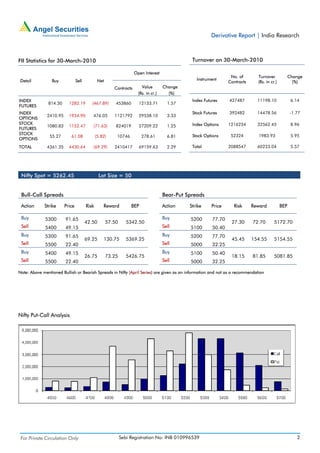

The open interest in Nifty futures decreased by 1.64% while the open interest in Mini Nifty futures decreased by 14.88% as the market closed at 5262.45 levels. Put-call ratio increased slightly to 1.17. Some stocks saw an increase in open interest such as ASIANPAINT, EDUCOMP, OPTOCIRCUI, and TECHM, while others such as INDIANB, SIEMENS, MCLEODRUSS, and SCI saw a decrease. Bullish and bearish option strategies on Nifty are presented for April series.