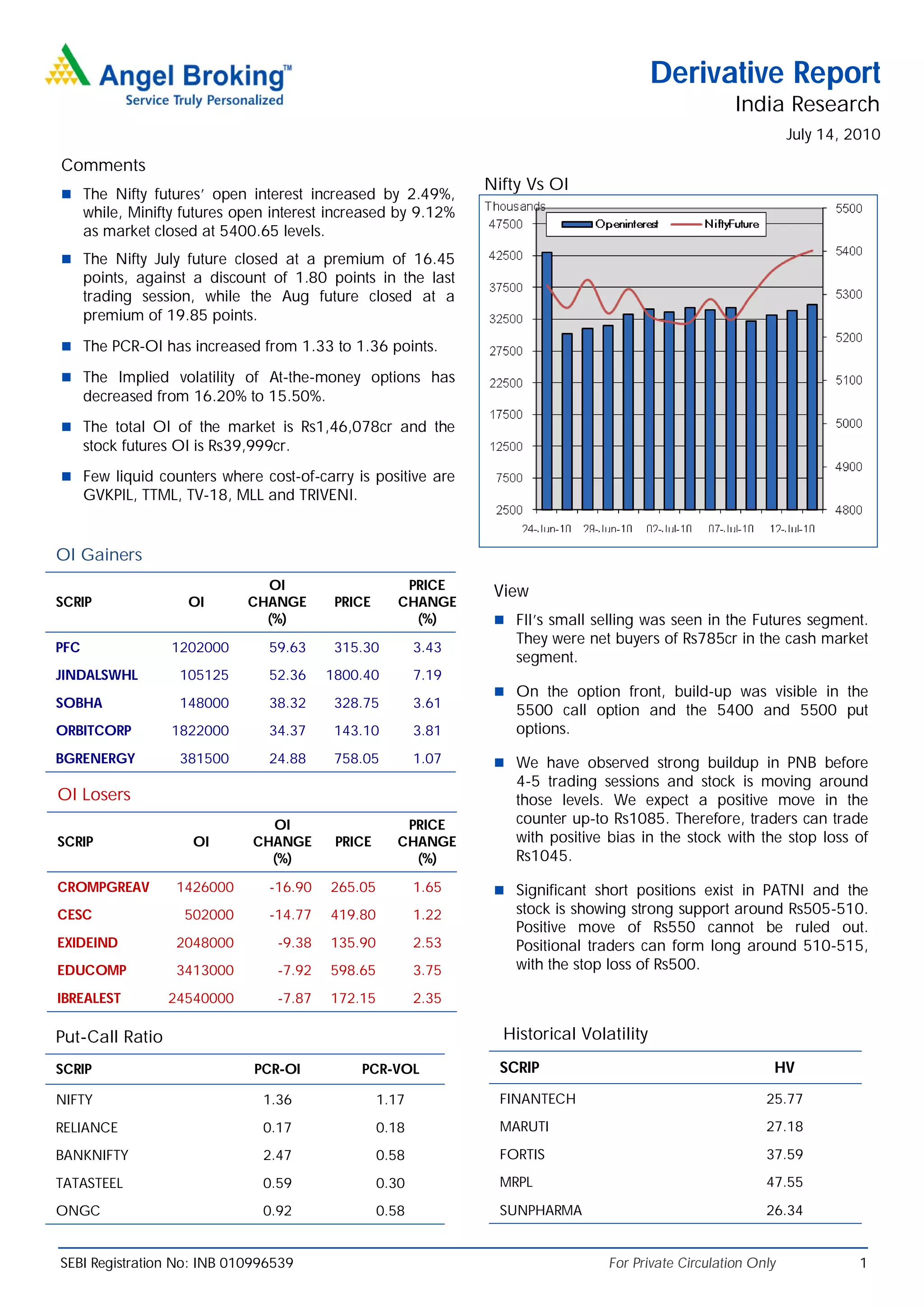

The summary discusses the Indian derivatives market activity for July 14, 2010. Open interest for Nifty futures increased by 2.49% while Minifity futures increased by 9.12%. Nifty July futures closed at a premium while August futures closed at a higher premium. Put-call ratios increased slightly. Implied volatility decreased. Several stocks saw significant changes in their open interest such as increases for PFC, JINDALSWHL, and decreases for CROMPGREAV. The document provides analysis of spreads, historical volatility, and previous trading strategies.