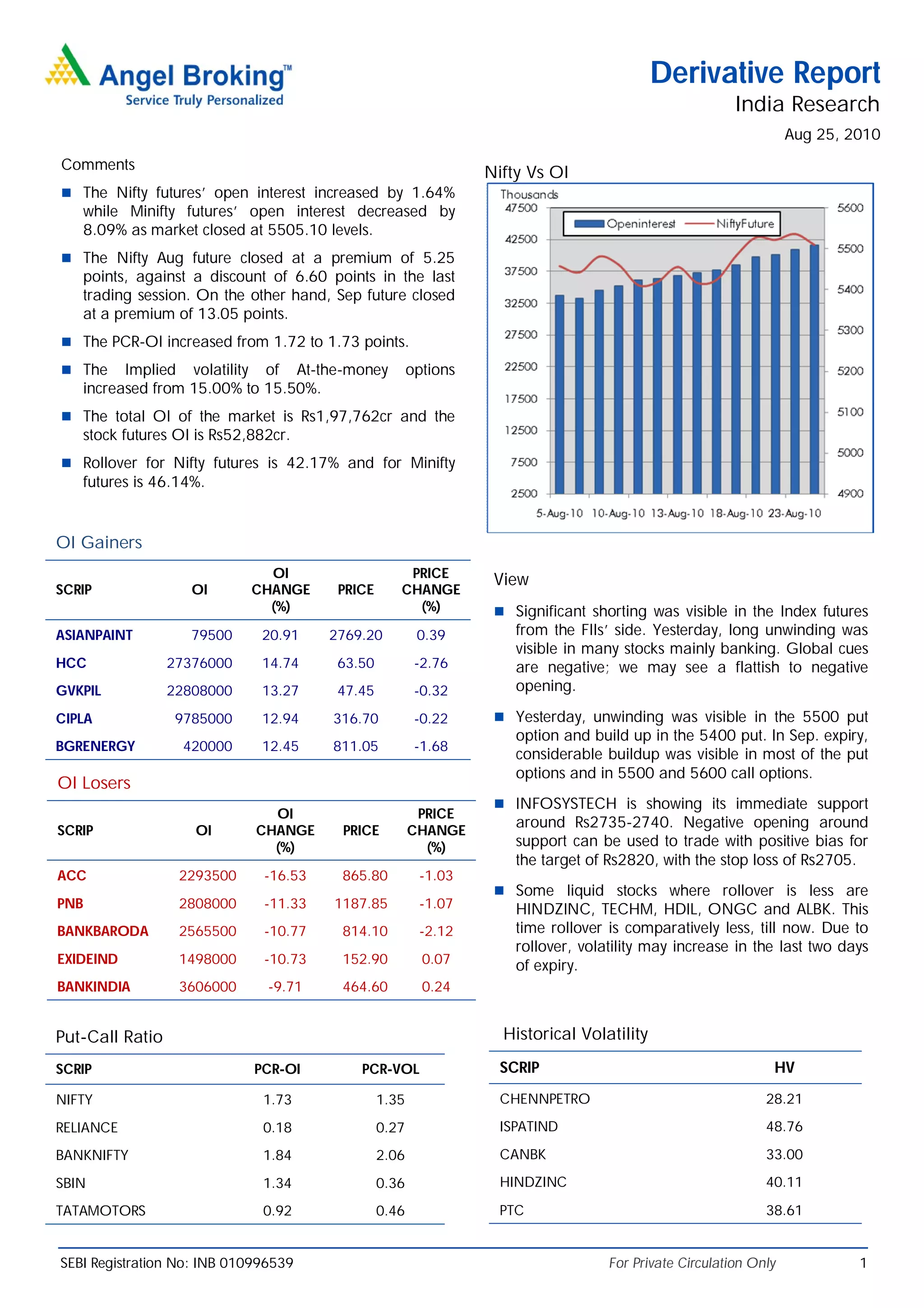

The derivative report summarizes developments in the Indian derivatives market on August 25, 2010. Open interest in Nifty futures increased by 1.64% while open interest in Minifity futures decreased by 8.09%. The Nifty August future closed at a premium while the September future closed at a higher premium. Key put-call ratios and historical volatilities are also mentioned. Some stocks that saw significant changes in open interest are highlighted.