The document provides a summary of derivative market activity in India for August 23, 2010. Key points include:

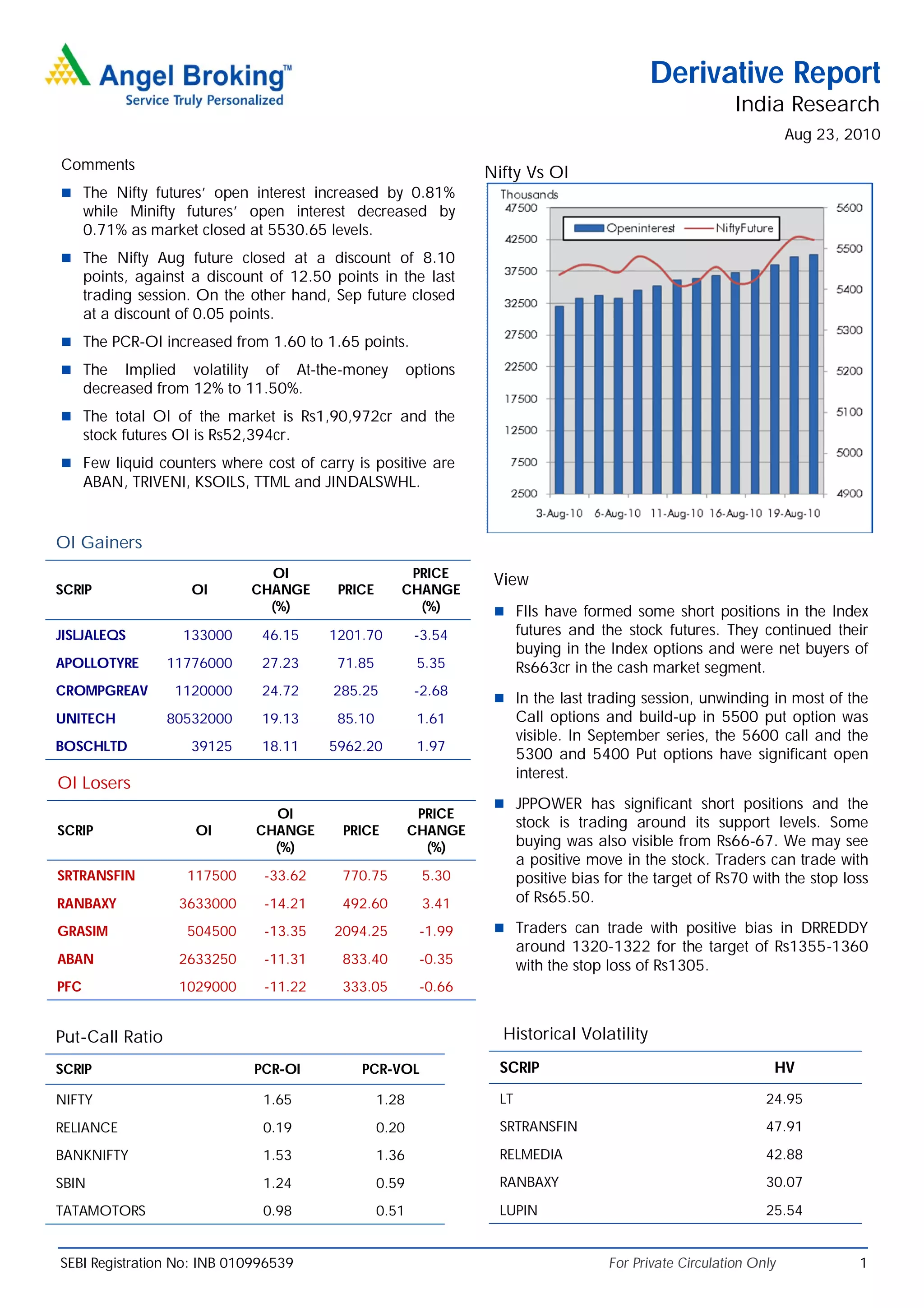

- Nifty futures open interest increased 0.81% while Mini Nifty interest decreased 0.71% as the market closed at 5530.65.

- Nifty August futures closed at a discount of 8.10 points and September futures closed at a discount of 0.05 points.

- Put-call ratio for Nifty increased to 1.65 from 1.60. Implied volatility of at-the-money options decreased to 11.50% from 12%.

- Total open interest in the market was Rs. 1,90,972 cr and stock futures open interest was Rs.