The document provides a summary of derivative market activity in India for June 25, 2010. Key points include:

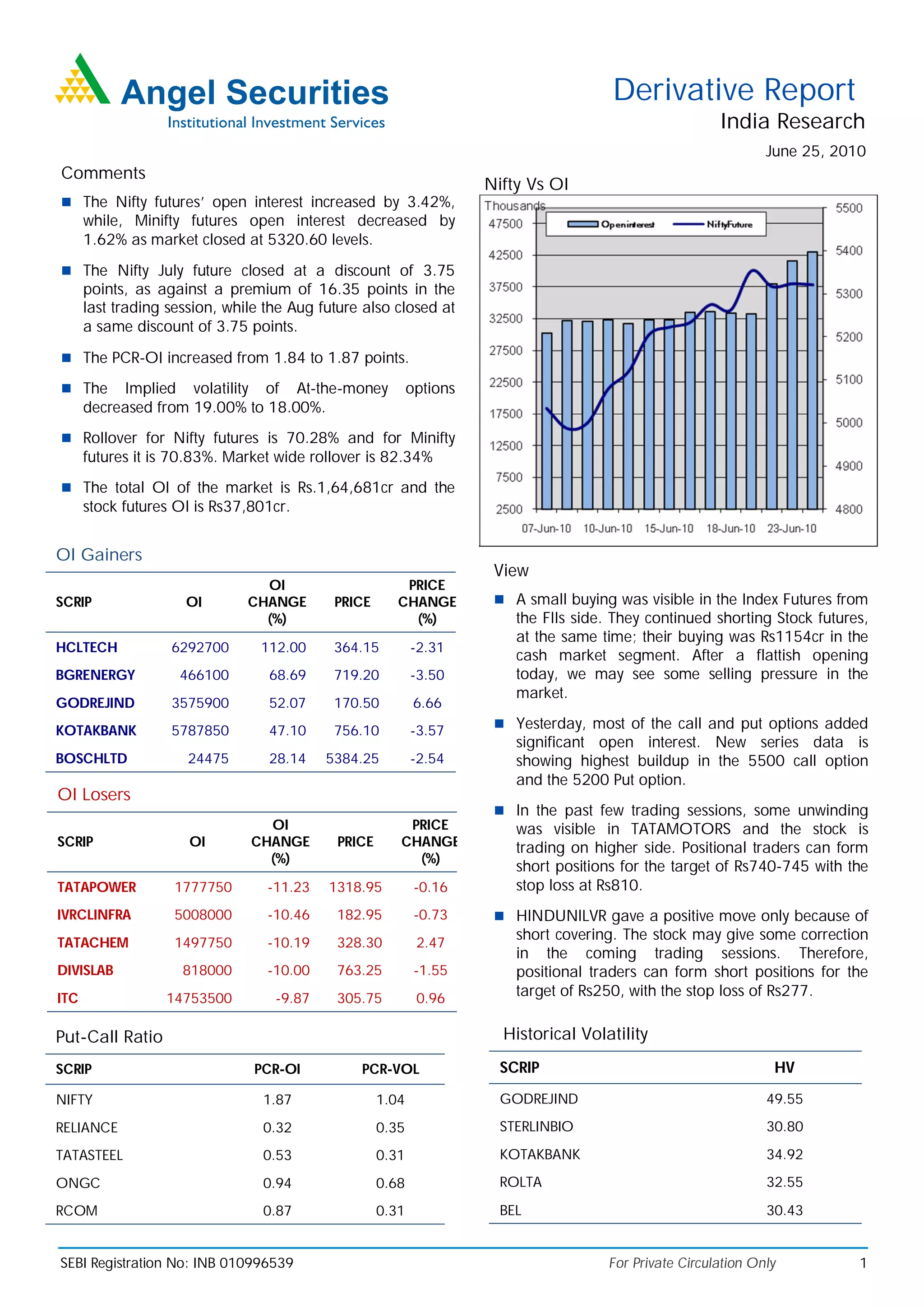

1) Nifty futures open interest increased 3.42% while Minifity futures decreased 1.62% as the market closed at 5320.60.

2) Several stocks saw significant changes in open interest, both increases like HCLTECH (112%) and decreases like TATAPOWER (-11.23%).

3) The put-call ratio for Nifty futures increased to 1.87 from 1.84. Historical volatility decreased for some stocks.

4) FIIs were net buyers of stocks and index futures but net sellers of index options and stock futures. Total