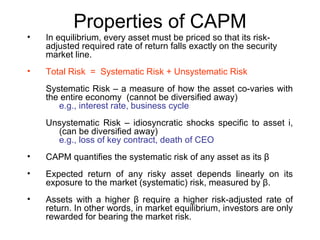

The Capital Asset Pricing Model (CAPM) asserts that the expected return of an asset is determined by its sensitivity to non-diversifiable market risk, as measured by beta. Under CAPM, the expected return of an asset is equal to the risk-free rate plus a risk premium that is proportional to the asset's beta. CAPM provides a model for pricing assets and estimating the expected return of risky projects based on an asset's systematic risk.

![CAPM results

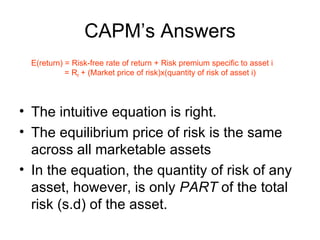

E(return) = Risk-free rate of return + Risk premium specific to asset i

= Rf + (Market price of risk)x(quantity of risk of asset i)

Precisely:

[1] Expected Return on asset i = E(Ri)

[2] Equilibrium Risk-free rate of return = Rf

[3] Quantity of risk of asset i = COV(Ri, RM)/Var(RM)

[4] Market Price of risk = [E(RM)-Rf]

Thus, the equation known as the Capital Asset Pricing Model:

E(Ri) = Rf + [E(RM)-Rf] x [COV(Ri, RM)/Var(RM)]

Where [COV(Ri, RM)/Var(RM)] is also known as BETA of asset I

Or

E(Ri) = Rf + [E(RM)-Rf] x βi](https://image.slidesharecdn.com/2005fc49note04-120606083753-phpapp02/85/2005-f-c49_note04-7-320.jpg)

![Pictorial Result of CAPM

E(Ri)

Security

Market

Line

E(RM)

slope = [E(RM) - Rf] = Eqm. Price of risk

Rf

β =

βΜ= 1.0 [COV(Ri, RM)/Var(RM)]](https://image.slidesharecdn.com/2005fc49note04-120606083753-phpapp02/85/2005-f-c49_note04-8-320.jpg)

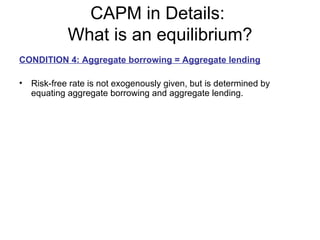

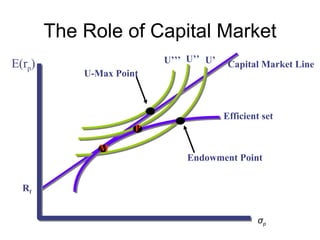

![CAPM in Details:

What is an equilibrium?

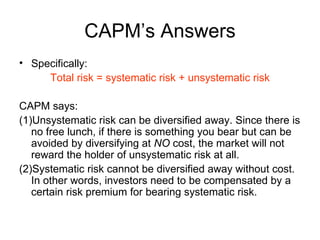

CONDITION 1: Individual investor’s equilibrium: Max U

• Assume:

• [1] Market is frictionless

=> borrowing rate = lending rate

=> linear efficient set in the return-risk space

[2] Anyone can borrow or lend unlimited amount at risk-free rate

• [3] All investors have homogenous beliefs

=> they perceive identical distribution of expected returns on

ALL assets

=> thus, they all perceive the SAME linear efficient set (we

called the line: CAPITAL MARKET LINE

=> the tangency point is the MARKET PORTFOLIO](https://image.slidesharecdn.com/2005fc49note04-120606083753-phpapp02/85/2005-f-c49_note04-9-320.jpg)

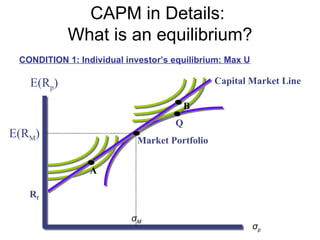

![CAPM

• 2 sets of Assumptions:

[1] Perfect market:

• Frictionless, and perfect information

• No imperfections like tax, regulations, restrictions to short

selling

• All assets are publicly traded and perfectly divisible

• Perfect competition – everyone is a price-taker

[2] Investors:

• Same one-period horizon

• Rational, and maximize expected utility over a mean-

variance space

• Homogenous beliefs](https://image.slidesharecdn.com/2005fc49note04-120606083753-phpapp02/85/2005-f-c49_note04-17-320.jpg)

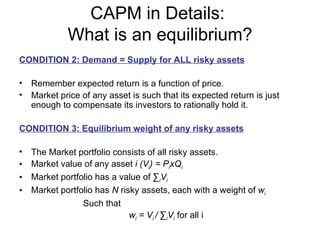

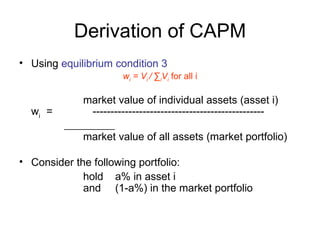

![Derivation of CAPM

• The expected return and standard deviation of such a

portfolio can be written as:

E(Rp) = aE(Ri) + (1-a)E(Rm)

σ(Rp) = [ a2σi2 + (1-a)2σm2 + 2a (1-a) σim ] 1/2

• Since the market portfolio already contains asset i and,

most importantly, the equilibrium value weight is wi

• therefore, the percent a in the above equations represent

excess demands for a risky asset

• We know from equilibrium condition 2 that in equilibrium,

Demand = Supply for all asset.

• Therefore, a = 0 has to be true in equilibrium.](https://image.slidesharecdn.com/2005fc49note04-120606083753-phpapp02/85/2005-f-c49_note04-19-320.jpg)

![Derivation of CAPM

E(Rp) = aE(Ri) + (1-a)E(Rm)

σ(Rp) = [ a2σi2 + (1-a)2σm2 + 2a (1-a) σim ] 1/2

• Consider the change in the mean and standard deviation with

respect to the percentage change in the portfolio invested in

asset i ∂ E( ) Rp

= E( Ri ) - E( Rm )

∂a

∂ σ ( Rp ) 1 2

= [ a 2 σ i2 + (1 - a ) σ m + 2a(1 - a)σ im ] -1/2 * [ 2a σ i2 - 2σ m + 2a σ m + 2σ im - 4a σ im ]

2 2 2

∂a 2

• Since a = 0 is an equilibrium for D = S, we must evaluate these

partial derivatives at a = 0

∂ E( R )

∂a

= E( R ) - E( R ) (evaluated at a = 0)

p

i m

∂ σ( Rp ) σ -σ 2

∂a

= im m

σm (evaluated at a = 0)](https://image.slidesharecdn.com/2005fc49note04-120606083753-phpapp02/85/2005-f-c49_note04-20-320.jpg)

![Derivation of CAPM

• the slope of the risk return trade-off evaluated at point M in

market equilibrium is ∂E( R )/∂a E( R ) - E( R )

p

∂σ ( R )/∂a

p

=

σ -σ

(evaluated at a = 0)

i

im

2

m

m

σm

• but we know that the slope of the opportunity set at point M

must also equal the slope of the capital market line. The slope

of the capital market line is ) -

E( Rm R f

σm

• Therefore, setting the slope of the opportunity set equal to the

slope of the capital market line

E( Ri ) - E( R m ) E( Rm ) - R f

=

( σ im - σ m ) / σ m

2

σm

• rearranging,

E( Ri ) = R f +

σ im [E( ) - ]

Rm R f

σm

2](https://image.slidesharecdn.com/2005fc49note04-120606083753-phpapp02/85/2005-f-c49_note04-21-320.jpg)

![Derivation of CAPM

• From previous page

E( Ri ) = R f + σ im [E( Rm ) - R f ]

σm 2

• Rearranging

E( Ri ) = R f + [E( Rm ) - R f ] β i CAPM Equation

• Where

σ im = COV( Ri , Rm )

βi=

σm 2

VAR( R m )

E(return) = Risk-free rate of return + Risk premium specific to asset i

E(Ri) = Rf + (Market price of risk)x(quantity of risk of asset i)](https://image.slidesharecdn.com/2005fc49note04-120606083753-phpapp02/85/2005-f-c49_note04-22-320.jpg)

![Pictorial Result of CAPM

E(Ri)

Security Market

Line

E(RM)

slope = [E(RM) - Rf] = Eqm. Price of risk

Rf

β =

βΜ= 1.0 [COV(Ri, RM)/Var(RM)]](https://image.slidesharecdn.com/2005fc49note04-120606083753-phpapp02/85/2005-f-c49_note04-23-320.jpg)

![Empirical Tests on CAPM

• In the next lecture, we’ll go over some of the empirical

tests of CAPM.

• Think about the following questions:

[1] What are the predictions of the CAPM?

[2] Are they testable?

[3] What is a regression?

[4] How to test hypothesis? What is t-test?](https://image.slidesharecdn.com/2005fc49note04-120606083753-phpapp02/85/2005-f-c49_note04-26-320.jpg)