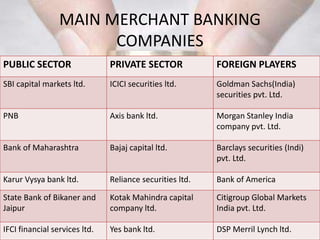

Merchant banking provides capital to companies through equity investments rather than loans. It originated in Italy and later spread to other European countries and India. Merchant banks offer services like corporate counseling, project financing, and credit syndication. They operate in both public and private sectors. Qualities of successful merchant bankers include analytical skills, knowledge, relationship building, and innovativeness.