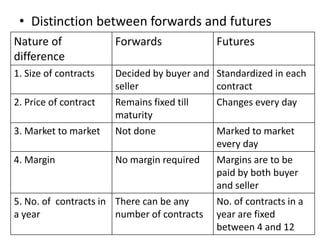

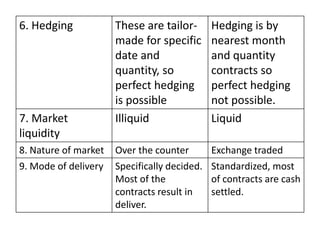

Derivatives are financial instruments whose value is derived from an underlying asset such as commodities, currencies, bonds or stocks. Forwards and futures are types of derivatives that allow parties to lock in prices for assets that will be delivered or settled for in the future. Forwards are private, bilateral contracts while futures are standardized contracts traded on an exchange with clearing houses that act as intermediaries, reducing counterparty risk. Key differences between forwards and futures include their level of standardization, margin requirements, market liquidity and mode of delivery or settlement.