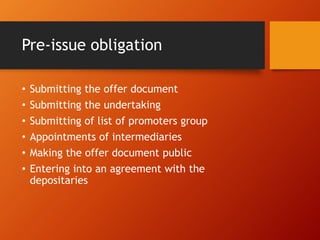

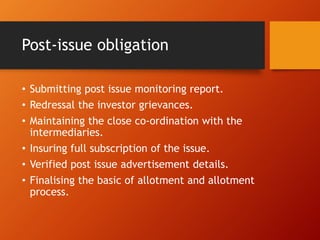

Merchant bankers are engaged in raising finance for clients through activities like managing public issues, right issues, and open offers. To obtain a certificate as a merchant banker, an applicant must be a body corporate, act as a primary dealer after registration, have necessary infrastructure, and meet capital adequacy requirements. The key functions of merchant bankers include raising finance, advising on expansion, managing public issues, and providing various financial services. SEBI guidelines govern merchant bankers' responsibilities and obligations related to public issues. Merchant bankers are classified into four categories by SEBI based on their professional competence, capital adequacy, experience, reputation, and quality of employees.