- The chapter discusses portfolio theory and models for determining asset prices like the Capital Asset Pricing Model (CAPM) and Arbitrage Pricing Theory (APT).

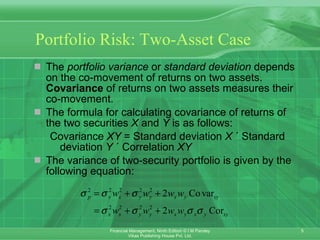

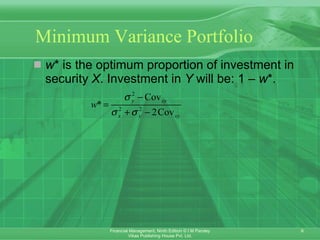

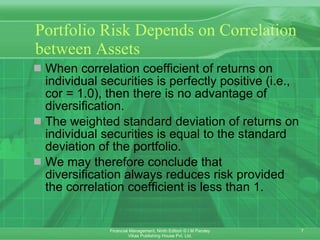

- Portfolio risk depends on the correlation and covariance of returns between assets. Diversification reduces unsystematic risk but not systematic market risk.

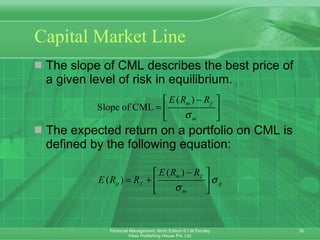

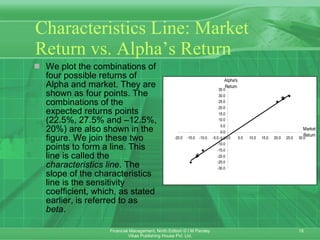

- CAPM suggests investors should hold a combination of the risk-free asset and the market portfolio. It provides a framework to determine required rates of return based on an asset's systematic risk or beta.

- APT assumes asset returns have predictable and unpredictable components related to macroeconomic factors. It provides an alternative model to CAPM for determining expected returns.