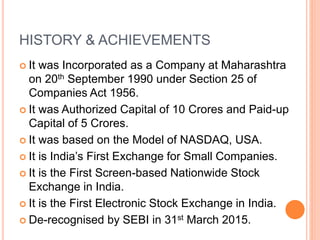

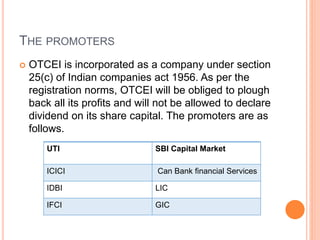

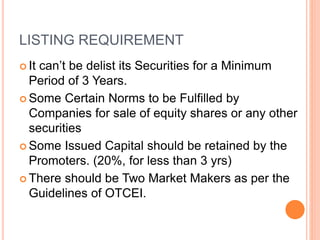

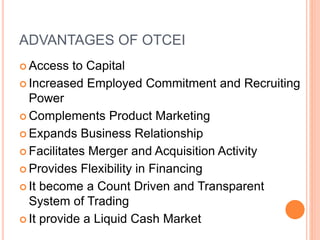

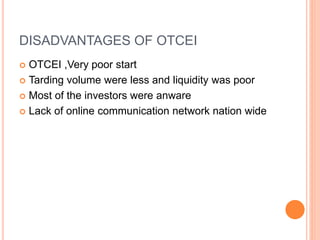

The document provides an overview of the Over The Counter Exchange of India (OTCEI). It discusses that OTCEI is an electronic stock exchange comprised of small and medium sized firms looking to gain access to capital markets. Some key points covered include OTCEI's history and establishment in 1990, its features like use of modern technology and all-India network, listing requirements for companies, advantages like access to capital, and disadvantages such as poor initial trading volumes and liquidity.