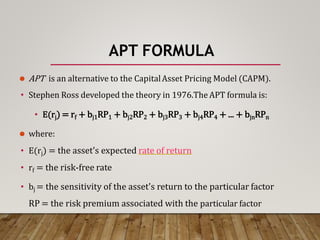

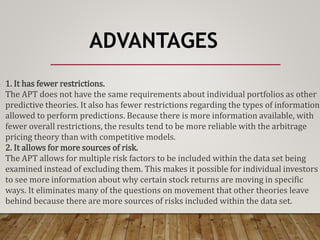

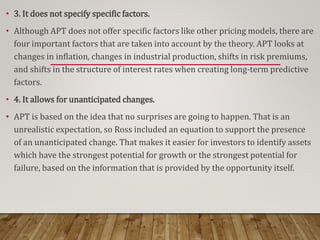

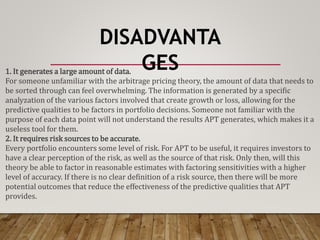

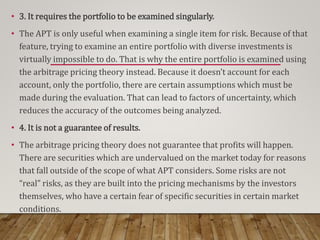

The document discusses the Arbitrage Pricing Theory (APT). APT assumes an asset's return depends on various macroeconomic, market, and security-specific factors. It uses a linear regression formula to model the relationship between an asset's expected return and its sensitivity to different risk factors. While more flexible than other models, APT requires accurately identifying risk sources and examining assets individually. It generates a lot of data but does not guarantee profitable outcomes.