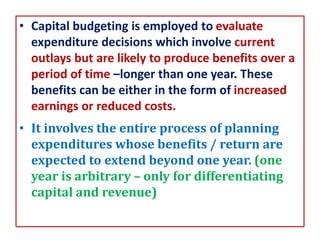

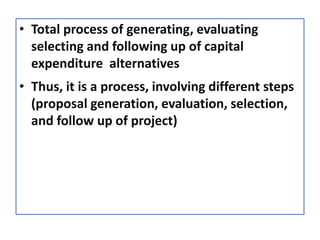

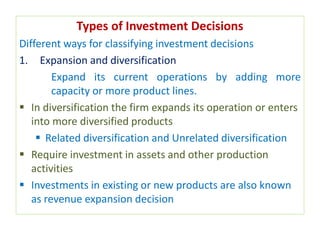

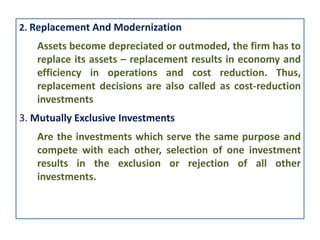

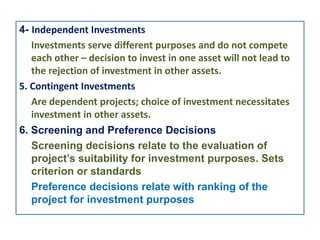

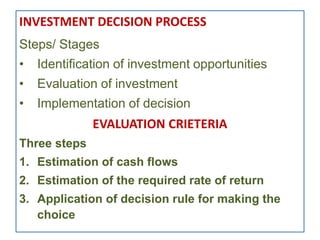

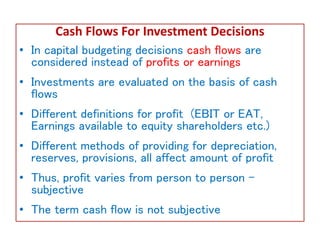

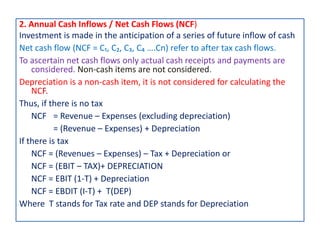

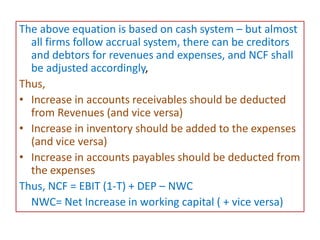

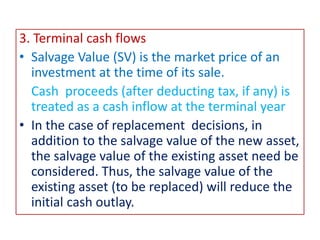

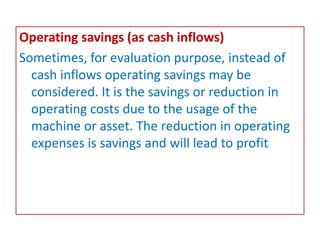

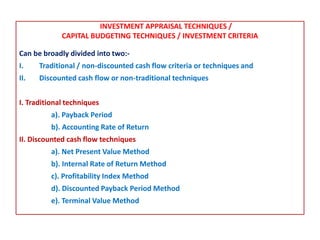

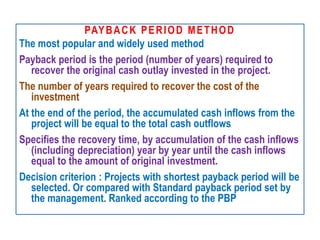

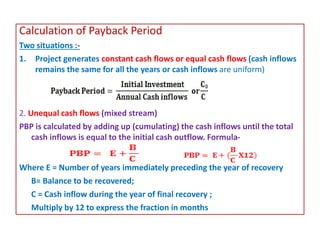

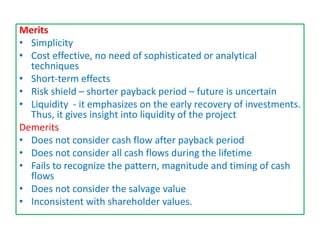

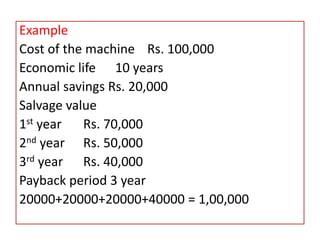

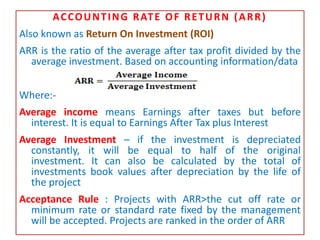

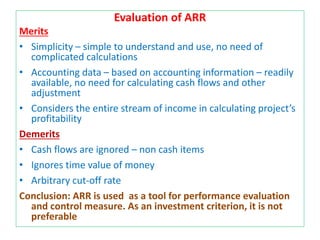

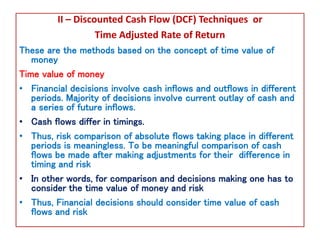

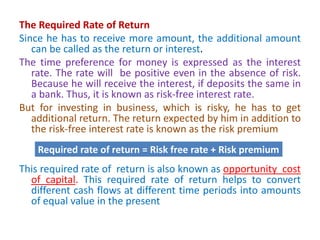

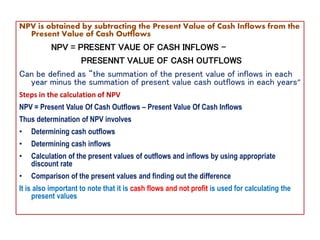

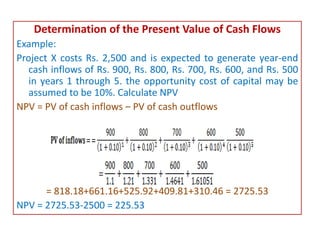

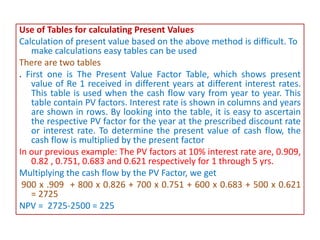

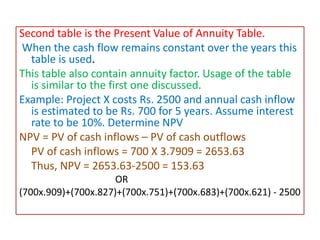

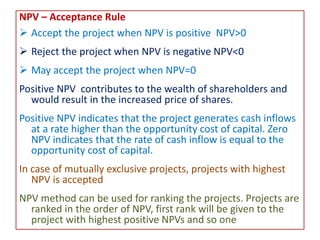

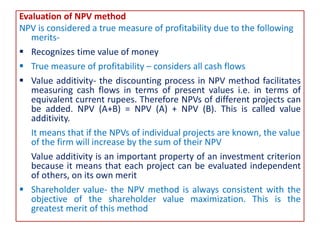

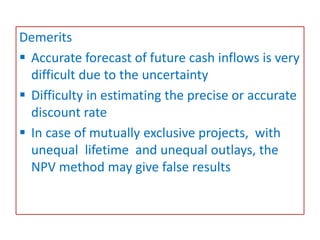

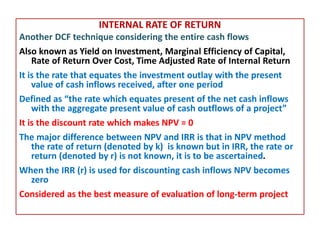

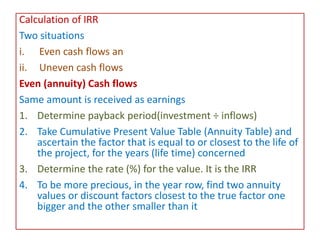

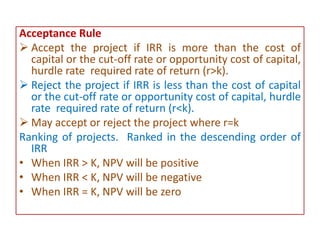

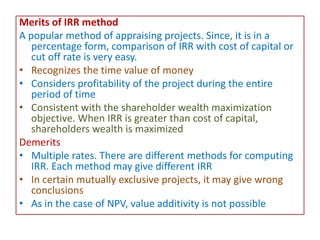

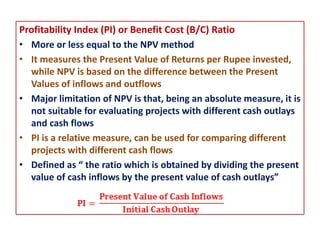

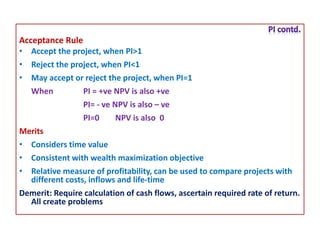

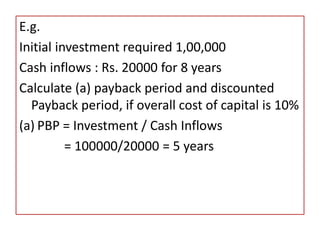

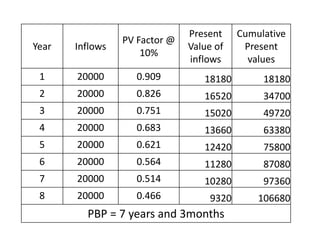

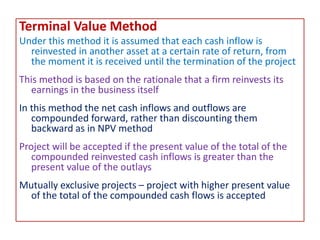

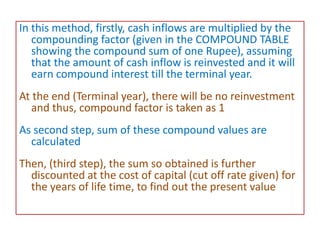

This document provides an overview of capital budgeting and investment decision making. It defines key terms like capital budgeting, investment decisions, cash flows, net present value, and discounted cash flow techniques. It also summarizes several approaches to evaluating investment projects, including payback period, accounting rate of return, net present value, and internal rate of return. The document emphasizes the importance of considering the time value of money when analyzing projects with cash flows occurring over multiple periods.