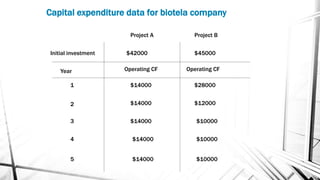

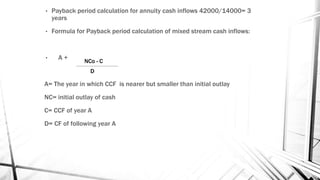

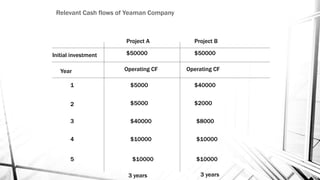

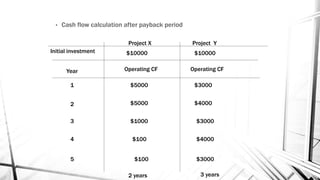

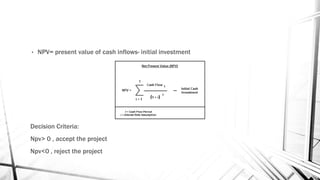

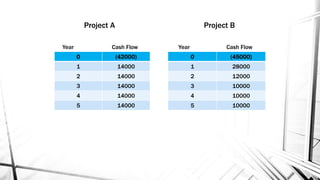

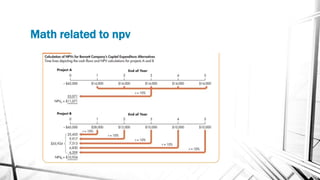

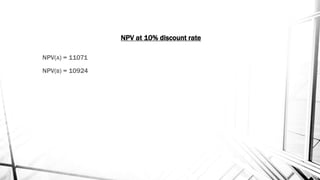

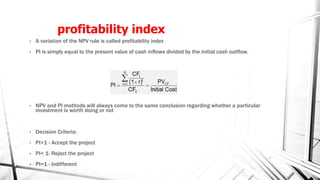

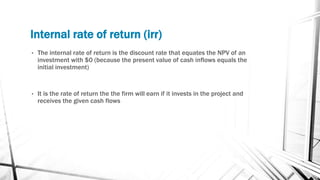

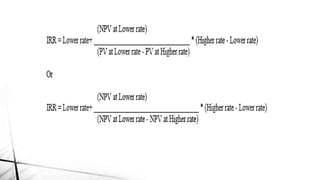

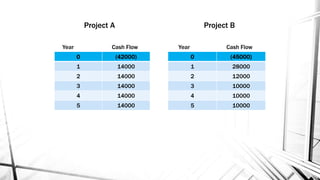

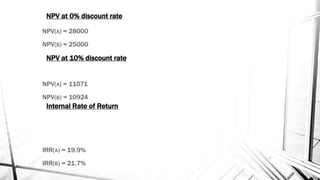

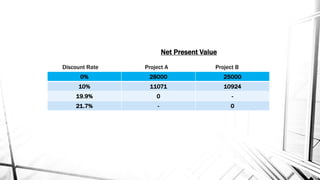

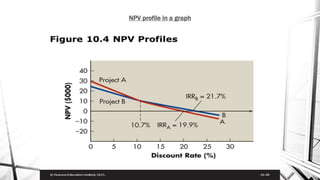

The document discusses various capital budgeting techniques used to evaluate long-term investment projects. It describes net present value (NPV) as a technique that measures the value created by discounting a project's cash flows to present value. It also covers internal rate of return (IRR), payback period, and profitability index. The techniques are applied to sample projects A and B to compare their results and demonstrate that different techniques can produce conflicting rankings of projects.