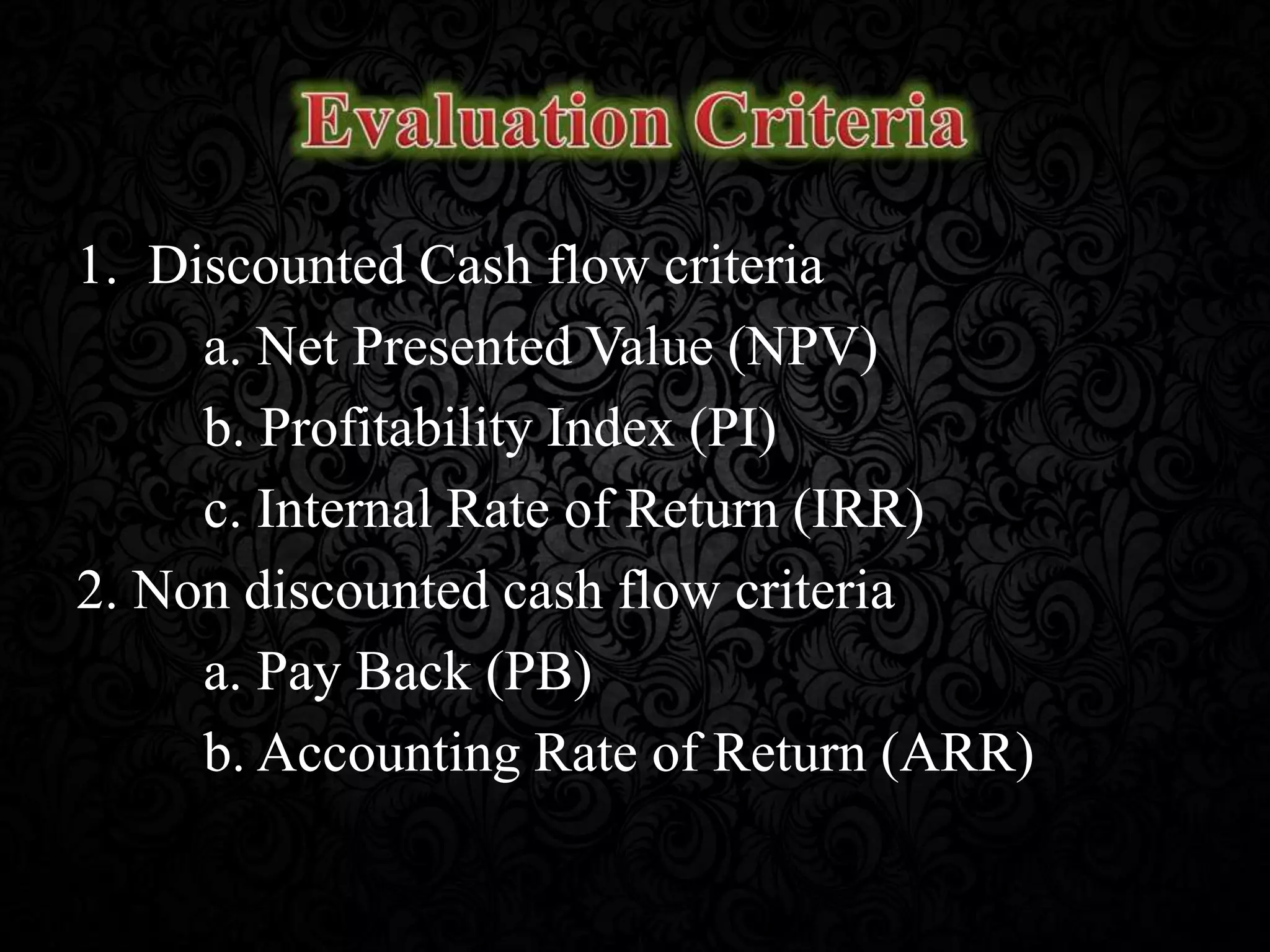

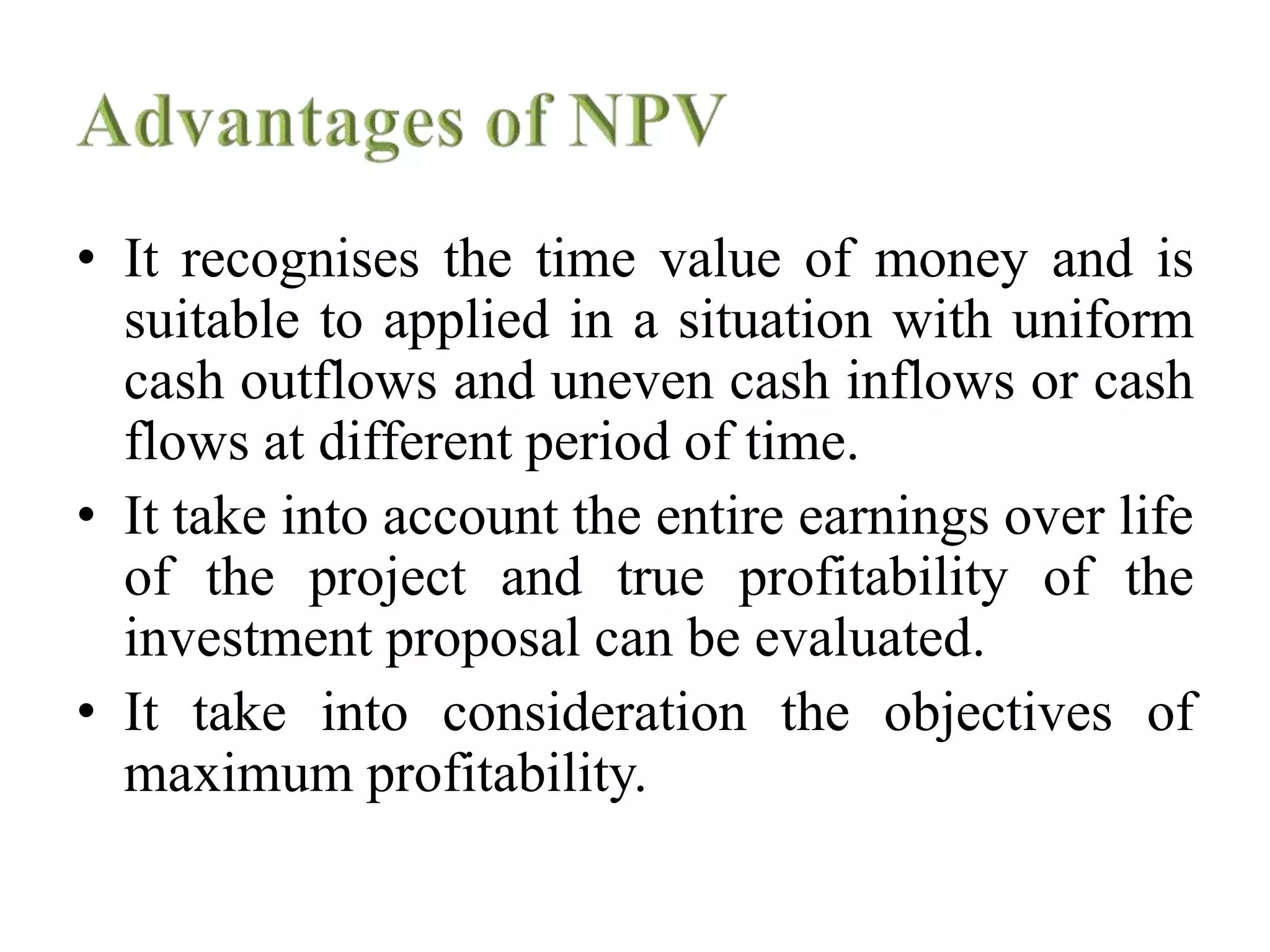

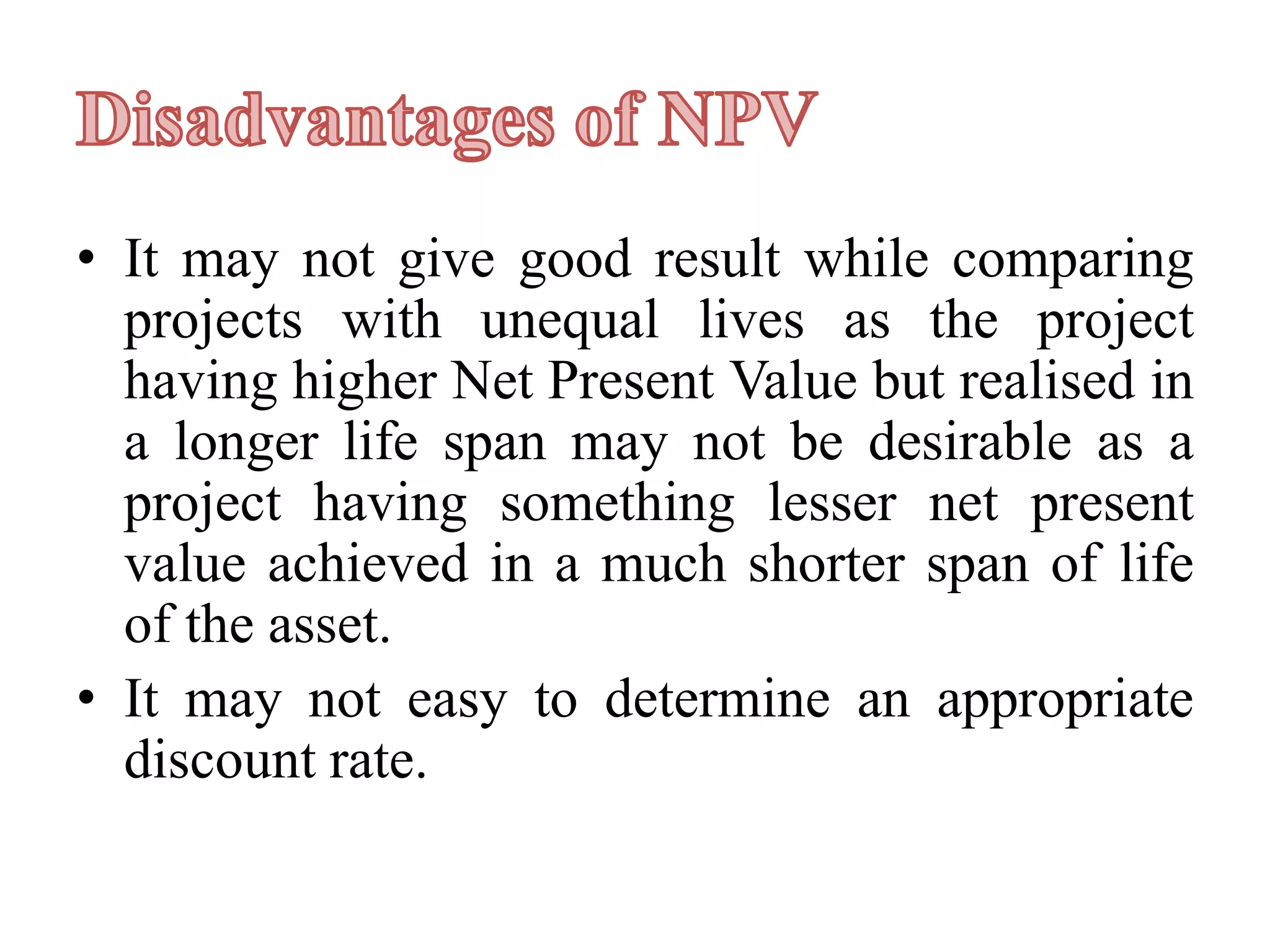

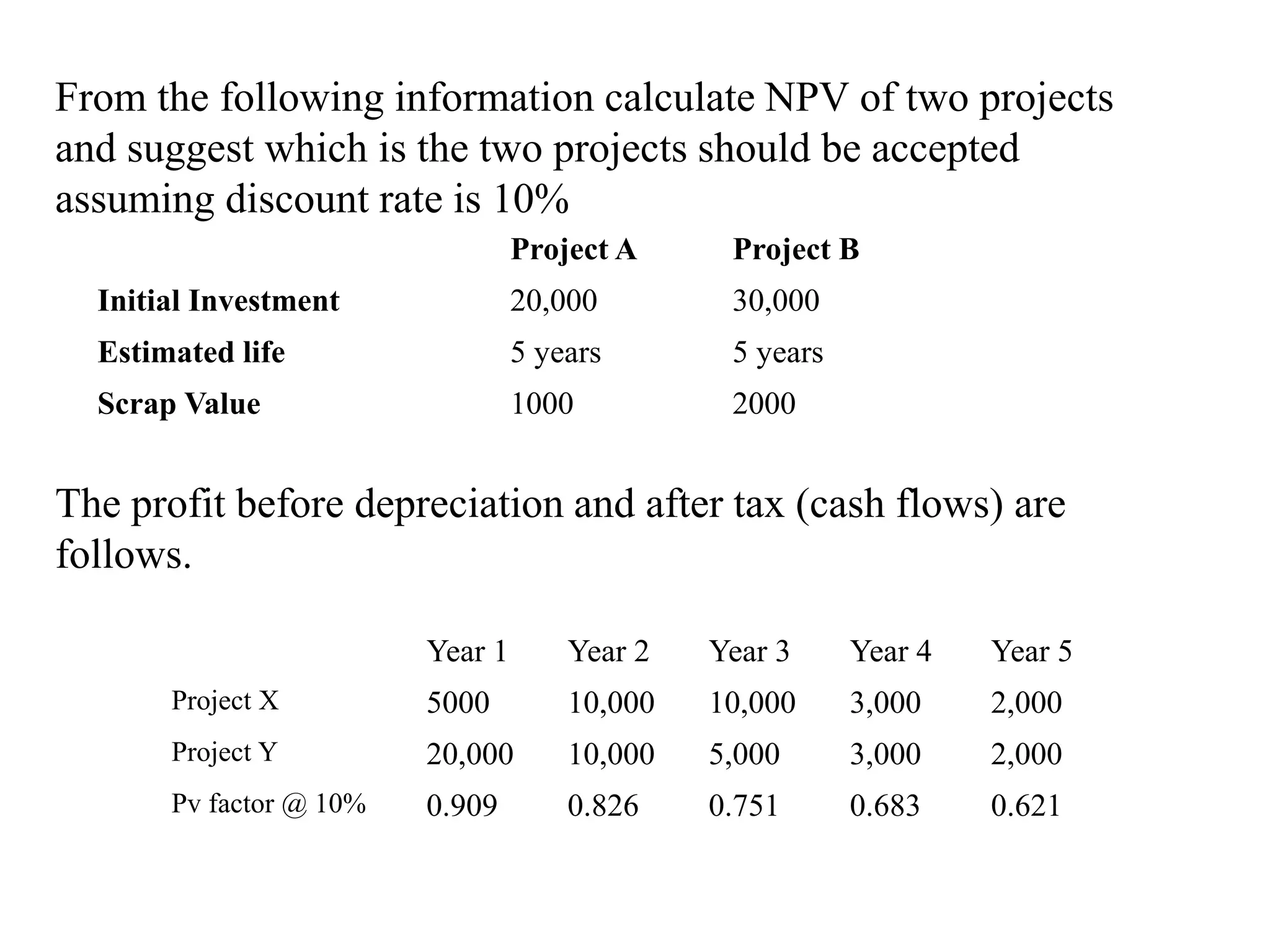

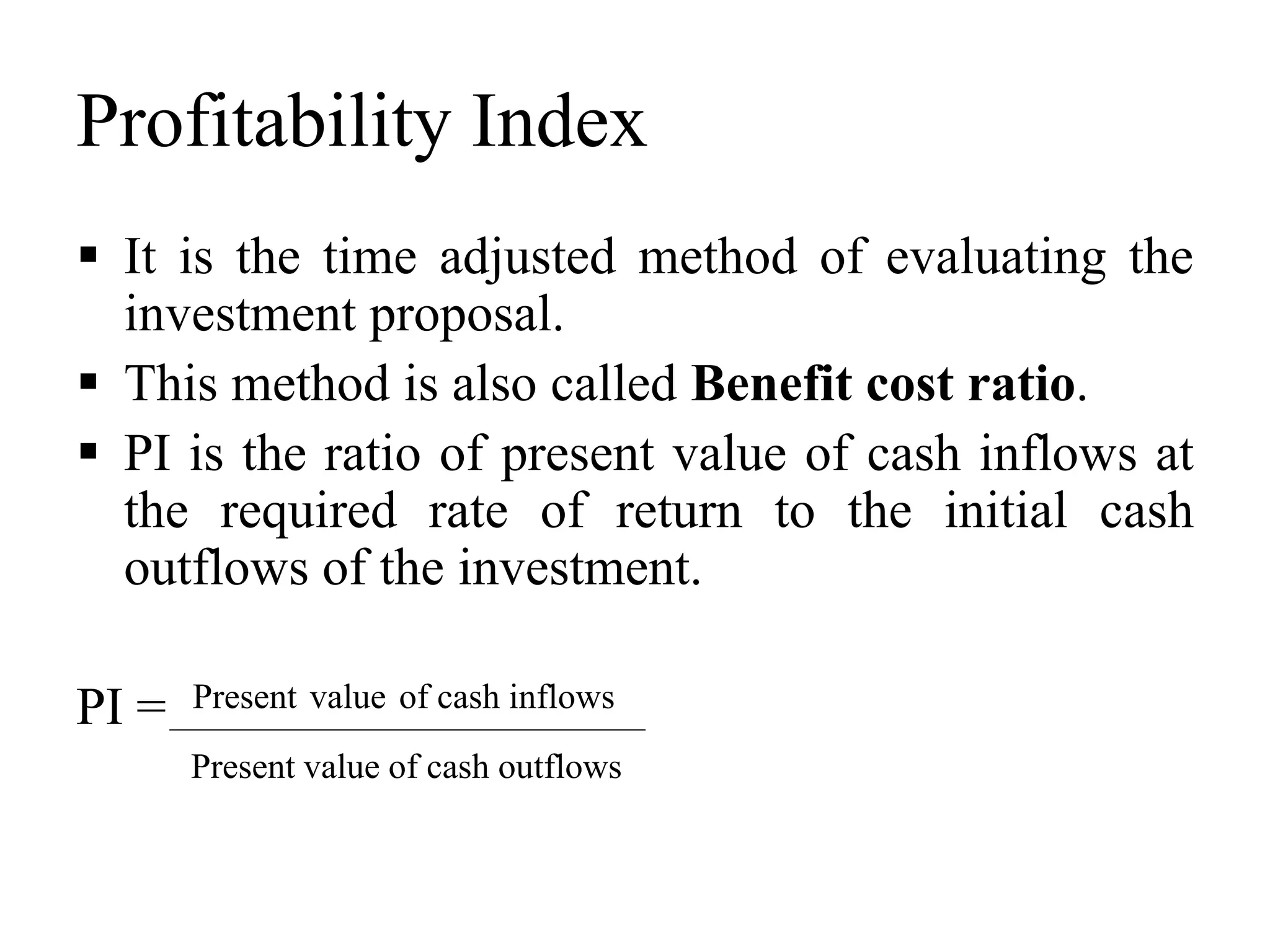

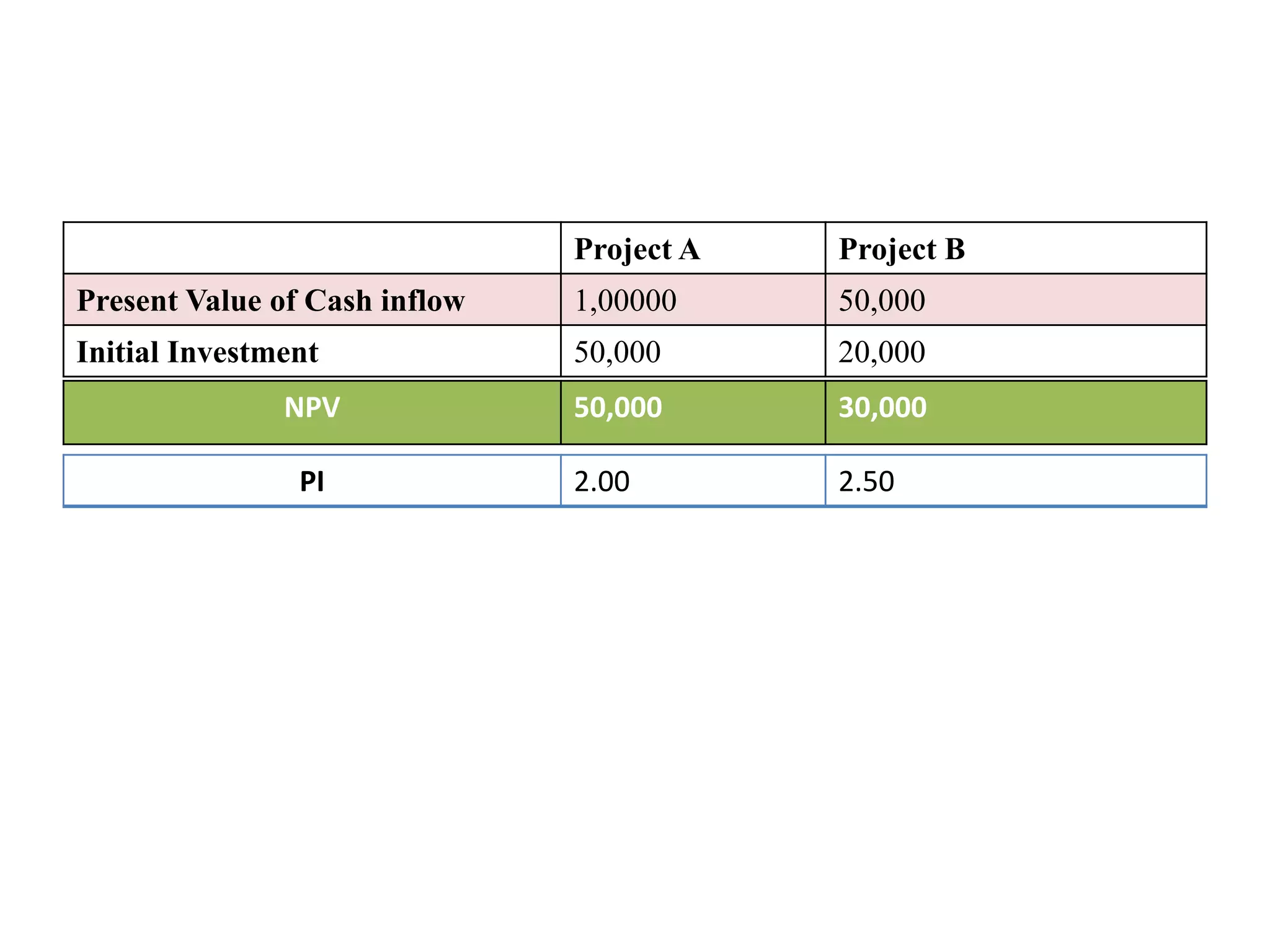

This document discusses capital budgeting and methods for evaluating investment projects. It introduces net present value (NPV) and profitability index (PI) as discounted cash flow methods for project evaluation. NPV calculates the present value of future cash flows less the initial investment, while PI is the ratio of present value of cash inflows to initial investment. Both methods accept projects with positive NPV or PI over 1. The document also discusses the advantages and limitations of each method and how NPV is preferred for mutually exclusive projects since it selects the project with the highest positive NPV.