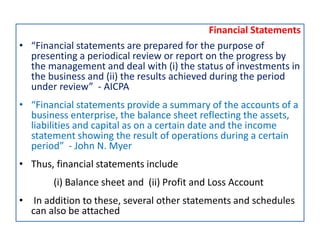

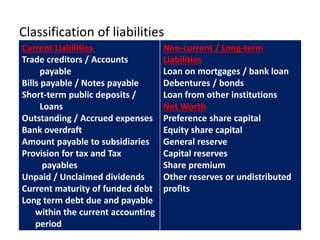

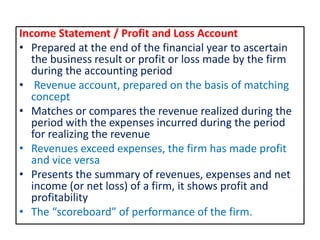

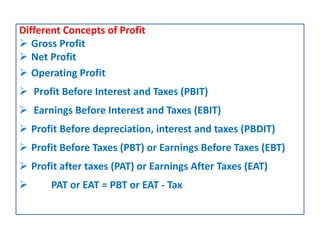

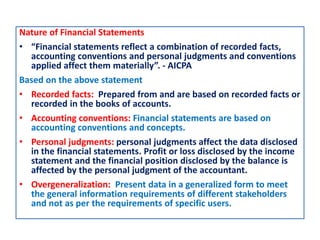

This document provides an overview of key concepts related to financial statements. It defines financial statements as organized collections of financial data according to accounting procedures. The two main financial statements are the income statement (also called the profit and loss account) and the balance sheet. The income statement shows revenues and expenses over a period of time, while the balance sheet presents the assets, liabilities, and capital of a business at a point in time. The document also discusses concepts like different types of profits, classification of assets and liabilities, and the nature and purpose of financial statements.